Answered step by step

Verified Expert Solution

Question

1 Approved Answer

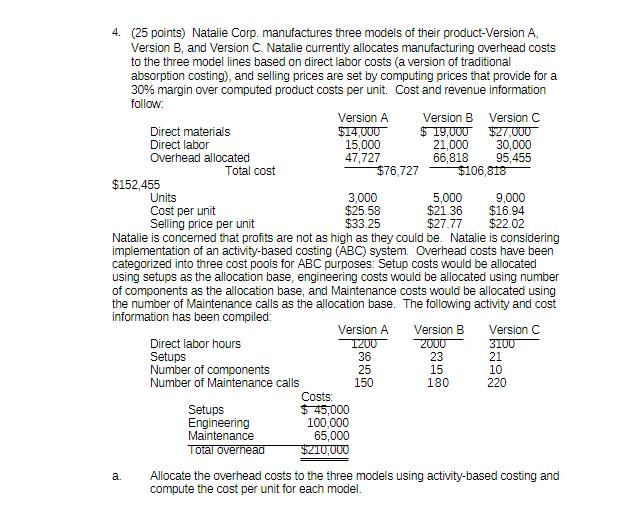

4. (25 points) Natalie Corp. manufactures three models of their product-Version A, Version B, and Version C. Natalie currently allocates manufacturing overhead costs to

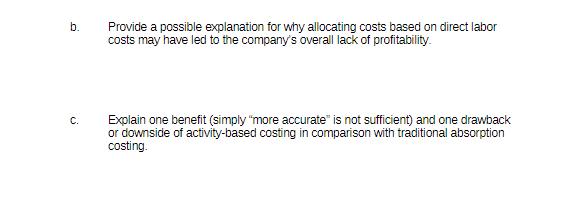

4. (25 points) Natalie Corp. manufactures three models of their product-Version A, Version B, and Version C. Natalie currently allocates manufacturing overhead costs to the three model lines based on direct labor costs (a version of traditional absorption costing), and selling prices are set by computing prices that provide for a 30% margin over computed product costs per unit. Cost and revenue information follow: Version A Direct materials Direct labor $14,000 15,000 Version B $ 19,000 21,000 Version C $27,000 30,000 Overhead allocated 47,727 66,818 95,455 Total cost $76,727 $106,818 $152,455 Units 3,000 5,000 9,000 Cost per unit $25.58 Selling price per unit $33.25 $21.36 $16.94 $27.77 $22.02 Natalie is concerned that profits are not as high as they could be. Natalie is considering implementation of an activity-based costing (ABC) system. Overhead costs have been categorized into three cost pools for ABC purposes: Setup costs would be allocated using setups as the allocation base, engineering costs would be allocated using number of components as the allocation base, and Maintenance costs would be allocated using the number of Maintenance calls as the allocation base. The following activity and cost information has been compiled: Version C a. Direct labor hours Setups Number of components Version A Version B 1200 2000 3100 36 23 21 25 15 10 150 180 220 Number of Maintenance calls Costs: Setups $ 45,000 Engineering 100,000 65,000 Maintenance Total overhead $210,000 Allocate the overhead costs to the three models using activity-based costing and compute the cost per unit for each model. b. Provide a possible explanation for why allocating costs based on direct labor costs may have led to the company's overall lack of profitability. C. Explain one benefit (simply "more accurate" is not sufficient) and one drawback or downside of activity-based costing in comparison with traditional absorption costing.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Allocation of Overhead Costs Using ActivityBased Costing ABC To allocate the overhead costs using ActivityBased Costing we first need to identify and allocate the costs based on the cost drivers Ste...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started