Answered step by step

Verified Expert Solution

Question

1 Approved Answer

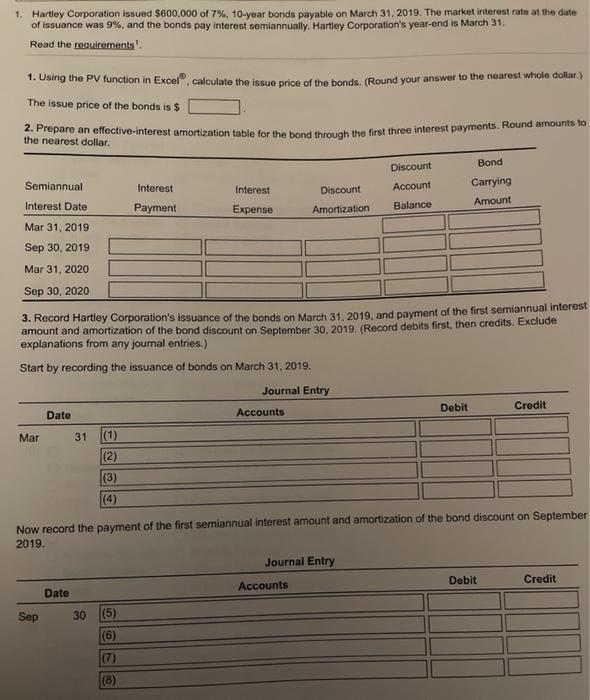

1. Hartley Corporation issued $600,000 of 7%, 10-year bonds payable on March 31, 2019. The market interest rate at the date. of issuance was

1. Hartley Corporation issued $600,000 of 7%, 10-year bonds payable on March 31, 2019. The market interest rate at the date. of issuance was 9%, and the bonds pay interest semiannually. Hartley Corporation's year-end is March 31. Read the requirements. 1. Using the PV function in Excel, calculate the issue price of the bonds. (Round your answer to the nearest whole dollar.) The issue price of the bonds is $ 2. Prepare an effective-interest amortization table for the bond through the first three interest payments. Round amounts to the nearest dollar. Bond Discount Semiannual Interest Account Carrying Discount Interest Date Interest Expense Payment Amount Balance Amortization Mar 31, 2019 Sep 30, 2019 Mar 31, 2020 Sep 30, 2020 3. Record Hartley Corporation's issuance of the bonds on March 31, 2019, and payment of the first semiannual interest amount and amortization of the bond discount on September 30, 2019. (Record debits first, then credits. Exclude explanations from any journal entries.) Start by recording the issuance of bonds on March 31, 2019. Journal Entry Date Accounts Debit Credit Mar 31 (1) (2) (3) (4) Now record the payment of the first semiannual interest amount and amortization of the bond discount on September 2019. Journal Entry Debit Accounts Credit Date Sep 30 (5) (6) (8)

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Part 1 Issue Price of Bond Issue price of a bond is the present value PV of its future cash flows ie PV of its annual coupon payments and PV of its face value or maturity value Thus Issue Price of bon...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started