Question

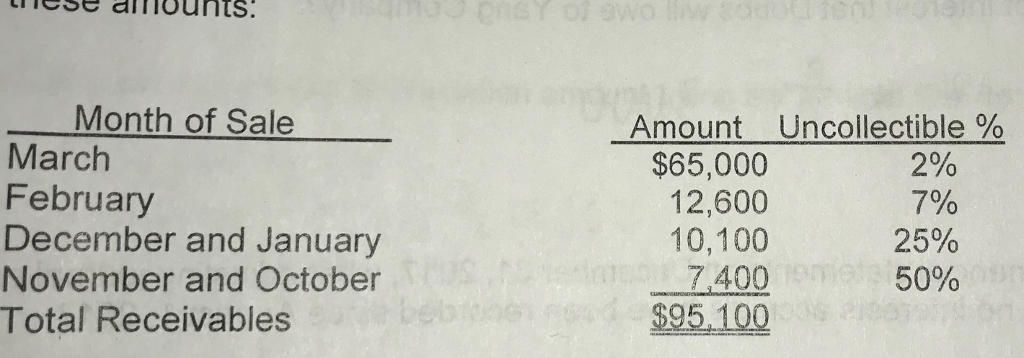

1. Hatcher Company has accounts receivable of $95,100 at March 31, 2017. An analysis of the accounts shows these amounts: a) Calculate the total estimated

1. Hatcher Company has accounts receivable of $95,100 at March 31, 2017. An analysis of the accounts shows these amounts: a) Calculate the total estimated uncollectible accounts on March 31, 2017.

a) Calculate the total estimated uncollectible accounts on March 31, 2017.

b) What is the total realizable value of the receivables on March 31, 2017?

c.) Using the information above, what entry should Hatcher make to record the estimated uncollectible amount using the Allowance method? Assume Hatcher already has 1,000 credit balance in its Allowance account.

d) Using the information above, what entry should Hatcher make to record the write-off of a $500 receivable?

e) Using the information above, what entry or entries will Hatcher make if it has a recovery of a $750 receivable that was previously written off?

ese aIiounts Month of Sale Amount Uncollectible % March February December and January November and October Total Receivables $65,000 12,600 10,100 7,400 $95 100 2% 7% 25% 60%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started