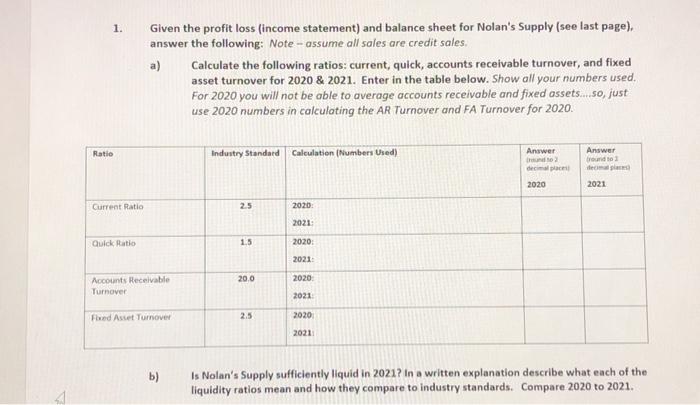

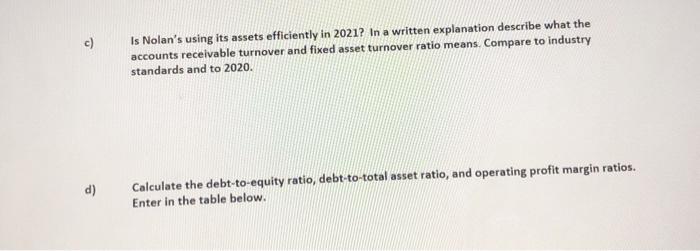

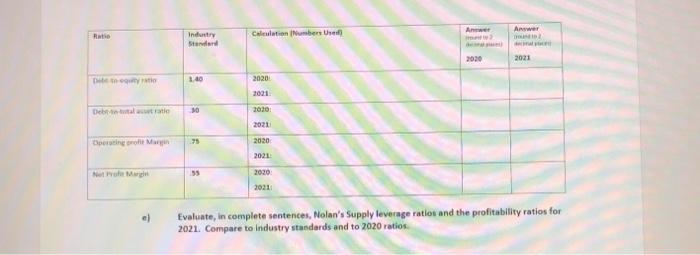

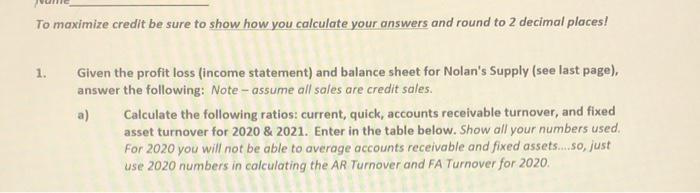

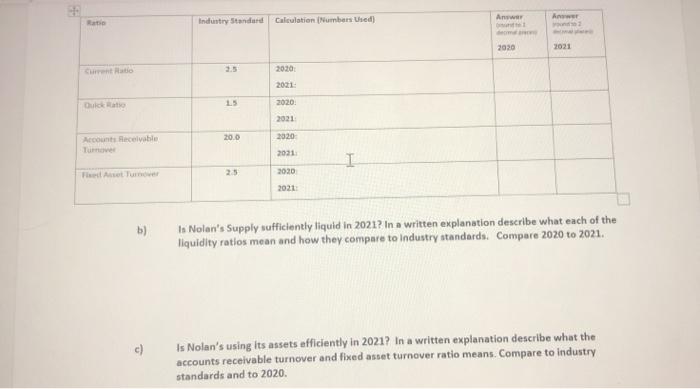

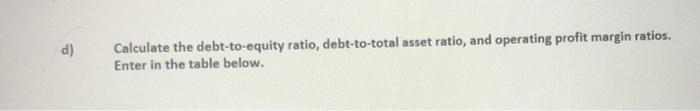

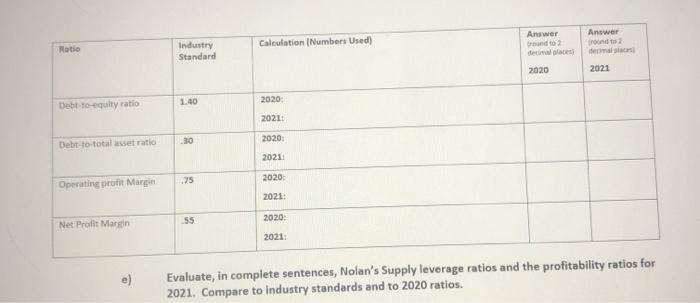

1. Given the profit loss (income statement) and balance sheet for Nolan's Supply (see last page), answer the following: Note - assume all sales are credit sales a) Calculate the following ratios: current, quick, accounts receivable turnover, and fixed asset turnover for 2020 & 2021. Enter in the table below. Show all your numbers used. For 2020 you will not be able to average accounts receivable and fixed assets....50, just use 2020 numbers in calculating the AR Turnover and FA Turnover for 2020. Ratio Industry Standard Calculation (Numbers Used) Answer Answer round to decimal 2020 2021 Current Ratio 25 2020 2021 Quick Ratio 1.5 2020 2021 20.0 2020 Accounts Receivable Turnover 2021 Fixed Asset Tumover 2.5 2020 2021 b) Is Nolan's Supply sufficiently liquid in 2021? In a written explanation describe what each of the liquidity ratios mean and how they compare to industry standards. Compare 2020 to 2021. c) Is Nolan's using its assets efficiently in 2021? In a written explanation describe what the accounts receivable turnover and fixed asset turnover ratio means. Compare to industry standards and to 2020. d) Calculate the debt-to-equity ratio, debt-to-total asset ratio, and operating profit margin ratios. Enter in the table below. Aw Anwwer Ratio Callation Numbers Used Industry Standard 2020 2021 wyti 1.40 2020 2021 Dentaltratie 2021 Bering of Man 2020 2021 2020 2021 e) Evaluate, in complete sentences, Nolan's Supply leverage ratios and the profitability ratios for 2021. Compare to Industry standards and to 2020 ratios To maximize credit be sure to show how you calculate your answers and round to 2 decimal places! 1. Given the profit loss (income statement) and balance sheet for Nolan's Supply (see last page), answer the following: Note - assume all sales are credit sales. a) Calculate the following ratios: current, quick, accounts receivable turnover, and fixed asset turnover for 2020 & 2021. Enter in the table below. Show all your numbers used. For 2020 you will not be able to average accounts receivable and fixed assets...so, just use 2020 numbers in calculating the AR Turnover and FA Turnover for 2020. Anwar www Industry Standard Calculation (Numbers Used) 2020 2021 2020 Quick Ratio 15 2020 2021 Accounts Receivable 20.0 2020 2031 I Theed Arrot Turnover 25 2020 2021 b) 1. Nolan's Supply sufficiently liquid in 2021? In a written explanation describe what each of the liquidity ratios mean and how they compare to Industry standards. Compare 2020 to 2021. c) Is Nolan's using its assets efficiently in 2021? In a written explanation describe what the accounts receivable turnover and fixed asset turnover ratio means. Compare to industry standards and to 2020 d) Calculate the debt-to-equity ratio, debt-to-total asset ratio, and operating profit margin ratios. Enter in the table below. Answer Calculation (Numbers Used) Answer and to decimal Industry Standard Ratio ema 2020 2021 1.40 2020 Debt-to-equity ratio 2021 .30 2020 Debt-to-total asset ratio 2021 .75 2020 Operating profit Margin 2021 55 2020: Net Profit Margin 20211 e) Evaluate, in complete sentences, Nolan's Supply leverage ratios and the profitability ratios for 2021. Compare to Industry standards and to 2020 ratios. 1. Given the profit loss (income statement) and balance sheet for Nolan's Supply (see last page), answer the following: Note - assume all sales are credit sales a) Calculate the following ratios: current, quick, accounts receivable turnover, and fixed asset turnover for 2020 & 2021. Enter in the table below. Show all your numbers used. For 2020 you will not be able to average accounts receivable and fixed assets....50, just use 2020 numbers in calculating the AR Turnover and FA Turnover for 2020. Ratio Industry Standard Calculation (Numbers Used) Answer Answer round to decimal 2020 2021 Current Ratio 25 2020 2021 Quick Ratio 1.5 2020 2021 20.0 2020 Accounts Receivable Turnover 2021 Fixed Asset Tumover 2.5 2020 2021 b) Is Nolan's Supply sufficiently liquid in 2021? In a written explanation describe what each of the liquidity ratios mean and how they compare to industry standards. Compare 2020 to 2021. c) Is Nolan's using its assets efficiently in 2021? In a written explanation describe what the accounts receivable turnover and fixed asset turnover ratio means. Compare to industry standards and to 2020. d) Calculate the debt-to-equity ratio, debt-to-total asset ratio, and operating profit margin ratios. Enter in the table below. Aw Anwwer Ratio Callation Numbers Used Industry Standard 2020 2021 wyti 1.40 2020 2021 Dentaltratie 2021 Bering of Man 2020 2021 2020 2021 e) Evaluate, in complete sentences, Nolan's Supply leverage ratios and the profitability ratios for 2021. Compare to Industry standards and to 2020 ratios To maximize credit be sure to show how you calculate your answers and round to 2 decimal places! 1. Given the profit loss (income statement) and balance sheet for Nolan's Supply (see last page), answer the following: Note - assume all sales are credit sales. a) Calculate the following ratios: current, quick, accounts receivable turnover, and fixed asset turnover for 2020 & 2021. Enter in the table below. Show all your numbers used. For 2020 you will not be able to average accounts receivable and fixed assets...so, just use 2020 numbers in calculating the AR Turnover and FA Turnover for 2020. Anwar www Industry Standard Calculation (Numbers Used) 2020 2021 2020 Quick Ratio 15 2020 2021 Accounts Receivable 20.0 2020 2031 I Theed Arrot Turnover 25 2020 2021 b) 1. Nolan's Supply sufficiently liquid in 2021? In a written explanation describe what each of the liquidity ratios mean and how they compare to Industry standards. Compare 2020 to 2021. c) Is Nolan's using its assets efficiently in 2021? In a written explanation describe what the accounts receivable turnover and fixed asset turnover ratio means. Compare to industry standards and to 2020 d) Calculate the debt-to-equity ratio, debt-to-total asset ratio, and operating profit margin ratios. Enter in the table below. Answer Calculation (Numbers Used) Answer and to decimal Industry Standard Ratio ema 2020 2021 1.40 2020 Debt-to-equity ratio 2021 .30 2020 Debt-to-total asset ratio 2021 .75 2020 Operating profit Margin 2021 55 2020: Net Profit Margin 20211 e) Evaluate, in complete sentences, Nolan's Supply leverage ratios and the profitability ratios for 2021. Compare to Industry standards and to 2020 ratios