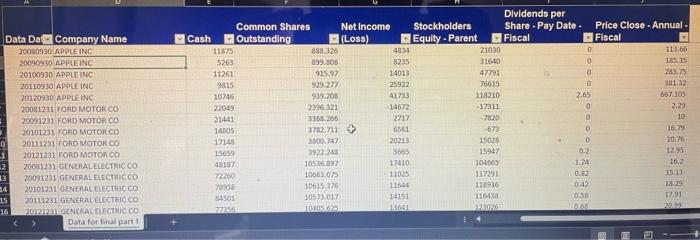

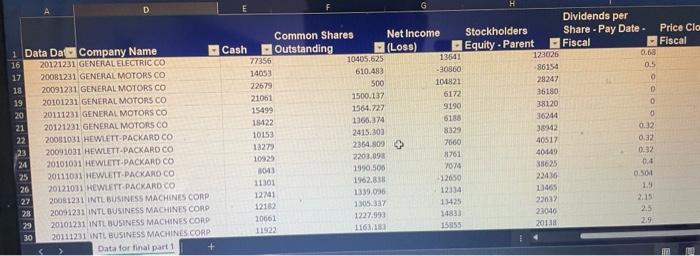

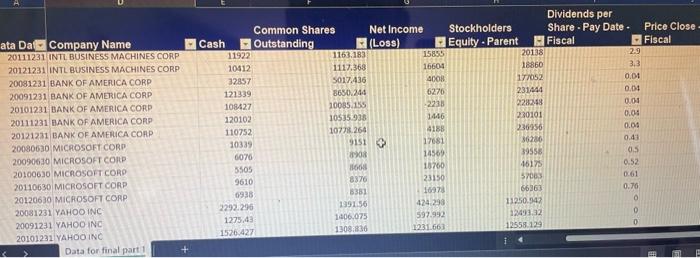

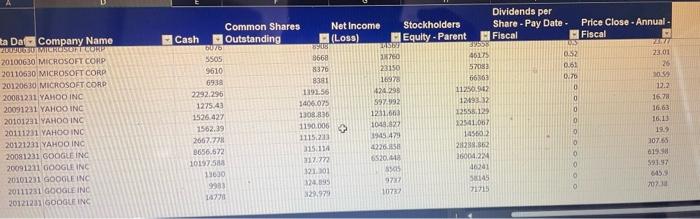

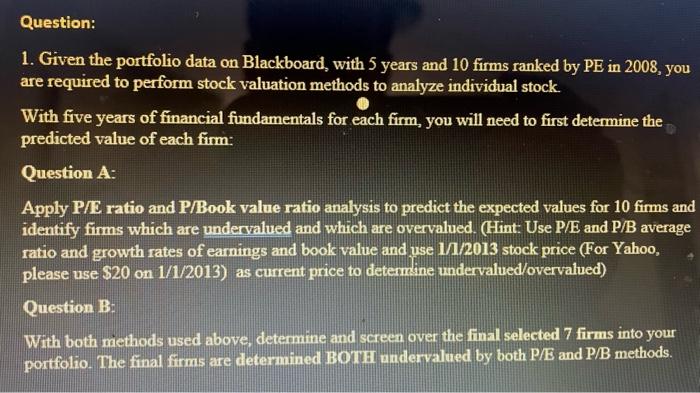

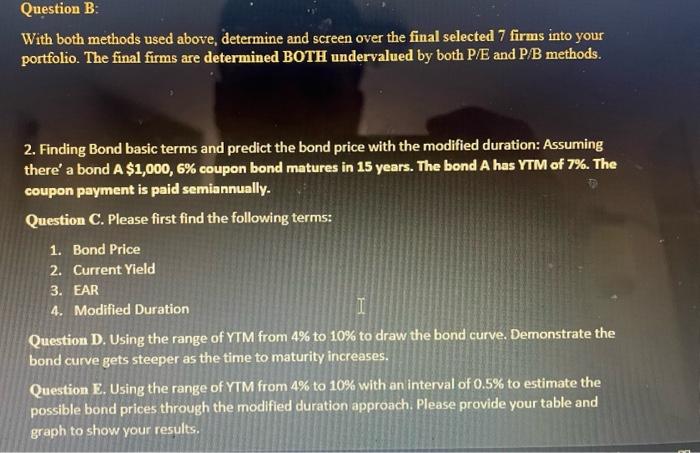

1. Given the portfolio data on Blackboard, with 5 years and 10 firms ranked by PE in 2008 , you are required to perform stock valuation methods to analyze individual stock. With five years of financial fundamentals for each firm, you will need to first determine the predicted value of each firm: Question A: Apply P/E ratio and P/Book value ratio analysis to predict the expected values for 10 firms and identify firms which are undervalued and which are overvalued. (Hint: Use P/E and P/B average ratio and growth rates of earnings and book value and yse 1/12013 stock price (For Yahoo, please use $20 on 1/1/2013) as current price to determine undervalued/overvalued) Question B: With both methods used above, determine and screen over the final selected 7 firms into your portfolio. The final firms are determined BOTII undervalued by both P/E and P/B methods. With both methods used above, determine and screen over the final selected 7 firms into your portfolio. The final firms are determined BOTH undervalued by both P/E and P/B methods. 2. Finding Bond basic terms and predict the bond price with the modified duration: Assuming there' a bond A$1,000,6% coupon bond matures in 15 years. The bond A has YTM of 7%. The coupon payment is paid semiannually. Question C. Please first find the following terms: 1. Bond Price 2. Current Yield 3. EAR 4. Modified Duration Question D. Using the range of YTM from 4% to 10% to draw the bond curve. Demonstrate the bond curve gets steeper as the time to maturity increases. Question E. Using the range of YTM from 4% to 10% with an interval of 0.5% to estimate the possible bond prices through the modified duration approach. Please provide your table and graph to show your results. 1. Given the portfolio data on Blackboard, with 5 years and 10 firms ranked by PE in 2008 , you are required to perform stock valuation methods to analyze individual stock. With five years of financial fundamentals for each firm, you will need to first determine the predicted value of each firm: Question A: Apply P/E ratio and P/Book value ratio analysis to predict the expected values for 10 firms and identify firms which are undervalued and which are overvalued. (Hint: Use P/E and P/B average ratio and growth rates of earnings and book value and yse 1/12013 stock price (For Yahoo, please use $20 on 1/1/2013) as current price to determine undervalued/overvalued) Question B: With both methods used above, determine and screen over the final selected 7 firms into your portfolio. The final firms are determined BOTII undervalued by both P/E and P/B methods. With both methods used above, determine and screen over the final selected 7 firms into your portfolio. The final firms are determined BOTH undervalued by both P/E and P/B methods. 2. Finding Bond basic terms and predict the bond price with the modified duration: Assuming there' a bond A$1,000,6% coupon bond matures in 15 years. The bond A has YTM of 7%. The coupon payment is paid semiannually. Question C. Please first find the following terms: 1. Bond Price 2. Current Yield 3. EAR 4. Modified Duration Question D. Using the range of YTM from 4% to 10% to draw the bond curve. Demonstrate the bond curve gets steeper as the time to maturity increases. Question E. Using the range of YTM from 4% to 10% with an interval of 0.5% to estimate the possible bond prices through the modified duration approach. Please provide your table and graph to show your results