Question

1. Hint: pay attention to the weight of the questions! Problem Number 1 (Weight 25%) The following is the transaction of the trading company Maju

1. Hint: pay attention to the weight of the questions! Problem Number 1 (Weight 25%) The following is the transaction of the trading company "Maju Sukses" in December 2020 by using the "Periodic Inventory System" method. On 2 December 2020 the company purchased $ 4,500 of merchandise on credit 2/10. On December 5, 2020, the company pays cash delivery fees on the order dated December 2, 2020 for $ 200. On December 6, 2020, the company sold merchandise online a 2/10 credit of $ 6,000. On December 7, 2020, the company returned the purchase of goods done on December 2, 2020 for $ 500. On 8 December 2020 the company purchased $ 3,500 of merchandise in cash. On 12 December 2020 the company paid the invoice for the purchase of goods which are due with a 2% discount for payment in time 10 days. On December 13, 2020 the company received sales returns from consumers for $ 500. On December 16, 2020 the company received payment for merchandise which is sold on credit on December 6, 2020 by giving 2% discount on sales because it is paid on 10 days. The following is the balance sheet data for the 2020 Maju Sukses trading company:

Based on the data above, please answer the following questions: a. Make a general journal of the 8 transactions (December 2-16, 2020). b. Prepare a worksheet as of December 31, 2020 c. Based on the material you have studied, give your opinion the method which one would you choose to record the inventory, what is the method perpetual or periodic method? Please answer in your own words and give a complete and systematic answer. d. Based on the answers to points a & b, how to make a trading company "Forward Success" get more profit but still maintain product quality? Please answer in your own words and provide answers clear and systematic. e. Based on the material you have studied, give your opinion on differences in accounting records for trading companies and service companies. In addition, include the accounting record cycle for the company trade.

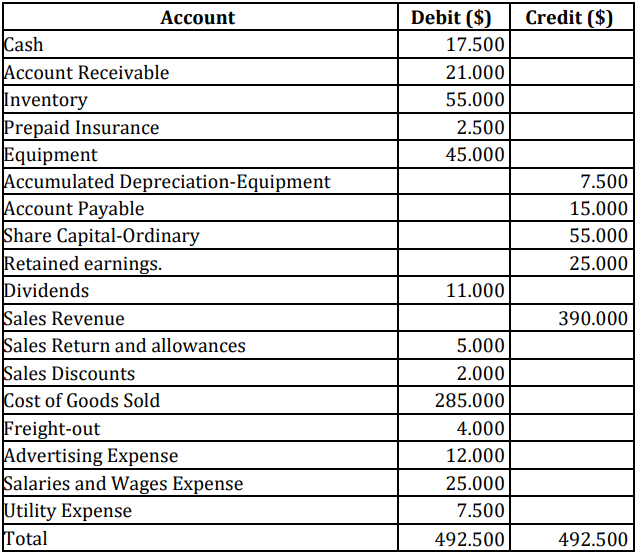

Account Cash |Account Receivable Inventory Prepaid Insurance Equipment Accumulated Depreciation Equipment Account Payable Share Capital-Ordinary Retained earnings. Dividends Sales Revenue Sales Return and allowances Sales Discounts Cost of Goods Sold Freight-out Advertising Expense Salaries and Wages Expense Utility Expense Total Debit ($) Credit ($) 17.500 21.000 55.000 2.500 45.000 7.500 15.000 55.000 25.000 11.000 390.000 5.000 2.000 285.000 4.000 12.000 25.000 7.500 492.500| 492.500 Account Cash |Account Receivable Inventory Prepaid Insurance Equipment Accumulated Depreciation Equipment Account Payable Share Capital-Ordinary Retained earnings. Dividends Sales Revenue Sales Return and allowances Sales Discounts Cost of Goods Sold Freight-out Advertising Expense Salaries and Wages Expense Utility Expense Total Debit ($) Credit ($) 17.500 21.000 55.000 2.500 45.000 7.500 15.000 55.000 25.000 11.000 390.000 5.000 2.000 285.000 4.000 12.000 25.000 7.500 492.500| 492.500

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started