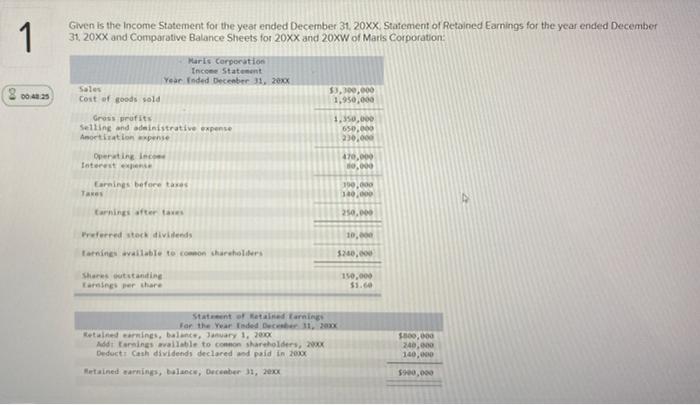

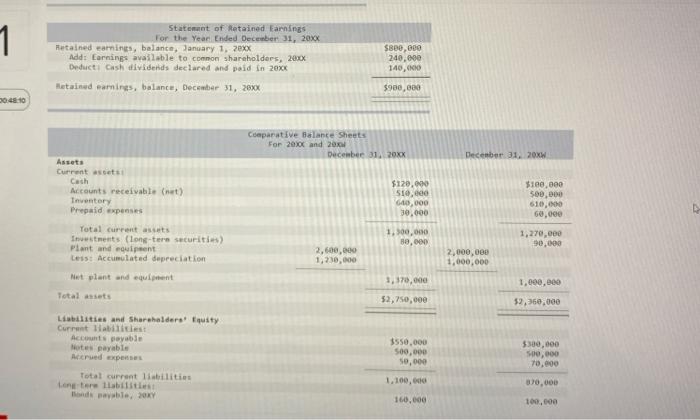

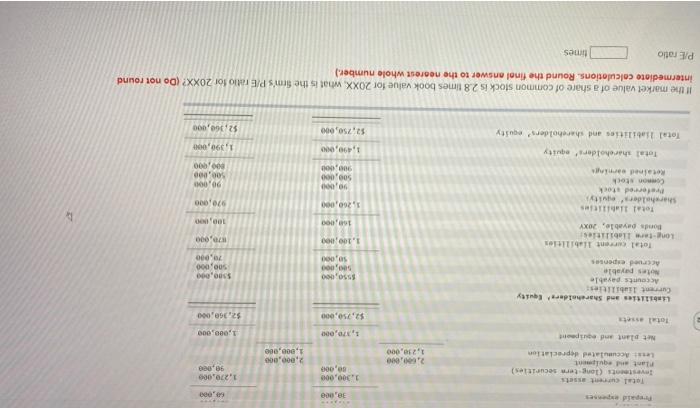

1 Given is the Income Statement for the year ended December 31, 20XX Statement of Retained Earnings for the year ended December 31 20XX and Comparative Balance Sheets for 20XX and 20XW of Marls Corporation: Maris Corporation Income Statement Year Ended December 31, 20xx Cost of goods sold Sales 00:49:25 $3,300,000 1,950.000 1.350,000 650,000 230.000 Gross profits Selling and administrative expense Amortization pense Operating Inc Interest Earnings before tases Taxes 470,000 0,000 190.000 110.000 Earnings after taves 250.000 10. Preferred stock dividends Earnings available to common shareholders 5300.000 Share outstanding Tarings per thare 110,000 $1.6 Start of Natal Earnings For the Year Ended December 11, 2030 Betalne arning balance, January 1, 2010 Adottonings wallable to conto shareholders, 20XX Deduct Cash dividends declared and paid in 2000 $100,000 240,00 140,000 Metained in Balance, December 31, 2020 $120,000 Statent of Retained Earnings For the Year Ended December 31, 20XX Retained earnings, balance, January 1, 20XX Add: Earnings available to common shareholders, 200X Deducti Cash dividends declared and paid in 20xx $800,000 240.000 140,000 Metained earnings, balance, December 31, 20XX $900,000 0:48:10 Comparative Balance Sheets For 20% and 20 December 31, 20XX December 31, 20W $120.000 51.ee 40,000 $100,000 500,000 610,000 60,000 30.000 Assets Current assets Cash Accounts receivable (net) Inventory Prepaid expenses Total current assets Investments (long-ter securitis) Plant and equipent Less: Accumulated depreciation Mut plant and equipment Total assets 1.300.000 30,000 1,270,000 90.000 2,600,000 1,230,000 2,000,000 1,000,000 3,370,000 1,000,eee 32,750,000 52,750,000 Liabilities and Shareholders musty Current Habilities Accounts payable Notes payable Mered expenses Total current liabilities Lotere labilities and able 20xY 3550.000 500,000 50,000 5300,000 500,000 70.000 1.100,00 30,000 160,000 100.000 64.000 Total current assets Tevests (long ter securities) plant and equipment Leat Accumulated depreciation 30,00 1.300,000 30.000 1,270,000 90,000 2.6.0 1,210.000 2.000.000 1,000,000 1,000,000 Net plant and pant Total asset 5.70,000 $2,750,000 $2.360,000 Libilities and Shareholdere Equity Current liabilities: Accounts payable Notes payable Accrud expenses $550,00 500,000 50,000 $300,000 500,000 70.000 1.100,00 Total current liabilities Lontar abilities tonds Dayable, OXY 170.000 16,00 100, 1,260,000 970.NO Total lliti Shareholders' evity Preferred to Connon stock Retained in Total shareholders equity 90,00 500,000 900, 90.000 500.000 100,990 1,490,000 Total Habilities and shareholders' equity 1,390,000 $2,300,000 52,750,000 If the market value of a share of common stock is 2.8 times book value for 20XX, what is the firm's PE ratio for 20XX? (Do not round intermediate calculations. Round the final answer to the nearest whole number.) PE ratio times