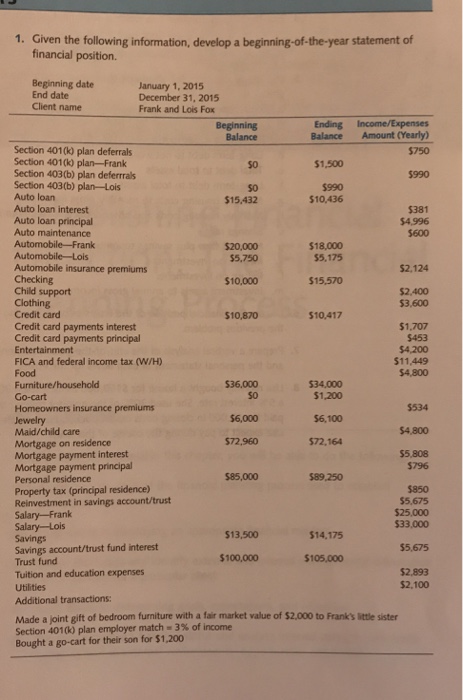

1. Given the following information, develop a beginning-of-the-year statement of financial position. Beginning date End date Client name January 1, 2015 December 31, 2015 Frank and Lois Fox Beginning Balance Amount (Yearly) $750 Section 401(k) plan deferrals Section 401(k) plan-Frank Section 403(b) plan deferrrals Section 403(b) plan-Lois Auto loan Auto loan interest Auto loan principal Auto maintenance $1,500 $990 50 $15,432 $990 $10,436 381 $4,996 5600 $18,000 5,175 $15,570 $20,000 $5,750 Automobile -Lois Automobile insurance premiums Checking Child support Clothing Credit card Credit card payments interest Credit card payments principal $2.124 $10,000 $2,400 53,600 510,870 510,417 $1,707 $453 $4,200 $11,449 FICA and federal income tax (W/H) Furniture/household 536,000 so $6,000 572,960 51,200 $6,100 572.164 $534 Maid/child care Mortgage on residence Mortgage payment interest Mortgage payment principal Personal residence Property tax (principal residence) Reinvestment in savings account/trust 54,800 $5,808 5796 $89,250 5850 $5,675 $25,000 $33,000 $13,500 $14,175 Savings account/trust fund interest Trust fund Tuition and education expenses Utilities Additional transactions Made a joint gift of bedroom furniture with a fair market value of $2,000 to Frank's little sister Section 401(k) plan employer match-3% of income Bought a go-cart for their son for $1,200 $5,675 $100,000 $105,000 $2,893 $2,100 1. Given the following information, develop a beginning-of-the-year statement of financial position. Beginning date End date Client name January 1, 2015 December 31, 2015 Frank and Lois Fox Beginning Balance Amount (Yearly) $750 Section 401(k) plan deferrals Section 401(k) plan-Frank Section 403(b) plan deferrrals Section 403(b) plan-Lois Auto loan Auto loan interest Auto loan principal Auto maintenance $1,500 $990 50 $15,432 $990 $10,436 381 $4,996 5600 $18,000 5,175 $15,570 $20,000 $5,750 Automobile -Lois Automobile insurance premiums Checking Child support Clothing Credit card Credit card payments interest Credit card payments principal $2.124 $10,000 $2,400 53,600 510,870 510,417 $1,707 $453 $4,200 $11,449 FICA and federal income tax (W/H) Furniture/household 536,000 so $6,000 572,960 51,200 $6,100 572.164 $534 Maid/child care Mortgage on residence Mortgage payment interest Mortgage payment principal Personal residence Property tax (principal residence) Reinvestment in savings account/trust 54,800 $5,808 5796 $89,250 5850 $5,675 $25,000 $33,000 $13,500 $14,175 Savings account/trust fund interest Trust fund Tuition and education expenses Utilities Additional transactions Made a joint gift of bedroom furniture with a fair market value of $2,000 to Frank's little sister Section 401(k) plan employer match-3% of income Bought a go-cart for their son for $1,200 $5,675 $100,000 $105,000 $2,893 $2,100