Question

1) Heath Inc.'s balance sheet shows that it has $10 million in short-term investments, $15 million in notes payable, $60 million in long-term bonds, and

1) Heath Inc.'s balance sheet shows that it has $10 million in short-term investments, $15 million in notes payable, $60 million in long-term bonds, and $15 million in preferred stock. Heath has 60 million shares outstanding. Calculate the following: a) total intrinsic value for Heath Inc. b) intrinsic value of equity for Heath Inc. c) intrinsic stock price per share for Heath Inc.

2) Distinguish between the call option and the put option. The current price of a stock is $50. In 1 year, the price will be either $65 or $35. The risk-free annual rate is 5%. Find the price of a call option on the stock with an exercise price of $55 that expires in 1 year. (Hint: Use daily compounding.)

Formula/ equation and answers, please. No Excel.

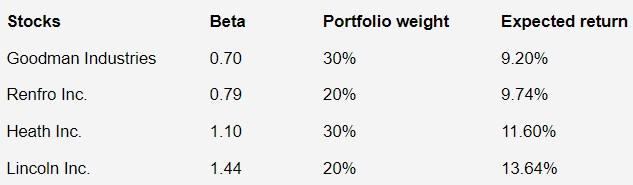

StocksGoodmanIndustriesRenfroInc.HeathInc.LincolnInc.Beta0.700.791.101.44Portfolioweight30%20%30%20%Expectedreturn9.20%9.74%11.60%13.64%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started