Question

(1) Hanson Company has forecast a demand of 10,000 units per month. Which product(s) should Hanson manufacture 10,000 units of to maximize its profits? (2)Assume

(1) Hanson Company has forecast a demand of 10,000 units per month. Which product(s) should Hanson manufacture 10,000 units of to maximize its profits?

(2)Assume that skilled technicians are in short supply so that the total labor hours each month is restricted to 24,000 hrs. How many units of each type should Hanson manufacture (assuming it can sell all it can manufacture)?

(3)Assume that the company can hire any number of skilled technicians, but the machine hrs. are limited to 24,000 hrs. per month. How many of each units should Hanson manufacture (assuming it can sell all it can manufacture)?

(4)Assume that both resources are limited, so that the capacities of each of machine hrs. and labor hrs. are restricted to 24,000 hrs. per month. Now, how many units of each type should Hanson manufacture (assuming it can sell all it can manufacture)?

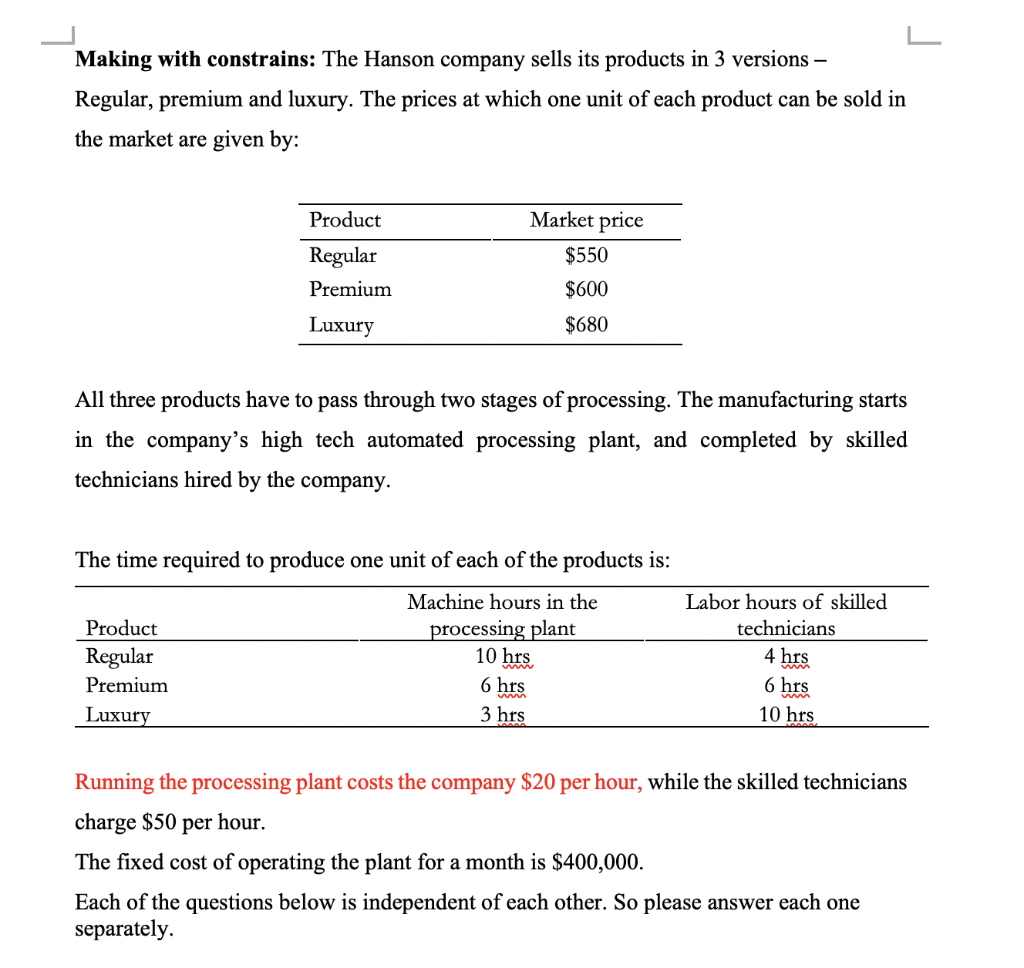

Making with constrains: The Hanson company sells its products in 3 versions Regular, premium and luxury. The prices at which one unit of each product can be sold in the market are given by: Product Regular Premium Luxury Market price $550 $600 $680 All three products have to pass through two stages of processing. The manufacturing starts in the company's high tech automated processing plant, and completed by skilled technicians hired by the company. The time required to produce one unit of each of the products is: Product Regular Premium Luxury Machine hours in the processing plant 10 hrs 6 hrs 3 hrs Labor hours of skilled technicians 4 hrs 6 hrs 10 hrs Running the processing plant costs the company $20 per hour, while the skilled technicians charge $50 per hour. The fixed cost of operating the plant for a month is $400,000. Each of the questions below is independent of each other. So please answer each one separately

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started