Answered step by step

Verified Expert Solution

Question

1 Approved Answer

. 1. Gotham Ltd purchased 100% of the issued shares in City Ltd on 1 July 2017 for $70 000. City Lid's assets were all

.

.

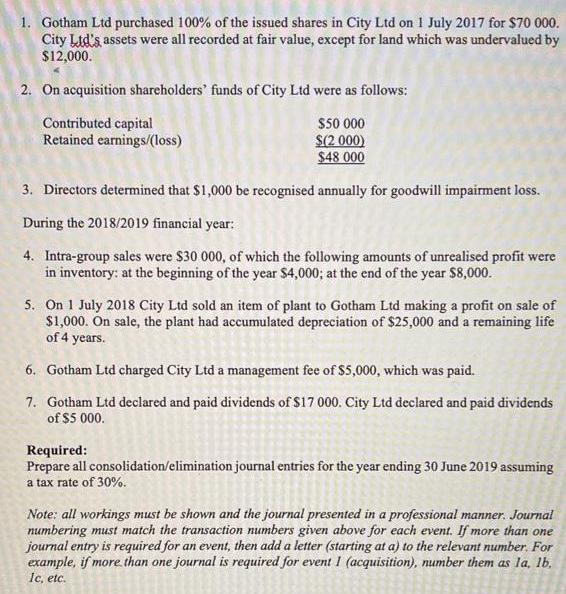

1. Gotham Ltd purchased 100% of the issued shares in City Ltd on 1 July 2017 for $70 000. City Lid's assets were all recorded at fair value, except for land which was undervalued by $12,000. 2. On acquisition shareholders' funds of City Ltd were as follows: Contributed capital Retained earnings/(loss) $50 000 S(2 000) $48 000 3. Directors determined that $1,000 be recognised annually for goodwill impairment loss. During the 2018/2019 financial year: 4. Intra-group sales were $30 000, of which the following amounts of unrealised profit were in inventory: at the beginning of the year S4,000; at the end of the year $8,000. 5. On 1 July 2018 City Ltd sold an item of plant to Gotham Ltd making a profit on sale of $1,000. On sale, the plant had accumulated depreciation of $25,000 and a remaining life of 4 years. 6. Gotham Ltd charged City Ltd a management fee of $5,000, which was paid. 7. Gotham Ltd declared and paid dividends of $17 000. City Ltd declared and paid dividends of $5 000. Required: Prepare all consolidation/elimination journal entries for the year ending 30 June 2019 assuming a tax rate of 30%. Note: all workings must be shown and the journal presented in a professional manner. Journal numbering must match the transaction numbers given above for each event. If more than one journal entry is required for an event, then add a letter (starting at a) to the relevant number. For example, if more than one journal is required for event I (acquisition), number them as la, 1b. lc, etc.

Step by Step Solution

★★★★★

3.34 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

103 income as pde l Particula8 Debit 7 credit Amount Amount N072014 undavations J8000 Net assets ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started