Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. Given these numbers, create journal entries for each transaction, Showing the final credit debit balance. 2. Create a T account for cash showing the

1. Given these numbers, create journal entries for each transaction, Showing the final credit debit balance.

1. Given these numbers, create journal entries for each transaction, Showing the final credit debit balance.

2. Create a T account for cash showing the final balance.

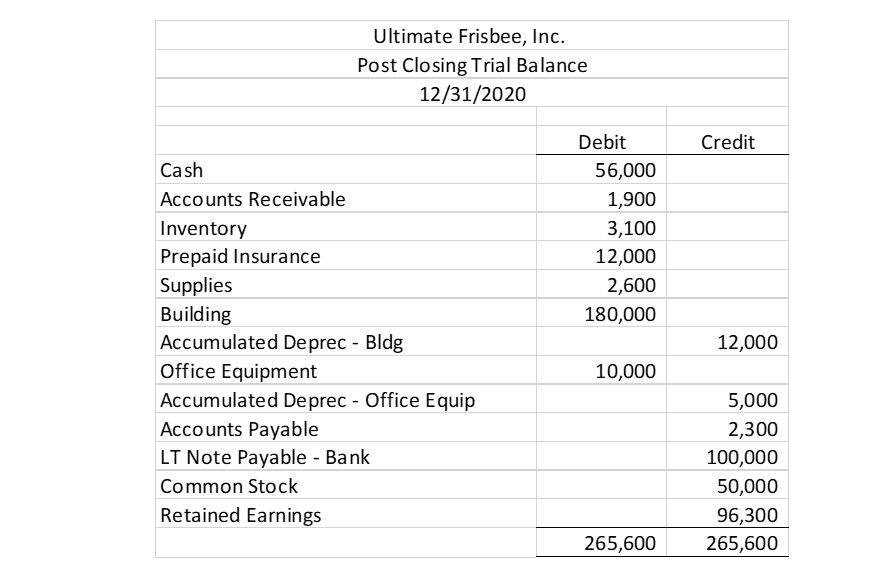

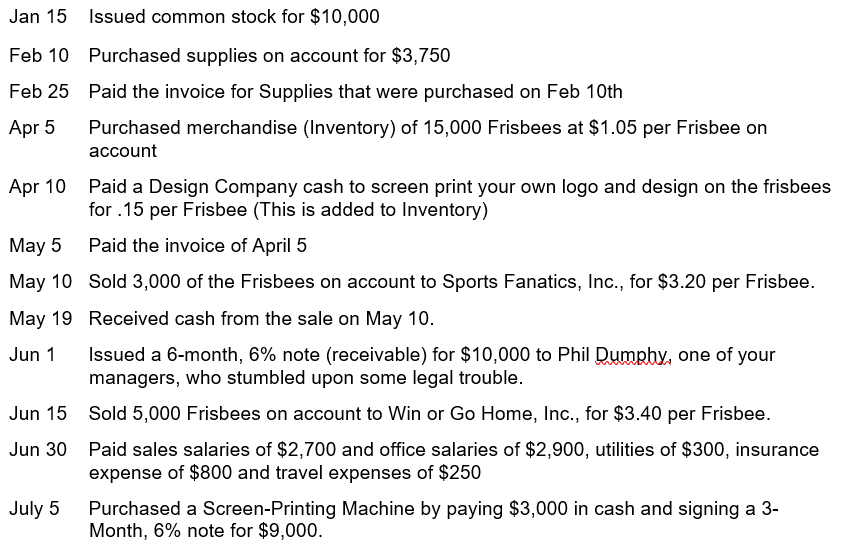

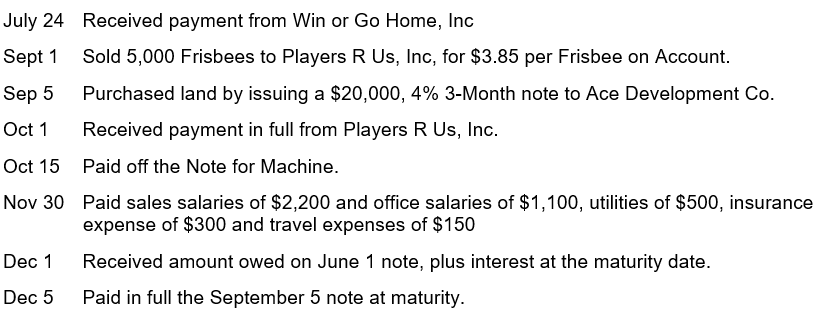

Ultimate Frisbee, Inc. Post Closing Trial Balance 12/31/2020 Cash Accounts Receivable Inventory Prepaid Insurance Supplies Building \begin{tabular}{|r|} \hline Debit \\ \hline 56,000 \\ 1,900 \\ 3,100 \\ 12,000 \\ 2,600 \\ \hline 180,000 \\ \hline \end{tabular} Accumulated Deprec - Bldg Office Equipment 10,000 Accumulated Deprec - Office Equip Accounts Payable LT Note Payable - Bank Common Stock Retained Earnings \begin{tabular}{r|r|} & 50,000 \\ \hline 265,600 & 96,300 \\ \hline \end{tabular} Feb 10 Purchased supplies on account for $3,750 Feb 25 Paid the invoice for Supplies that were purchased on Feb 10th Apr 5 Purchased merchandise (Inventory) of 15,000 Frisbees at $1.05 per Frisbee on account Apr 10 Paid a Design Company cash to screen print your own logo and design on the frisbees for .15 per Frisbee (This is added to Inventory) May 5 Paid the invoice of April 5 May 10 Sold 3,000 of the Frisbees on account to Sports Fanatics, Inc., for $3.20 per Frisbee. May 19 Received cash from the sale on May 10. Jun 1 Issued a 6-month, 6\% note (receivable) for $10,000 to Phil Dumphy, one of your managers, who stumbled upon some legal trouble. Jun 15 Sold 5,000 Frisbees on account to Win or Go Home, Inc., for $3.40 per Frisbee. Jun 30 Paid sales salaries of $2,700 and office salaries of $2,900, utilities of $300, insurance expense of $800 and travel expenses of $250 July 5 Purchased a Screen-Printing Machine by paying $3,000 in cash and signing a 3Month, 6% note for $9,000. July 24 Received payment from Win or Go Home, Inc Sept 1 Sold 5,000 Frisbees to Players R Us, Inc, for $3.85 per Frisbee on Account. Sep 5 Purchased land by issuing a $20,000,4% 3-Month note to Ace Development Co. Oct 1 Received payment in full from Players R Us, Inc. Oct 15 Paid off the Note for Machine. Nov 30 Paid sales salaries of $2,200 and office salaries of $1,100, utilities of $500, insurance expense of $300 and travel expenses of $150 Dec 1 Received amount owed on June 1 note, plus interest at the maturity date. Dec 5 Paid in full the September 5 note at maturityStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started