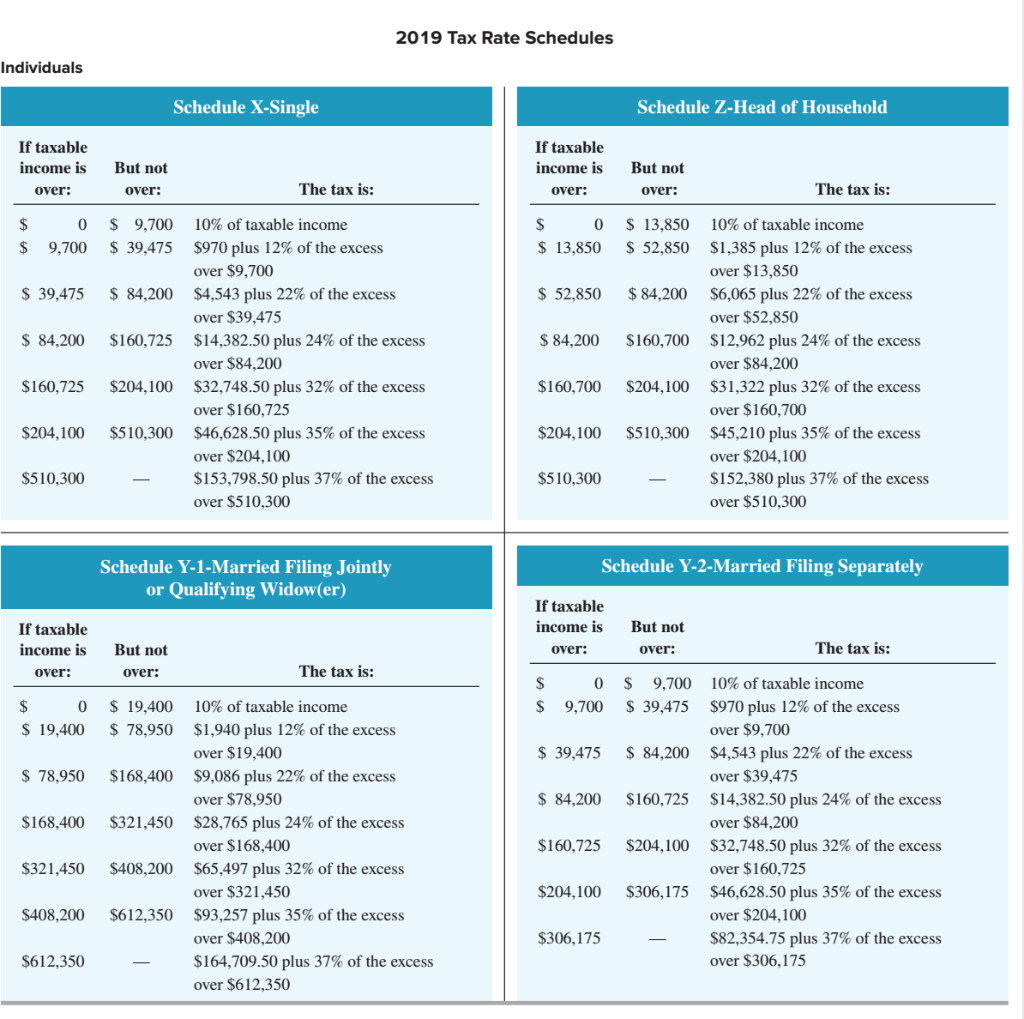

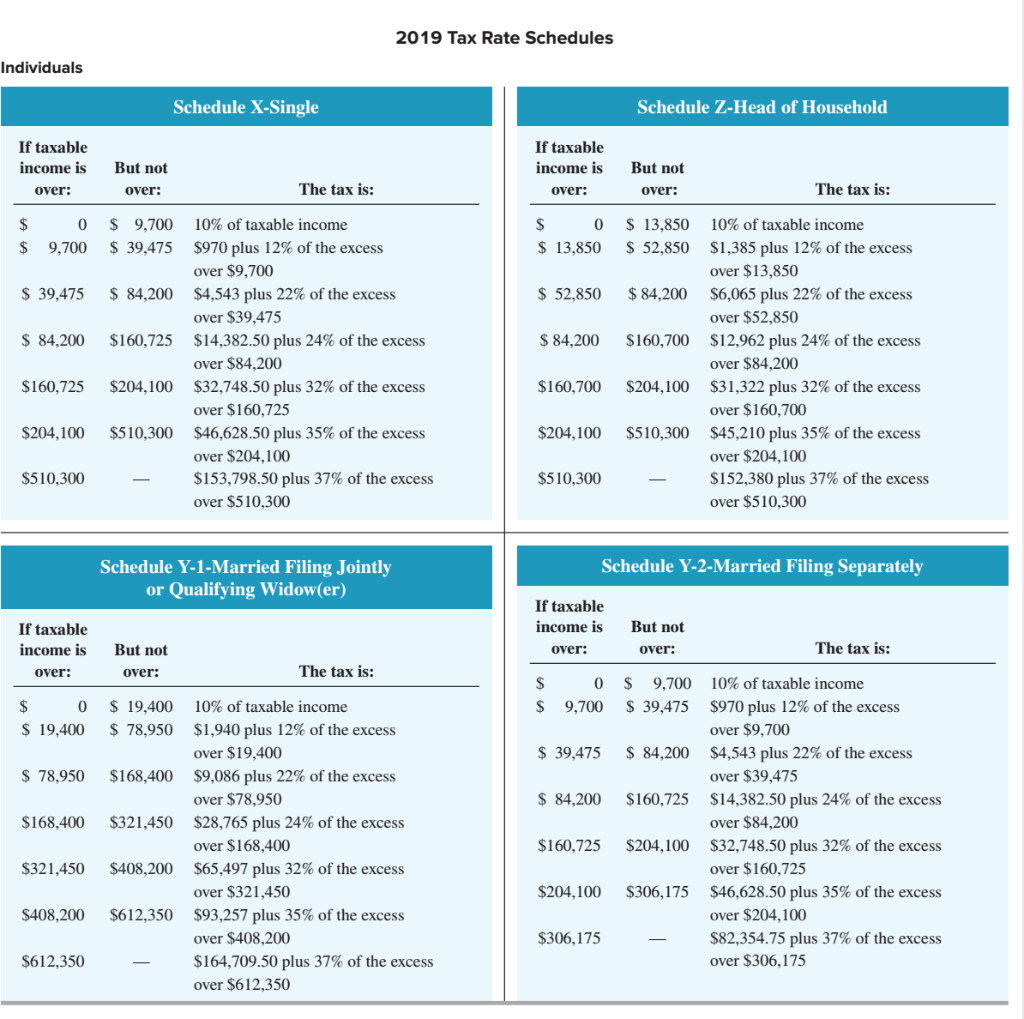

1. Gill and Molly are married and for 2019, they each made $50,000 and $30,000 of taxable income in wages, respectively. In addition, Molly received $13,000 of interest income from a municipal bond investment that is not taxable. Use the appropriate Federal Tax Rate Schedule in Appendix D towards the back of your book to answer the following. Round dollar amounts to the nearest cent ($3,500.0372 $3,500.04). Round percentages to the second decimal place (e.g. 35.027956% 35.03%). a. What are Gill's total income and taxable income? b. What are Molly's total income and taxable income? c. Ignoring your answer in a. and b., if Gill and Molly file jointly as a married couple for 2019 and their total income is $120,000 and their total taxable income is $108,000: 2019 Tax Rate Schedules Individuals Schedule X-Single Schedule Z-Head of Household If taxable income is over: But not over: If taxable income is over: But not over: The tax is: The tax is: $ $ 0 9,700 $ 9,700 $ 39,475 $ 0 $ 13,850 $ 13,850 $ 52,850 $ 39,475 $ 84,200 $ 52,850 $ 84,200 $ 84,200 $160,725 $ 84,200 $160,700 10% of taxable income $970 plus 12% of the excess over $9,700 $4,543 plus 22% of the excess over $39,475 $14,382.50 plus 24% of the excess over $84.200 $32,748.50 plus 32% of the excess over $160,725 $46,628.50 plus 35% of the excess over $204,100 $153,798.50 plus 37% of the excess over $510,300 10% of taxable income $1,385 plus 12% of the excess over $13,850 $6,065 plus 22% of the excess over $52,850 $12,962 plus 24% of the excess over $84,200 $31,322 plus 32% of the excess over $160,700 $45,210 plus 35% of the excess over $204,100 $152,380 plus 37% of the excess over $510,300 $160,725 $204,100 $160,700 $204,100 $204,100 $510,300 $204,100 $510,300 $510,300 - $510,300 Schedule Y-2-Married Filing Separately Schedule Y-1-Married Filing Jointly or Qualifying Widow(er) If taxable income is over: If taxable income is over: But not over: The tax is: But not over: The tax is: $ $ 0 9,700 $ 9,700 $ 39,475 $ 0 $ 19,400 $ 19,400 $ 78,950 $ 39,475 $ 84,200 $ 78,950 $168,400 $ 84,200 $160,725 $168,400 $321,450 10% of taxable income $1,940 plus 12% of the excess over $19,400 $9,086 plus 22% of the excess over $78,950 $28,765 plus 24% of the excess over $168,400 $65,497 plus 32% of the excess over $321,450 $93,257 plus 35% of the excess over $408,200 $164,709.50 plus 37% of the excess over $612,350 10% of taxable income $970 plus 12% of the excess over $9,700 $4,543 plus 22% of the excess over $39,475 $14,382.50 plus 24% of the excess over $84,200 $32,748.50 plus 32% of the excess over $160,725 $46,628.50 plus 35% of the excess over $204,100 $82,354.75 plus 37% of the excess over $306,175 $160,725 $204,100 $321,450 $408,200 $204,100 $306,175 $408,200 $612,350 $306,175 $612,350