Question

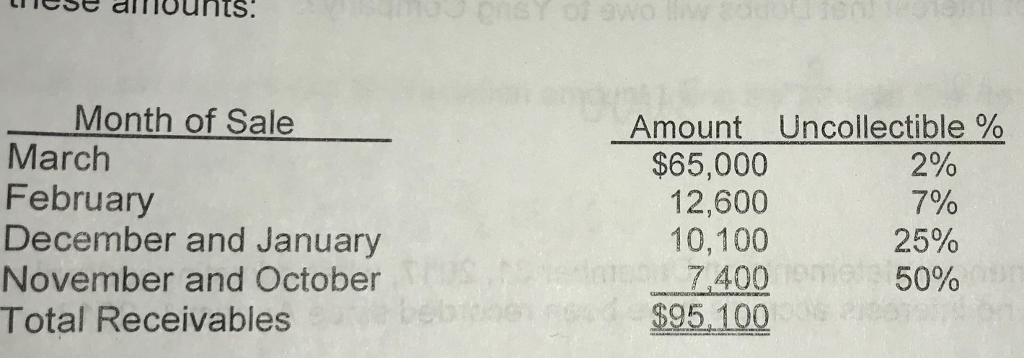

1. Hatcher Company has accounts receivable of $95,100 at March 31, 2017. An analysis of the accounts shows these amounts: a) Calculate the total estimated

1. Hatcher Company has accounts receivable of $95,100 at March 31, 2017. An analysis of the accounts shows these amounts: a) Calculate the total estimated uncollectible accounts on March 31, 2017.

a) Calculate the total estimated uncollectible accounts on March 31, 2017.

b) What is the total realizable value of the receivables on March 31, 2017?

c. Using the information above, what entry should Hatcher make to record the estimated uncollectible amount using the Allowance method? Assume Hatcher already has 1,000 credit balance in its Allowance account.

d) Using the information above, what entry should Hatcher make to record the write-off of a $500 receivable?

e) Using the information above, what entry or entries will Hatcher make if it has a recovery of a $750 receivable that was previously written off?

2. Under the allowance method of accounting for uncollectible accounts: (MULTIPLE CHOICE)

a) the cash realization value of accounts receivable is greater before an account is written off than after it is written off.

b) Bad Debit expense is debited when a specific account is written off as uncollectible

c) the cash realizable value of accounts is in the balance sheet is the same before and after an account is written off

d) Allowance for Doubtful Accounts is closed each year to income summary

3. The balance in the Accumulated Depreciation account represents the: (MULTIPLE CHOICE QUESTION)

a) cash fund to be used to replace plant assets

b) amount to be deducted from the cost of the plant asset to arrive at its fair market value

c) amount charged to expense in the current period

d) amount charged to expense since the acquisition of the plant asset

4. Button company purchases land for $90,000 cash. Button assumes $2,500 in property taxes due on the land. The title and attorney dees totaled $1,000. Button has the land graded for $2,200. They paid $10,000 for paving of the parking lot. They also paid an architect a fee of $15,000 to design a new office building that will go on the site. What amount does Burke record as the cost of the land?

a. $93,200 b.105,700 c. 95,700 d.120,700

ese aIiounts Month of Sale Amount Uncollectible % March February December and January November and October Total Receivables $65,000 12,600 10,100 7,400 $95 100 2% 7% 25% 60% ese aIiounts Month of Sale Amount Uncollectible % March February December and January November and October Total Receivables $65,000 12,600 10,100 7,400 $95 100 2% 7% 25% 60%Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started