Question

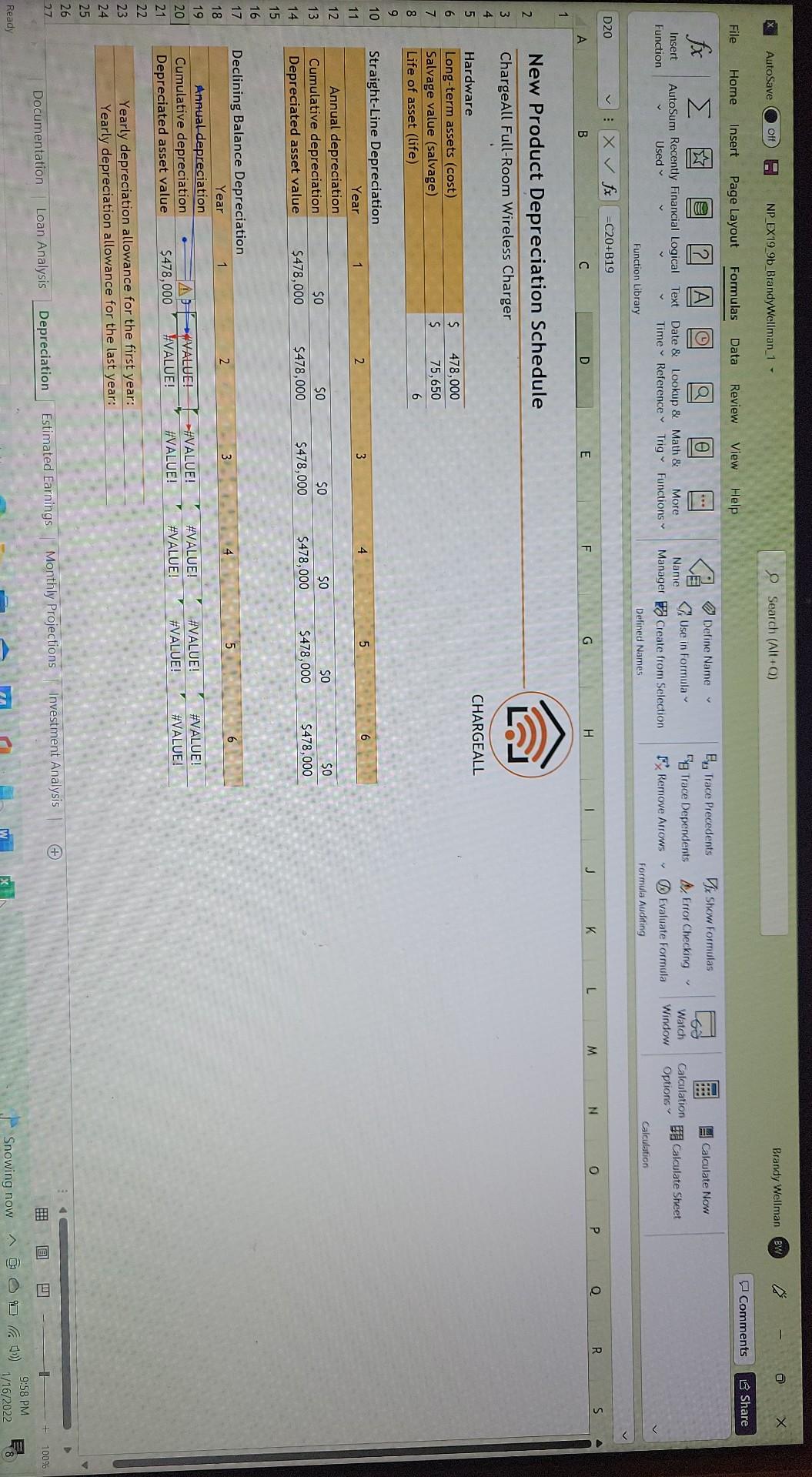

1. Go to the Depreciation worksheet. Hwan needs to correct the errors on this worksheet before he can perform any depreciation calculations. Correct the errors

1. Go to the Depreciation worksheet. Hwan needs to correct the errors on this worksheet before he can perform any depreciation calculations. Correct the errors as follows:

a. Use Trace Dependents arrows to determine whether the #VALUE! error in cell D20 is causing the other errors in the worksheet.

b. Use Trace Precedents arrows to find the source of the error in cell D20.

c. Correct the error so that the formula in cell D20 calculates the cumulative declining balance depreciation of the hardware by adding the cumulative depreciation value in Year 1 to the annual depreciation value in Year 2.

AutoSave a Oft Search (Alt+O) Brandy Wellman BW NP EX 19 9b BrandyWellman_1 Comments Share File Home Insert Page Layout Formulas Data Review View Help Define Name Q fx Calculate Now AutoSum Recently Financial Logical Text Date & Lookup & Math & More Used Time Reference Trig Functions Name CUse in Formula Manager 20 Create from Selection Insert Function E, Trace Precedents x Show Formulas 59 Trace Dependents Error Checking FRemove Arrows Evaluate Formula Formula Auditing 6 Watch Window Calculation Options Calculate Sheet Calculation Function Library Defined Names D20 VEX & fx =C20+B19 N L R O J M S 0 K F H G E B D 1 2 New Product Depreciation Schedule Charge All Full-Room Wireless Charger 3 4 5 CHARGEALL 6 Hardware Long-term assets (cost) Salvage value (salvage) Life of asset (life) S $ 7 478,000 75,650 6 8 9 10 4 3 5 6 1 Straight-Line Depreciation Year Annual depreciation Cumulative depreciation Depreciated asset value $0 $478,000 $0 $478,000 SO $478,000 $0 $478,000 $0 $478,000 $0 $478,000 6 2 4 3 11 12 13 14 15 16 17 18 19 20 21 22 23 24 25 26 Declining Balance Depreciation Year Annual depreciation Cumulative depreciation AP Depreciated asset value $478,000 #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! #VALUE! Yearly depreciation allowance for the first year: Yearly depreciation allowance for the last year: + 27 Investment Analysis Monthly Projections Estimated Earnings Loan Analysis Depreciation 100% Documentation Ready w Snowing now 9:58 PM 1/16/2022 8

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started