Question

Options information on Apple stock is given in the following table. Suppose you buy a March-18th expiration call option with an exercise price of

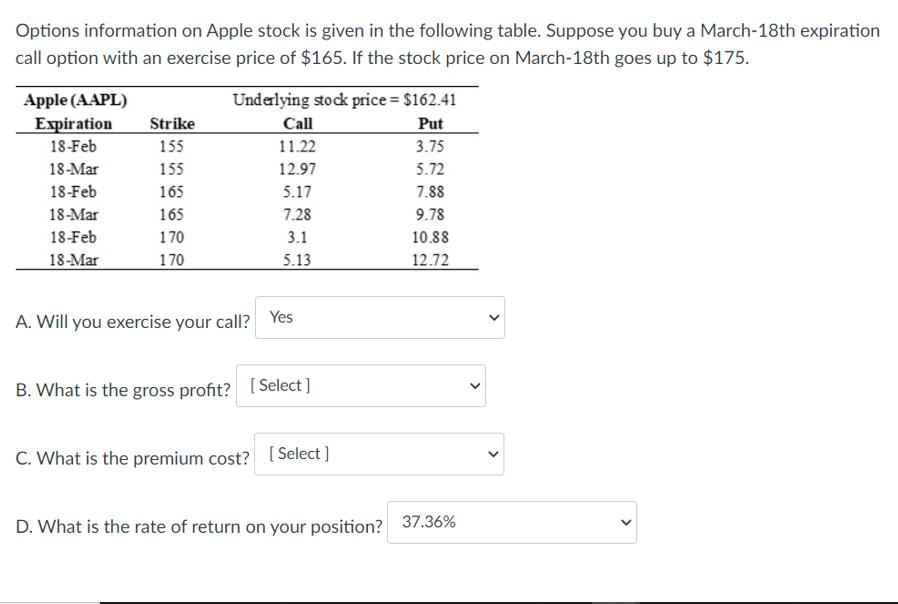

Options information on Apple stock is given in the following table. Suppose you buy a March-18th expiration call option with an exercise price of $165. If the stock price on March-18th goes up to $175. Apple (AAPL) Expiration 18-Feb. 18-Mar 18-Feb 18-Mar 18-Feb 18-Mar Strike 155 155 165 165 170 170 Underlying stock price = $162.41 Put 3.75 5.72 7.88 9.78 10.88 12.72 A. Will you exercise your call? Call 11.22 12.97 5.17 7.28 3.1 5.13 Yes B. What is the gross profit? [Select] C. What is the premium cost? [ [Select] D. What is the rate of return on your position? 37.36% > < >

Step by Step Solution

3.41 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

A To determine whether you should exercise your March 18 call option with an exercise price of 165 w...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Introduction To Derivatives And Risk Management

Authors: Don M. Chance, Robert Brooks

10th Edition

130510496X, 978-1305104969

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App