Question: Complete the following tasks using the templates provided in FNSACC421_AT2_TMP_v1 and the information and data provided in Appendix A for Golden Steer, including their procedural

Complete the following tasks using the templates provided in FNSACC421_AT2_TMP_v1 and the information and data provided in Appendix A for Golden Steer, including their procedural guidelines.

- Enter all journals for the transactions listed and post to the General Ledger as per organisational Policies and Procedures.

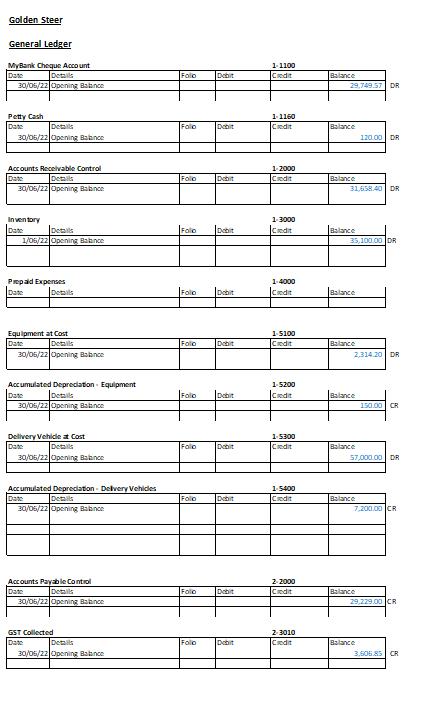

- Identify and correct errors - Check the opening balances in the General Ledger are the same as the balances provided by the external Accountant - Business to Business Accounting Pty Ltd. If there are any differences, the balances from the external Accountant are considered to be correct, so you are to change the General Ledger opening balances to be the same as those from Business to Business Accounting Pty Ltd.

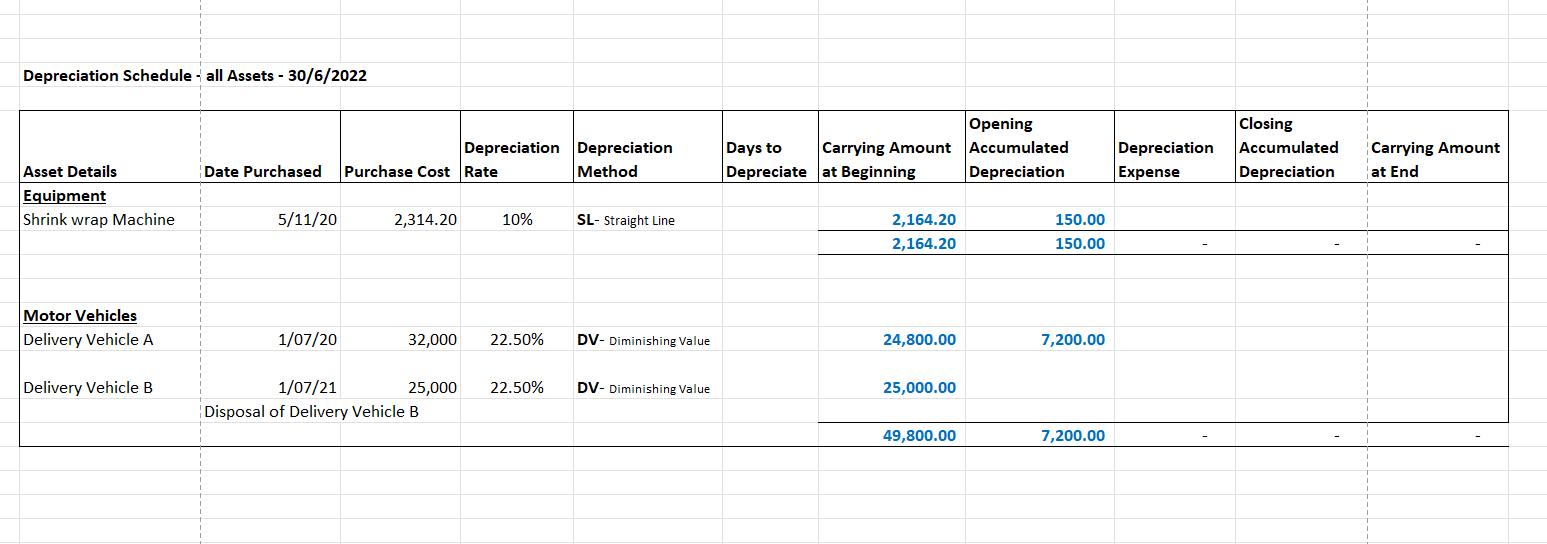

- Produce the Asset Register and Depreciation Schedule for 30 June 2022 (Excel templates provided - tab called Asset Reg & Depn Sch)

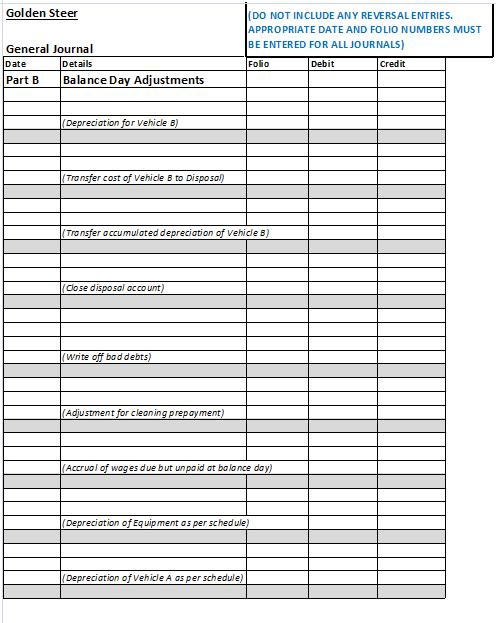

- Produce balance day adjustments, including depreciation

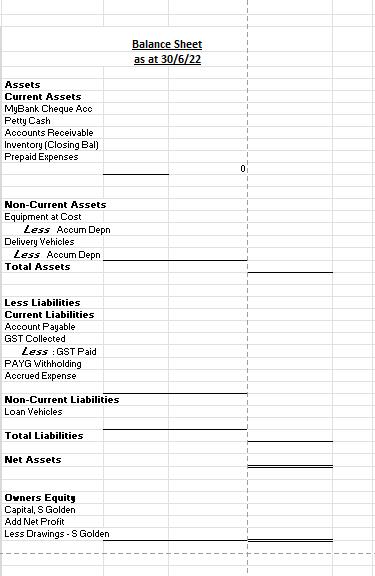

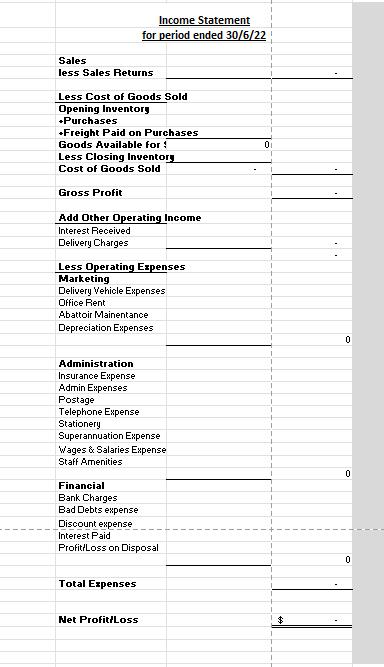

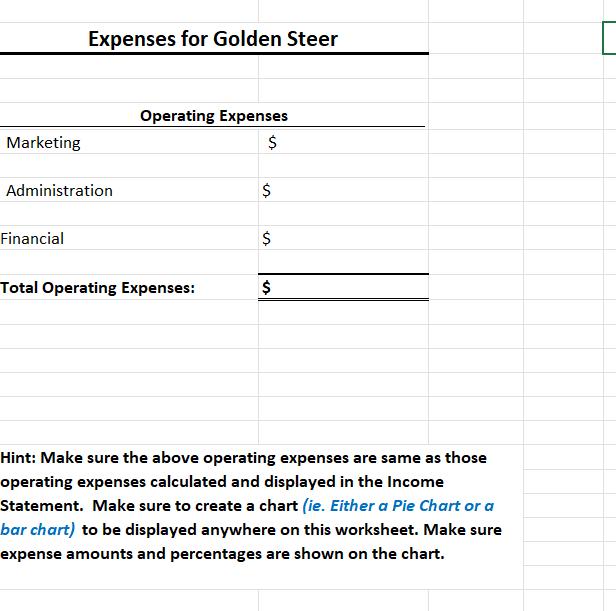

- Complete a Detailed Income Statement and Balance Sheet for 30 June 2022

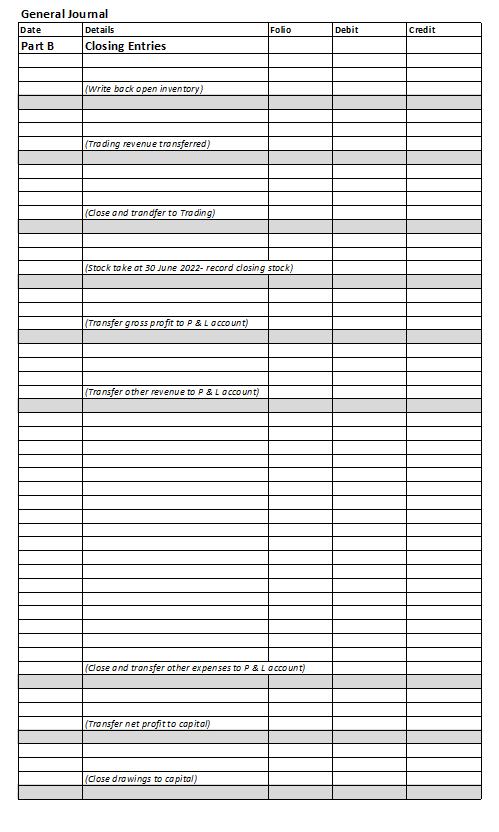

- Prepare closing entries as required and post to the general ledger

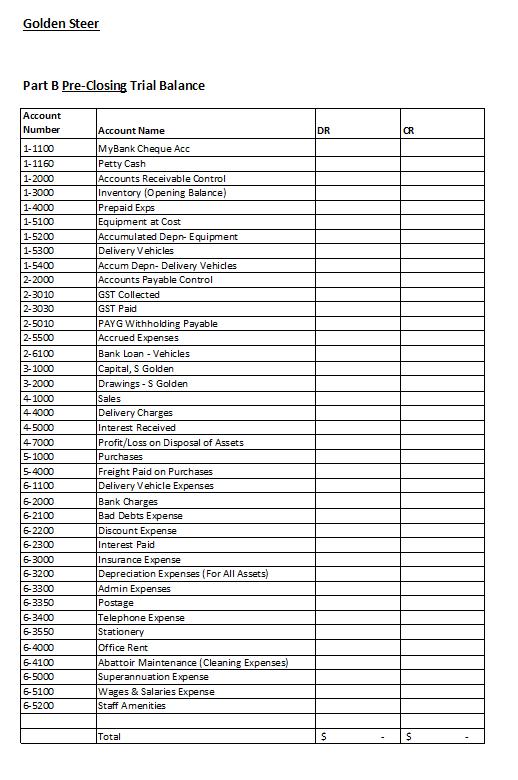

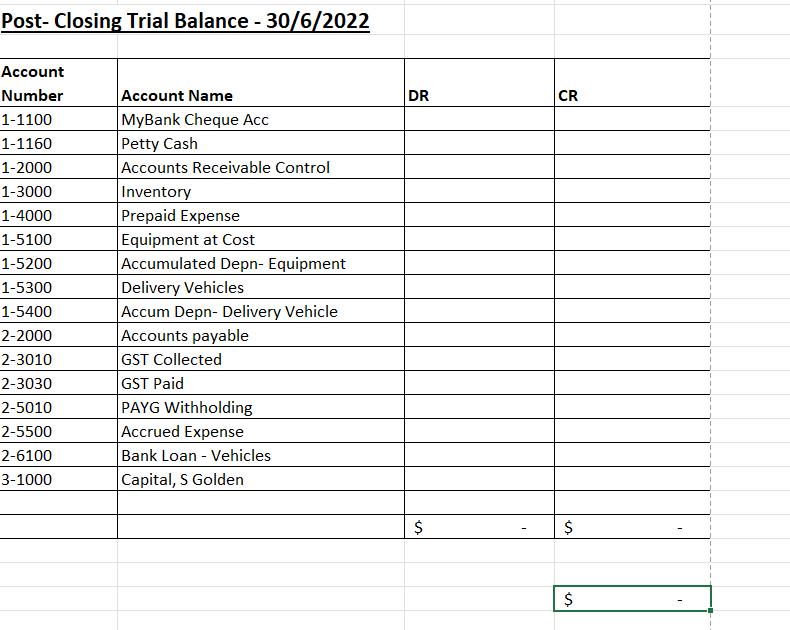

- Complete a post-closing Trial Balance as at 30/6/2022. End of Assessment

Appendix A

Golden Steer

ABN: 164 134 314

15 Buckjumper Ave

Rodeocity QLD 42777

Chart of Accounts

1-0000 Assets

1-1000 Current Assets

1-1100 MyBank Cheque Account (BSB:111-111 Acc no: 88888888)

1-1160 Petty Cash

1-2000 Accounts Receivable Control

1-3000 Inventory

1-4000 Prepaid Expenses

1-5000 Non-Current Assets

1-5100 Equipment at Cost

1-5200 less Accum Dep Equipment

1-5300 Delivery Vehicle at Cost

1-5400 less Accum Dep - Delivery Vehicle

2-1000 Current Liabilities

2-2000 Accounts Payable Control

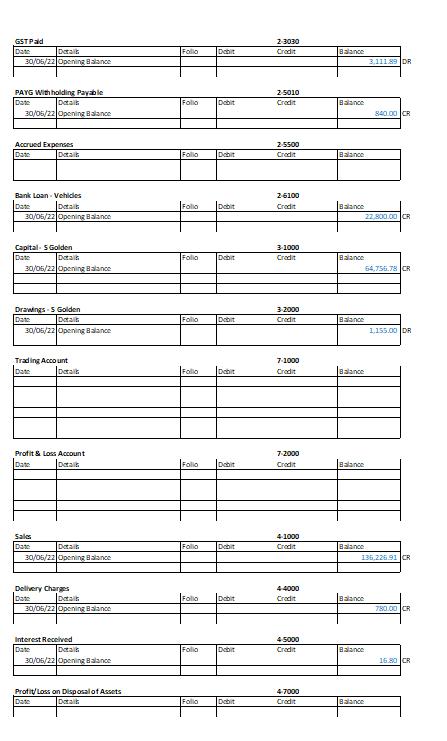

2-3000 GST Liabilities

2-3010 GST Collected

2-3030 GST Paid

2-5000 Payroll Liabilities

2-5010 PAYG Withholding Payable

2-5020 Superannuation Payable

2-5500 Accrued Expenses

2-6000 Non-Current Liabilities

2-6100 Bank Loan - Truck

3-0000 Equity

3-1000 Capital, S Golden

3-2000 Drawings, S Golden

4-0000 Income

4-1000 Sales

4-4000 Delivery Charges

4-5000 Interest Revenue

4-6000 Other income

4-7000 Profit/Loss on Disposal of Assets

5-0000 Cost of Sales

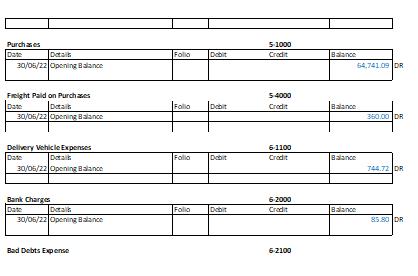

5-1000 Purchases

5-4000 Freight Paid on Purchases

6-0000 Expenses

6-1000 Advertising

6-1100 Delivery Vehicle Expenses

6-2000 Bank Charges

6-2100 Bad Debts Expense

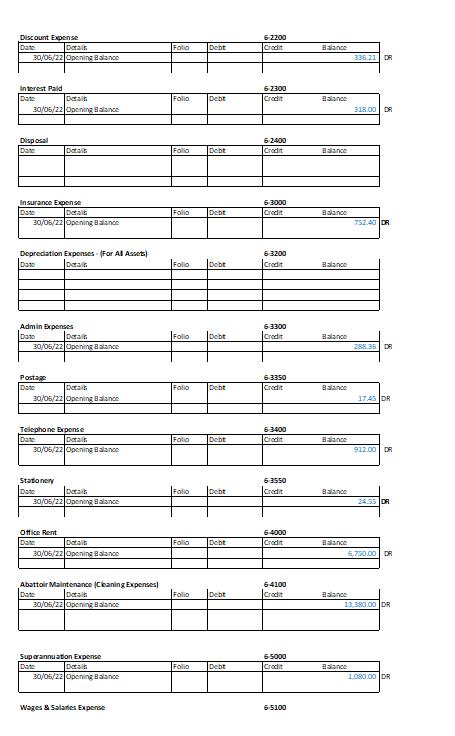

6-2200 Discount Expense

6-2300 Interest Paid

6-2400 Disposal

6-3000 Insurance Expense

6-3200 Depreciation Expense (For All Assets)

6-3300 Admin Expenses

6-3350 Postage

6-3400 Telephone Expense

6-3550 Stationery

6-4000 Office Rent

6-4100 Abattoir Maintenance (Cleaning Expenses)

6-5000 Superannuation Expense

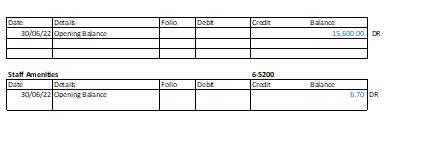

6-5100 Wages & Salaries Expense

6-5200 Staff Amenities

7-0000 Trading and Profit & Loss

7-1000 Trading Account

7-2000 Profit & Loss Account

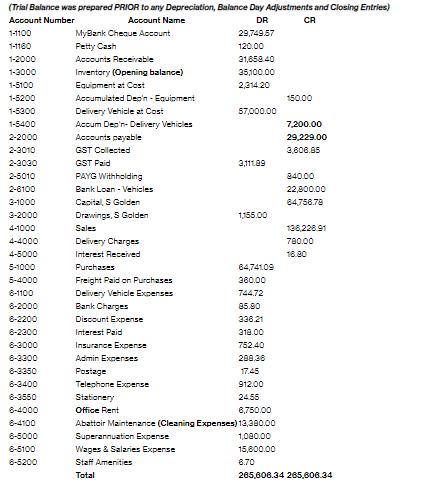

Trial Balance at 30.6.22

This Trial Balance was prepared by Business to Business Accounting Pty Ltd

Transactions

| Date | Details | $ |

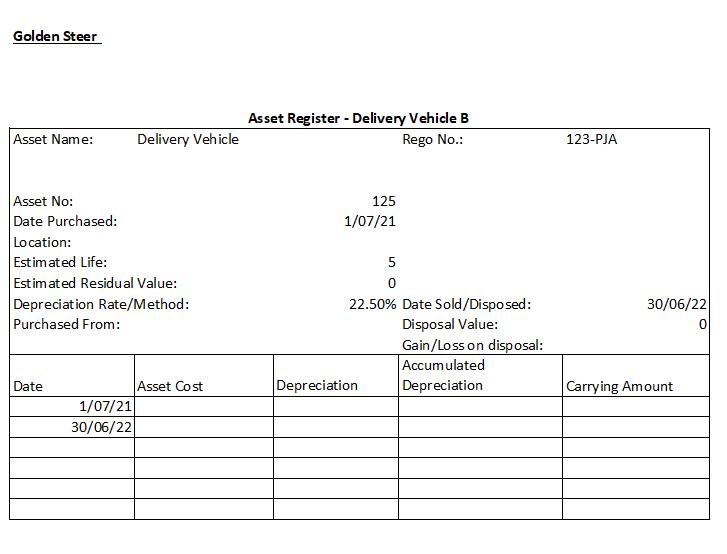

| 30/6/2022 | Delivery Vehicle (ie. Vehicle B) registration number 123-PJA (asset number 125, purchased 1/7/2021 for $25,000 ex GST, estimated useful life 5 years, $0 residual value, 22.5% DV depreciation rate) stolen and destroyed by fire. Complete the disposal entries for this stolen asset. (Insurance implications are not to be considered for this transaction) (Record these journals in the Balance Day Adjustment journal area) | |

| Balance Day Adjustments | ||

| 30/6/2022 | You have been notified that Delightful Diner has gone into liquidation. The unpaid balance relates to Invoice 7252 dated 05/03/2022. Write off the amount owing, $1,680, as a bad debt. (Hint: When you write off the bad debt, remember the rule stated in the Accounting Standard AASB1031) | |

| 30/6/2022 | Produce an adjustment entry for the prepaid cleaning contract - with Abbattoir Services Pty Ltd - $13,200 (included GST) was paid on 15/6/2022 for cleaning services covering 6 months period from 1/6/2022 to 30/11/2022. (Hint: Remember the rule stated in the Accounting Standard AASB1031. In your calculation remember to consider these points: How much the prepaid expense was planned for each month, and how much prepaid expense had been utilized in the month of June, and how much prepaid expense remaining at end of June.) | |

| 30/6/2022 | Wages need to be accrued for June | $1,100 |

| 30/6/2022 | Depreciation to be recorded for the year for remaining assets (ie. the Equipment, and the Vehicle A). (Assume the opening Accumulated Depreciation is correct in the Depreciation Schedule). | |

| 30/6/2022 | Closing inventory balance (ie. After stock take) | $36,900 |

Account Name (Trial Balance was prepared PRIOR to any Depreciation, Balance Day Adjustments and Closing Entries) Account Number CR DR 1-1100 MyBank Cheque Account 29,749.57 1-1180 Petty Cash 120.00 1-2000 Accounts Receivable 31,858.40 1-3000 Inventory (Opening balance) 35,100.00 1-5100 Equipment at Cost 2,314.20 1-5200 Accumulated Dep'n Equipment 150.00 1-5300 Delivery Vehicle at Cost 57,000.00 1-5400 Accum Dep'n-Delivery Vehicles 7,200.00 2-2000 Accounts payable 29,229.00 2-3010 GST Collected 3,806.85 2-3030 GST Paid 3,111.89 2-5010 PAYG Withholding 840.00 2-6100 Bank Loan - Vehicles 22,800.00 3-1000 Capital, S Golden 84,758.79 3-2000 Drawings, S Golden 1155.00 4-1000 Sales 138,228.91 4-4000 Delivery Charges 780.00 4-5000 Interest Received 18.80 5-1000 Purchases 84,741.09 5-4000 Freight Paid on Purchases 380.00 8-1100 Delivery Vehicle Expenses 744.72 8-2000 Bank Charges 85.90 6-2200 Discount Expense 338.21 8-2300 Interest Paid 318.00 8-3000 Insurance Expense 752.40 8-3300 Admin Expenses 290.36 8-3350 Postage 17.45 8-3400 Telephone Expense 912.00 8-3550 Stationery 24.55 6-4000 Office Rent 8,750.00 8-4100 Abattoir Maintenance (Cleaning Expenses) 13,300.00 8-5000 Superannuation Expense 1,000.00 8-5100 Wages & Salaries Expense 15,800.00 8-5200 Staff Amenities 8.70 Total 265,606.34 285,606.34

Step by Step Solution

There are 3 Steps involved in it

To answer all parts of the question with calculations in table form Ill organize the information provided into structured tables for each task Heres how the breakdown would look 1 Journal Entries Tabl... View full answer

Get step-by-step solutions from verified subject matter experts