Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) Go to Yahoo Finance on the Internet (http://finance.yahoo.com/). Retrieve 25 months of monthly price data (from July 2021 to July 2023) for the

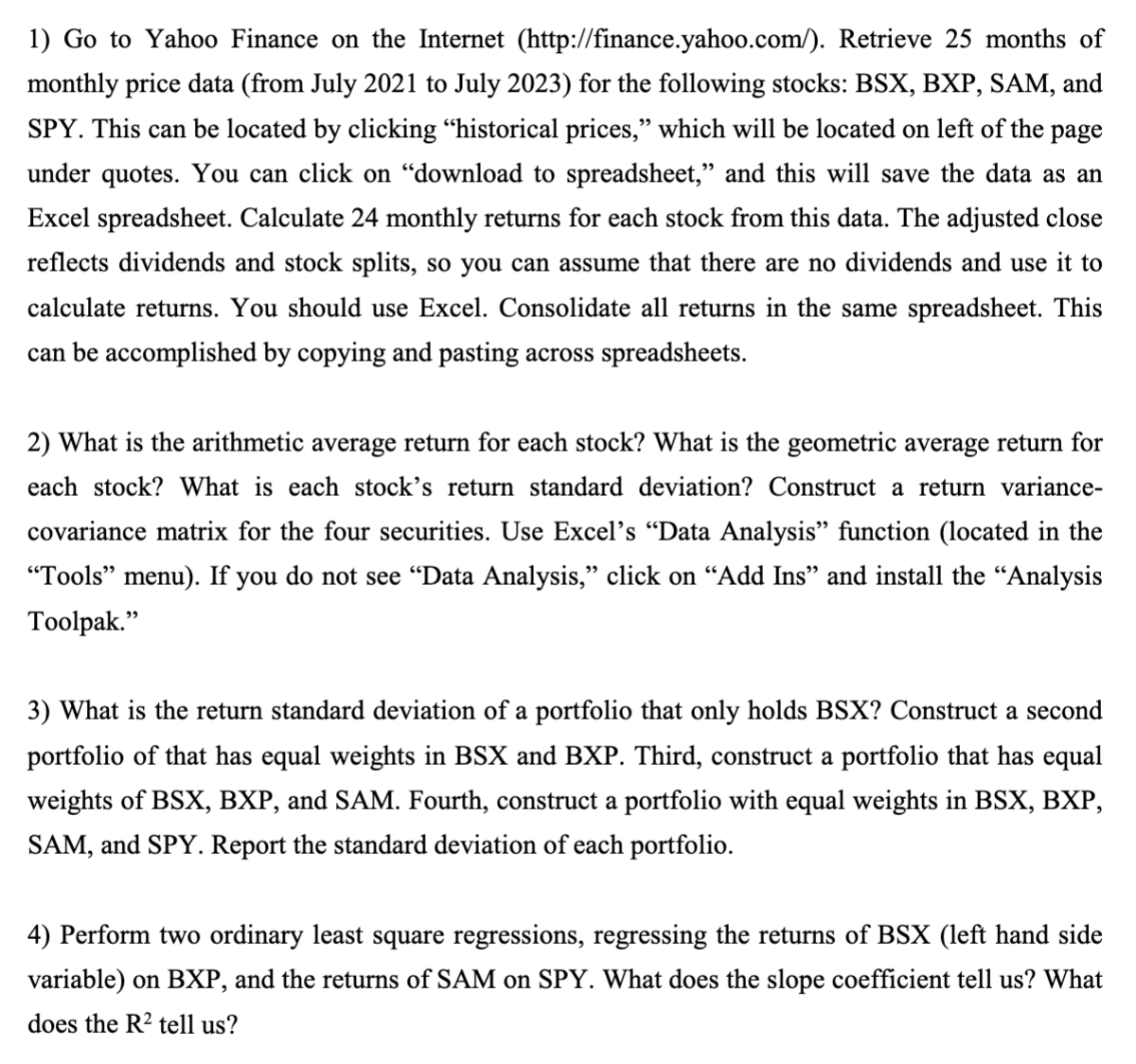

1) Go to Yahoo Finance on the Internet (http://finance.yahoo.com/). Retrieve 25 months of monthly price data (from July 2021 to July 2023) for the following stocks: BSX, BXP, SAM, and SPY. This can be located by clicking "historical prices," which will be located on left of the page under quotes. You can click on "download to spreadsheet," and this will save the data as an Excel spreadsheet. Calculate 24 monthly returns for each stock from this data. The adjusted close reflects dividends and stock splits, so you can assume that there are no dividends and use it to calculate returns. You should use Excel. Consolidate all returns in the same spreadsheet. This can be accomplished by copying and pasting across spreadsheets. 2) What is the arithmetic average return for each stock? What is the geometric average return for each stock? What is each stock's return standard deviation? Construct a return variance- covariance matrix for the four securities. Use Excel's "Data Analysis" function (located in the "Tools" menu). If you do not see "Data Analysis," click on "Add Ins and install the "Analysis Toolpak." 3) What is the return standard deviation of a portfolio that only holds BSX? Construct a second portfolio of that has equal weights in BSX and BXP. Third, construct a portfolio that has equal weights of BSX, BXP, and SAM. Fourth, construct a portfolio with equal weights in BSX, BXP, SAM, and SPY. Report the standard deviation of each portfolio. 4) Perform two ordinary least square regressions, regressing the returns of BSX (left hand side variable) on BXP, and the returns of SAM on SPY. What does the slope coefficient tell us? What does the R2 tell us?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started