1] Given an individual with a monthly turnover of TZS 1,000,000, calculate the annual amount of presumptive tax if the person: Complies with section

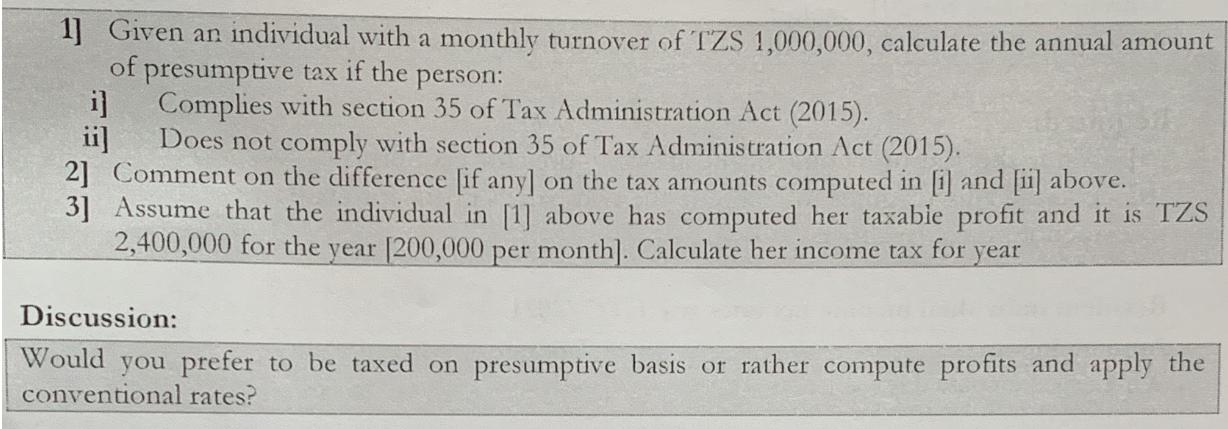

1] Given an individual with a monthly turnover of TZS 1,000,000, calculate the annual amount of presumptive tax if the person: Complies with section 35 of Tax Administration Act (2015). i] ii] Does not comply with section 35 of Tax Administration Act (2015). 2] Comment on the difference [if any] on the tax amounts computed in [i] and [ii] above. 3] Assume that the individual in [1] above has computed her taxable profit and it is TZS 2,400,000 for the year [200,000 per month]. Calculate her income tax for year Discussion: Would you prefer to be taxed on presumptive basis or rather compute profits and apply the conventional rates?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

1 i To calculate the annual amount of presumptive tax if the individual complies with section 35 of the Tax Administration Act 2015 Annual turnover Mo...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started