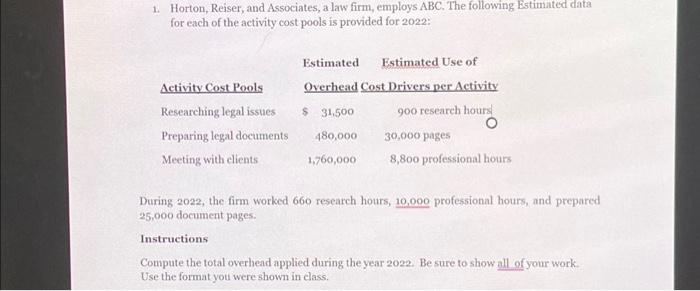

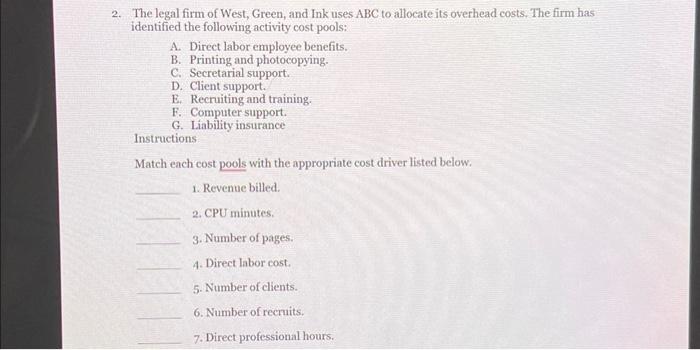

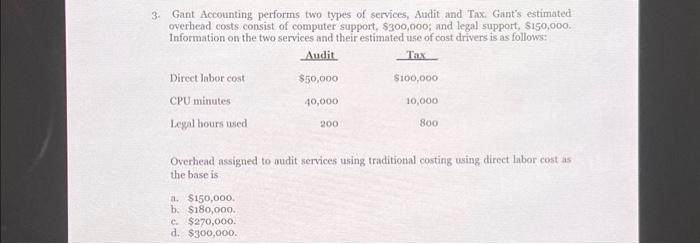

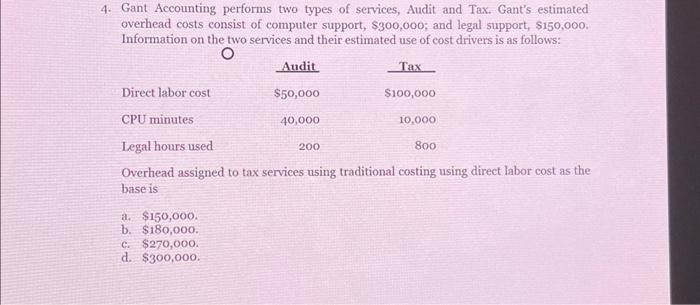

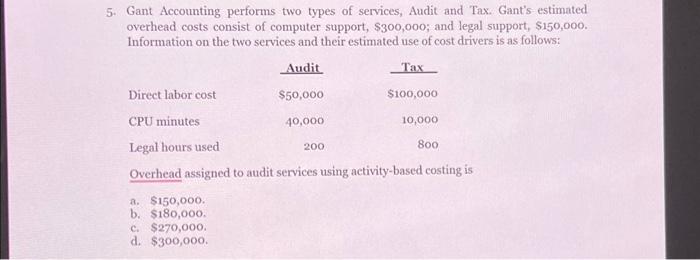

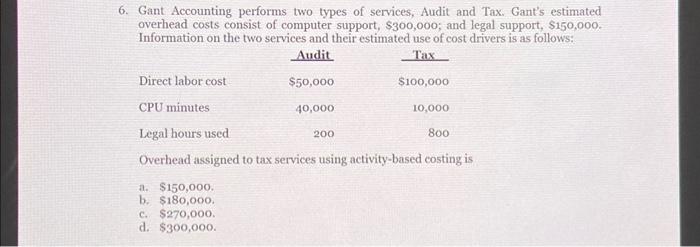

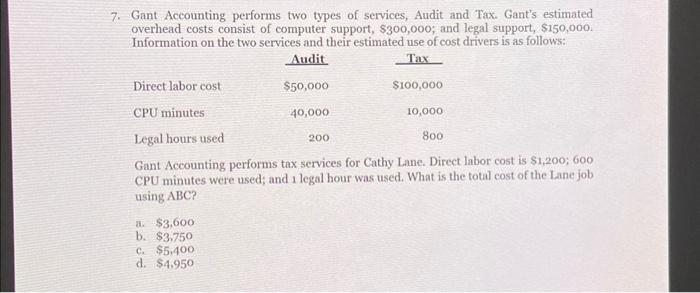

1. Horton, Reiser, and Associates, a law firm, employs ABC. The following Estimated data for each of the activity cost pools is provided for 2022 : During 2022, the firm worked 660 research hours, 10,000 professional hours, and prepared 25,000 document pages. Instructions Compute the total overhead applied during the year 2022 . Be sure to show all of your work. Use the format you were shown in class. 3. Gant Accounting performs two types of services, Audit and Tax. Gant's estimated overhead costs consist of computer support, $300,000; and legal support, \$150,000. Information on the two services and their estimated use of cost drivers is as follows: Overhead assigned to audit services using traditional costing using direct labor cost as the base is a. $150,000. b. $180,000. c. $270,000. d. $300,000. Gant Accounting performs two types of services, Audit and Tax. Gant's estimated overhead costs consist of computer support, $300,000; and legal support, $150,000. Information on the two services and their estimated use of cost drivers is as follows: Overhead assigned to audit services using activity-based costing is a. $150,000. b. $180,000. c. $270,000. d. $300,000. 2. The legal firm of West, Green, and Ink uses ABC to allocate its overhead costs. The firm has identified the following activity cost pools: A. Direct labor employee benefits. B. Printing and photocopying. C. Secretarial support. D. Client support. E. Recruiting and training. F. Computersupport. G. Liability insurance Instructions Match each cost pools with the appropriate cost driver listed below. 1. Revenue billed. 2. CPU minutes. 3. Number of pages. 4. Direct labor cost. 5. Number of clients. 6. Number of recruits. 7. Direct professional hours. Gant Accounting performs two types of services, Audit and Tax. Gant's estimated overhead costs consist of computer support, $300,000; and legal support, $150,000. Information on the two services and their estimated use of cost drivers is as follows: Overhead assigned to tax services using traditional costing using direct labor cost as the base is a. $150,000. b. $180,000. c. $270,000. d. $300,000. 7. Gant Accounting performs two types of services, Audit and Tax. Gant's estimated overhead costs consist of computer support, $300,000; and legal support, $150,000. Information on the two services and their estimated use of cost drivers is as follows: Gant Accounting performs tax services for Cathy Lane. Direct labor cost is \$1,200; 600 CPU minutes were used; and 1 legal hour was used. What is the total cost of the Lane job using ABC ? a. $3,600 b. $3.750 c. $5,400 d. $4,950 1. Horton, Reiser, and Associates, a law firm, employs ABC. The following Estimated data for each of the activity cost pools is provided for 2022 : During 2022, the firm worked 660 research hours, 10,000 professional hours, and prepared 25,000 document pages. Instructions Compute the total overhead applied during the year 2022 . Be sure to show all of your work. Use the format you were shown in class. 3. Gant Accounting performs two types of services, Audit and Tax. Gant's estimated overhead costs consist of computer support, $300,000; and legal support, \$150,000. Information on the two services and their estimated use of cost drivers is as follows: Overhead assigned to audit services using traditional costing using direct labor cost as the base is a. $150,000. b. $180,000. c. $270,000. d. $300,000. Gant Accounting performs two types of services, Audit and Tax. Gant's estimated overhead costs consist of computer support, $300,000; and legal support, $150,000. Information on the two services and their estimated use of cost drivers is as follows: Overhead assigned to audit services using activity-based costing is a. $150,000. b. $180,000. c. $270,000. d. $300,000. 2. The legal firm of West, Green, and Ink uses ABC to allocate its overhead costs. The firm has identified the following activity cost pools: A. Direct labor employee benefits. B. Printing and photocopying. C. Secretarial support. D. Client support. E. Recruiting and training. F. Computersupport. G. Liability insurance Instructions Match each cost pools with the appropriate cost driver listed below. 1. Revenue billed. 2. CPU minutes. 3. Number of pages. 4. Direct labor cost. 5. Number of clients. 6. Number of recruits. 7. Direct professional hours. Gant Accounting performs two types of services, Audit and Tax. Gant's estimated overhead costs consist of computer support, $300,000; and legal support, $150,000. Information on the two services and their estimated use of cost drivers is as follows: Overhead assigned to tax services using traditional costing using direct labor cost as the base is a. $150,000. b. $180,000. c. $270,000. d. $300,000. 7. Gant Accounting performs two types of services, Audit and Tax. Gant's estimated overhead costs consist of computer support, $300,000; and legal support, $150,000. Information on the two services and their estimated use of cost drivers is as follows: Gant Accounting performs tax services for Cathy Lane. Direct labor cost is \$1,200; 600 CPU minutes were used; and 1 legal hour was used. What is the total cost of the Lane job using ABC ? a. $3,600 b. $3.750 c. $5,400 d. $4,950