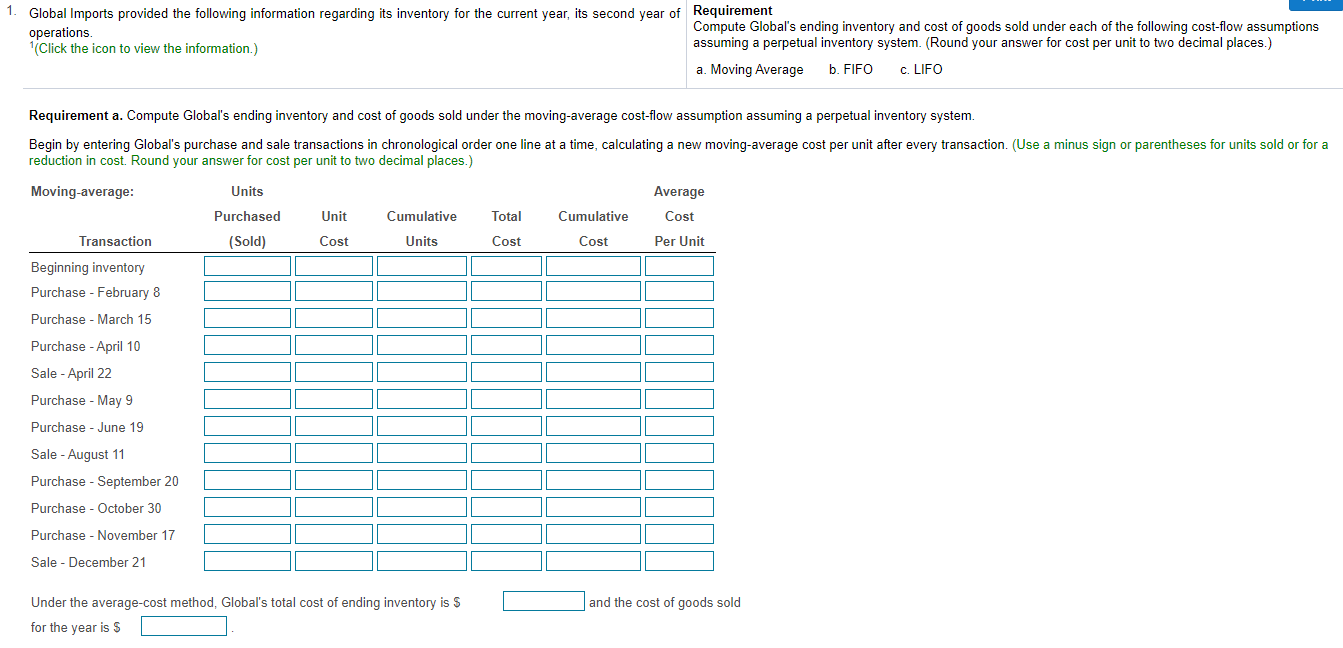

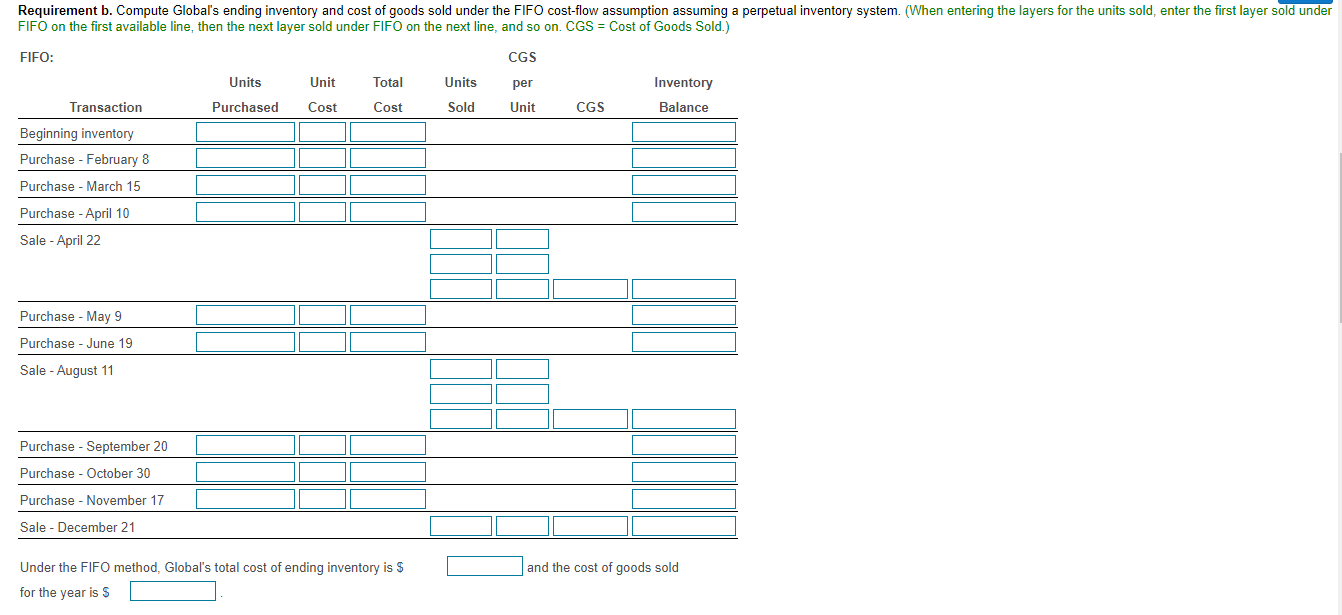

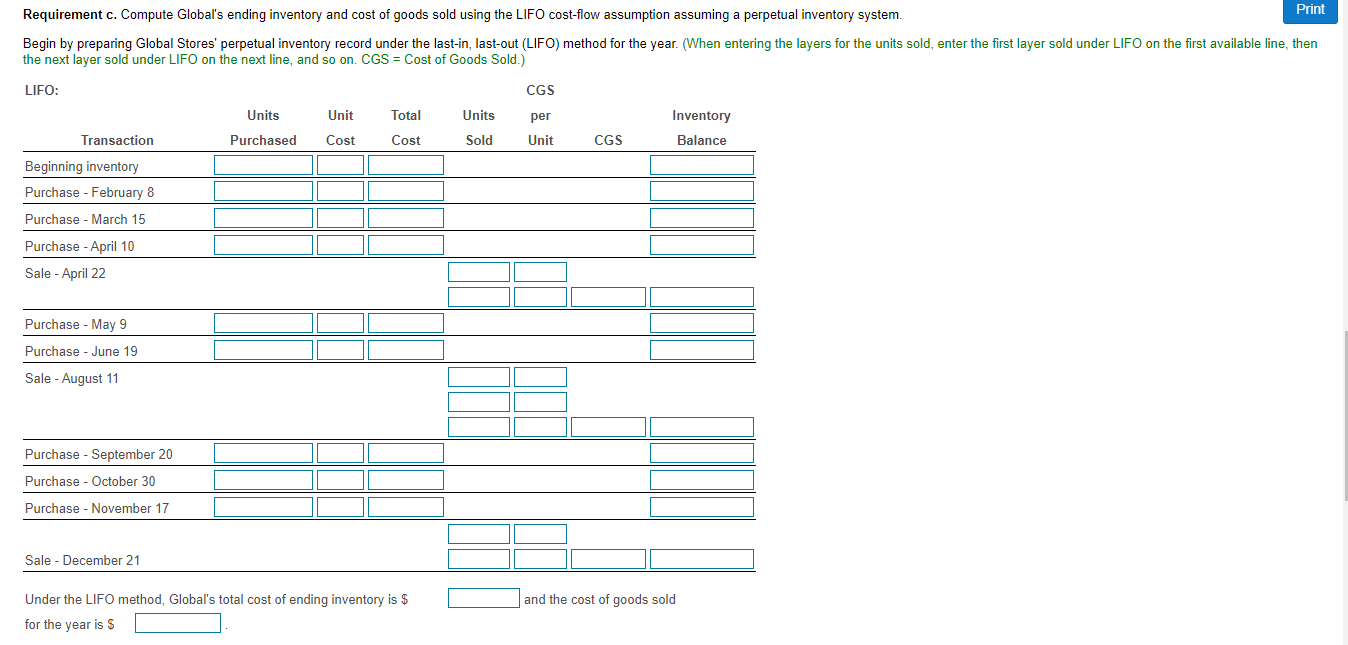

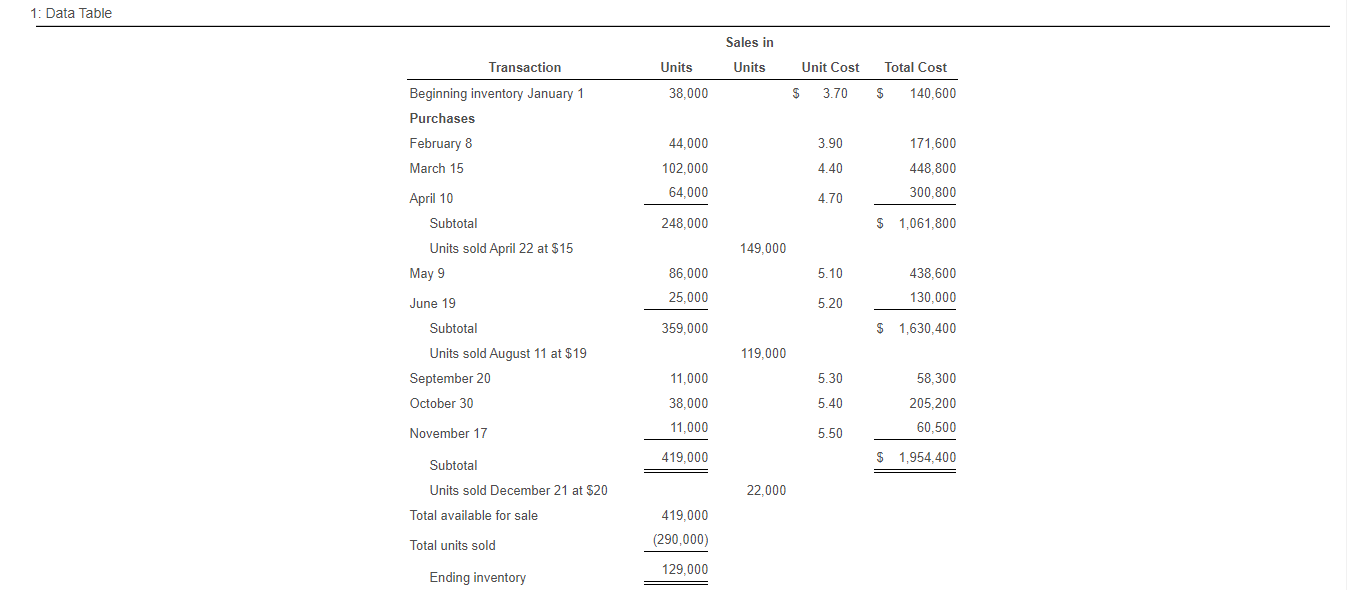

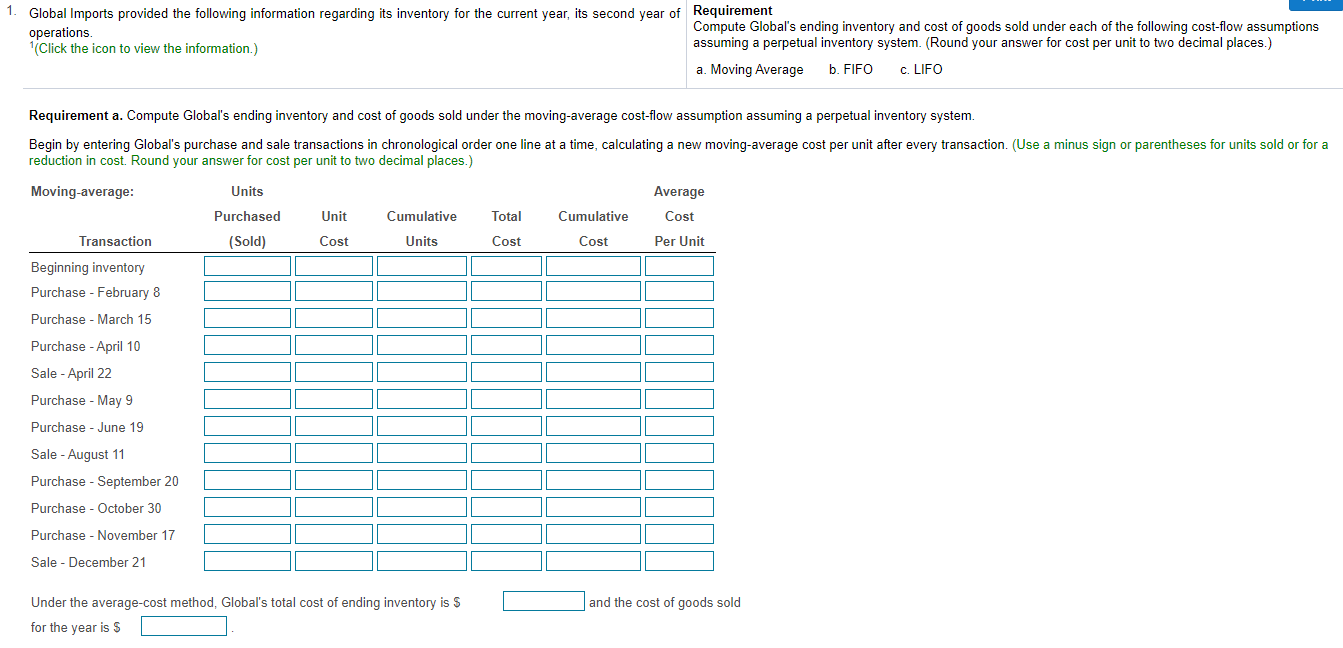

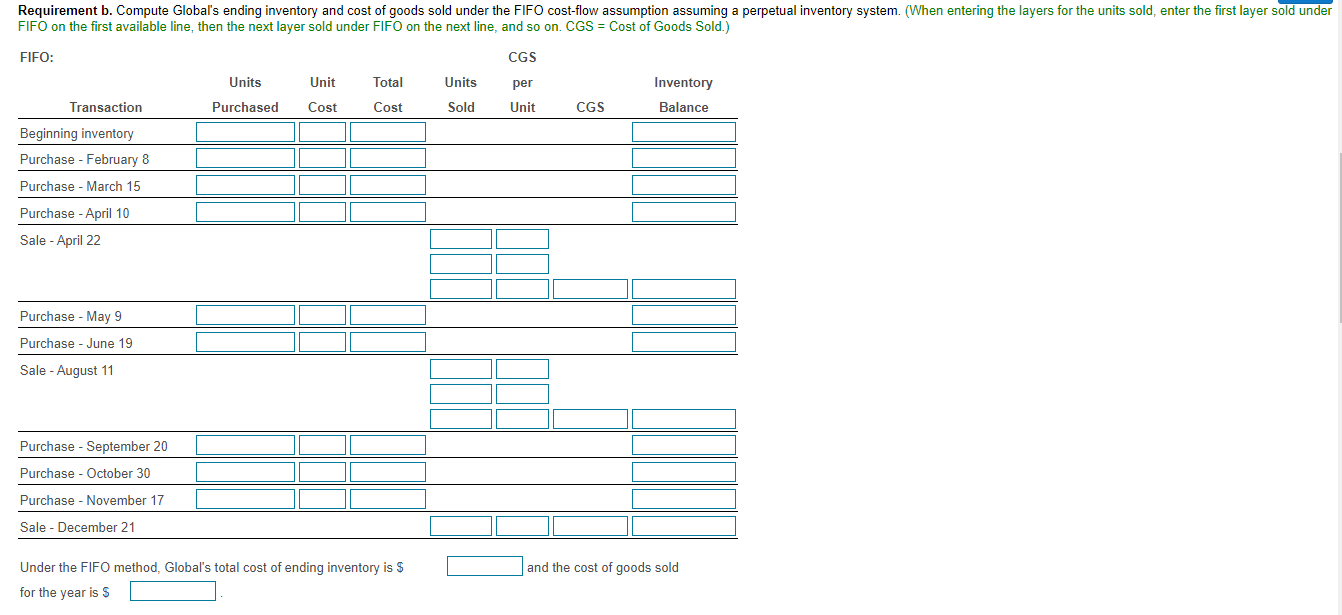

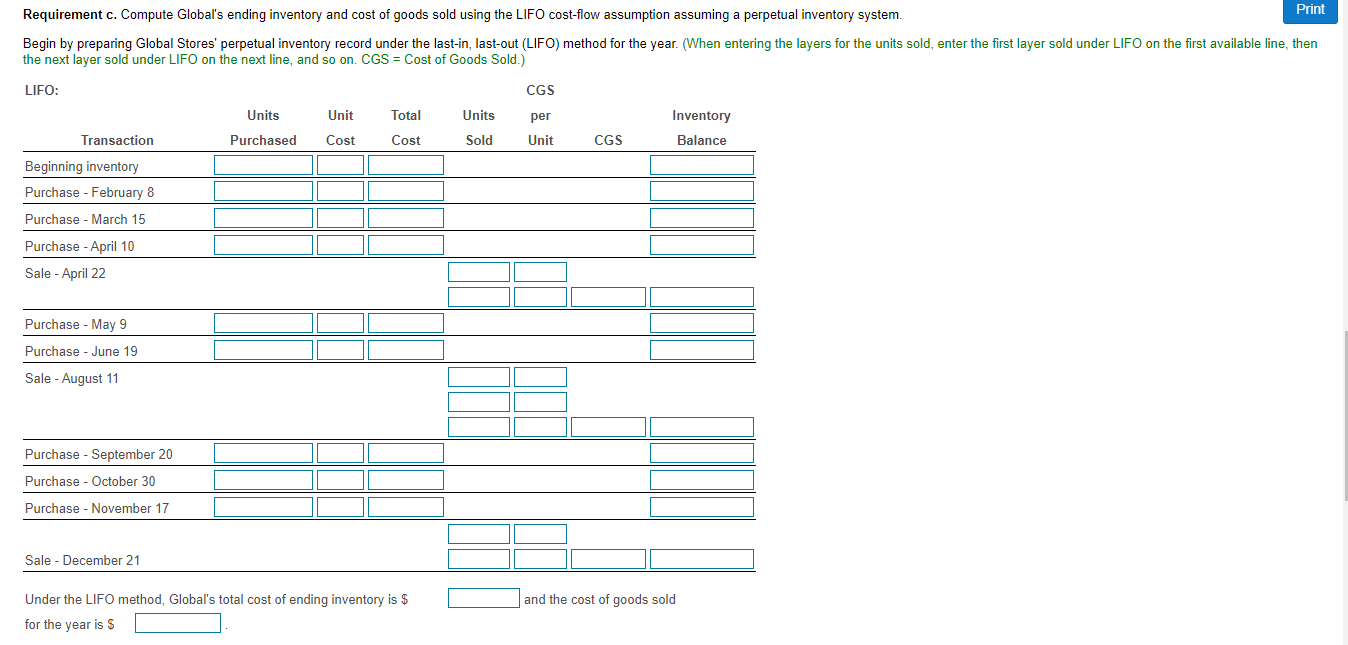

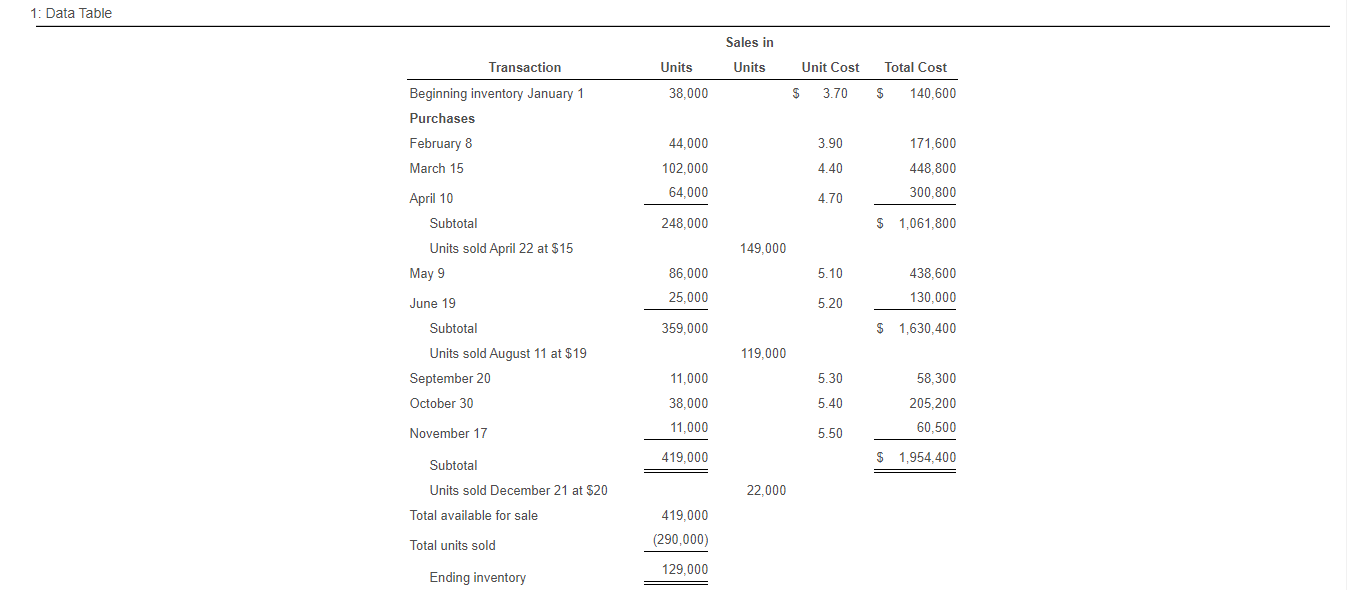

1. Global Imports provided the following information regarding its inventory operations Click the icon to view the information.) the current year, its second year of Requirement Compute Global's ending inventory and cost of goods sold under each of the following cost-flow assumptions assuming a perpetual inventory system. (Round your answer for cost per unit to two decimal places.) a. Moving Average b. FIFO c. LIFO Requirement a. Compute Global's ending inventory and cost of goods sold under the moving average cost-flow assumption assuming a perpetual inventory system. Begin by entering Global's purchase and sale transactions in chronological order one line at a time, calculating a new moving average cost per unit after every transaction. (Use a minus sign or parentheses for units sold or for a reduction in cost. Round your answer for cost per unit to two decimal places.) Moving-average: Units Average Purchased Unit Cumulative Total Cumulative Cost Transaction (Sold) Cost Units Cost Per Unit Beginning inventory Purchase - February 8 Cost Purchase - March 15 Purchase - April 10 Sale - April 22 Purchase - May 9 Purchase - June 19 Sale - August 11 Purchase - September 20 Purchase - October 30 Purchase - November 17 Sale - December 21 and the cost of goods sold Under the average-cost method, Global's total cost of ending inventory is $ for the year is $ Requirement b. Compute Global's ending inventory and cost of goods sold under the FIFO cost-flow assumption assuming a perpetual inventory system. (When entering the layers for the units sold, enter the first layer sold under FIFO on the first available line, then the next layer sold under FIFO on the next line, and so on. CGS = Cost of Goods Sold.) FIFO: CGS Units Unit Total Units per Inventory Transaction Purchased Cost Cost Sold Unit CGS Balance Beginning inventory Purchase - February 8 Purchase - March 15 Purchase - April 10 Sale - April 22 Purchase - May 9 Purchase - June 19 Sale - August 11 Purchase - September 20 Purchase - October 30 Purchase - November 17 Sale - December 21 and the cost of goods sold Under the FIFO method, Global's total cost of ending inventory is $ for the year is s Requirement c. Compute Global's ending inventory and cost of goods sold using the LIFO cost-flow assumption assuming a perpetual inventory system. Print Begin by preparing Global Stores' perpetual inventory record under the last-in, last-out (LIFO) method for the year. (When entering the layers for the units sold, enter the first layer sold under LIFO on the first available line, then the next layer sold under LIFO on the next line, and so on. CGS = Cost of Goods Sold.) LIFO: CGS Units Unit Total Units per Inventory Balance Purchased Cost Cost Sold Unit CGS Transaction Beginning inventory Purchase - February 8 Purchase - March 15 Purchase - April 10 Sale - April 22 Purchase - May 9 Purchase - June 19 Sale - August 11 Purchase - September 20 Purchase - October 30 Purchase - November 17 Sale - December 21 and the cost of goods sold Under the LIFO method, Global's total cost of ending inventory is $ for the year is $ 1: Data Table Sales in Transaction Units Units Unit Cost Total Cost 38,000 $ 3.70 $ 140,600 Beginning inventory January 1 Purchases February 8 March 15 44.000 3.90 171,600 4.40 102,000 64,000 448,800 300,800 April 10 4.70 Subtotal 248,000 $ 1,061,800 149.000 Units sold April 22 at $15 May 9 5.10 438,600 86,000 25,000 June 19 5.20 130,000 359,000 $ 1,630,400 119.000 Subtotal Units sold August 11 at $19 September 20 October 30 11,000 5.30 58,300 38,000 5.40 205,200 60.500 11,000 November 17 5.50 419,000 $ 1,954,400 Subtotal Units sold December 21 at $20 22.000 Total available for sale 419,000 (290,000) Total units sold 129,000 Ending inventory