Answered step by step

Verified Expert Solution

Question

1 Approved Answer

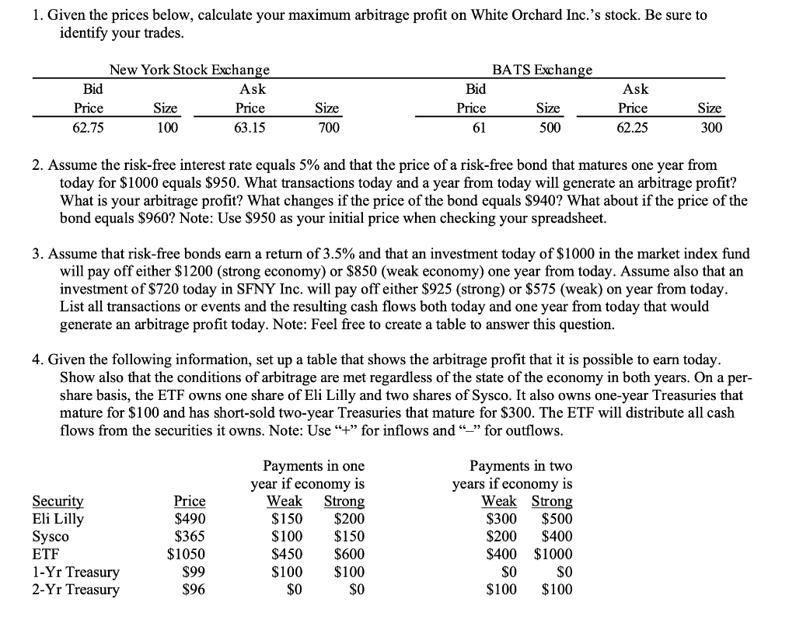

1. Given the prices below, calculate your maximum arbitrage profit on White Orchard Inc.'s stock. Be sure to identify your trades. Bid Price 62.75

1. Given the prices below, calculate your maximum arbitrage profit on White Orchard Inc.'s stock. Be sure to identify your trades. Bid Price 62.75 New York Stock Exchange Ask Price 63.15 Size 100 Security Eli Lilly Sysco ETF 1-Yr Treasury 2-Yr Treasury Size 700 Price $490 $365 $1050 Bid Price 61 2. Assume the risk-free interest rate equals 5% and that the price of a risk-free bond that matures one year from today for $1000 equals $950. What transactions today and a year from today will generate an arbitrage profit? What is your arbitrage profit? What changes if the price of the bond equals $940? What about if the price of the bond equals $960? Note: Use $950 as your initial price when checking your spreadsheet. $99 $96 BATS Exchange 3. Assume that risk-free bonds earn a return of 3.5% and that an investment today of $1000 in the market index fund will pay off either $1200 (strong economy) or $850 (weak economy) one year from today. Assume also that an investment of $720 today in SFNY Inc. will pay off either $925 (strong) or $575 (weak) on year from today. List all transactions or events and the resulting cash flows both today and one year from today that would generate an arbitrage profit today. Note: Feel free to create a table to answer this question. 4. Given the following information, set up a table that shows the arbitrage profit that it is possible to earn today. Show also that the conditions of arbitrage are met regardless of the state of the economy in both years. On a per- share basis, the ETF owns one share of Eli Lilly and two shares of Sysco. It also owns one-year Treasuries that mature for $100 and has short-sold two-year Treasuries that mature for $300. The ETF will distribute all cash flows from the securities it owns. Note: Use "+" for inflows and "_" for outflows. Payments in one year if economy is Weak Strong $150 $200 $100 $150 $450 $600 $100 $100 $0 $0 Size 500 Payments in two years if economy is Weak Strong $300 $200 $400 SO $100 Ask Price 62.25 Size 300 $500 $400 $1000 SO $100

Step by Step Solution

There are 3 Steps involved in it

Step: 1

It appears there are several questions related to finance and arbitrage in a document or exam paper ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started