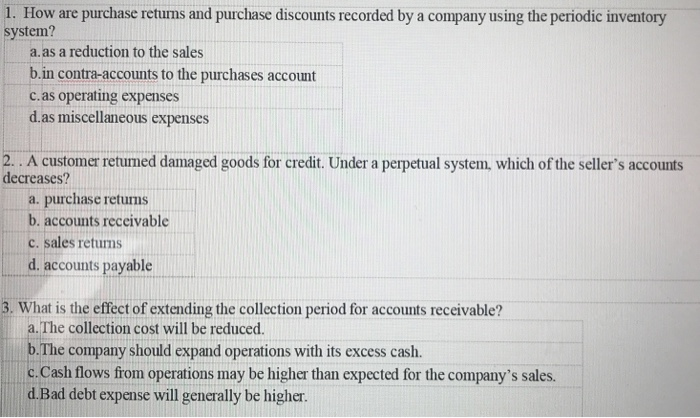

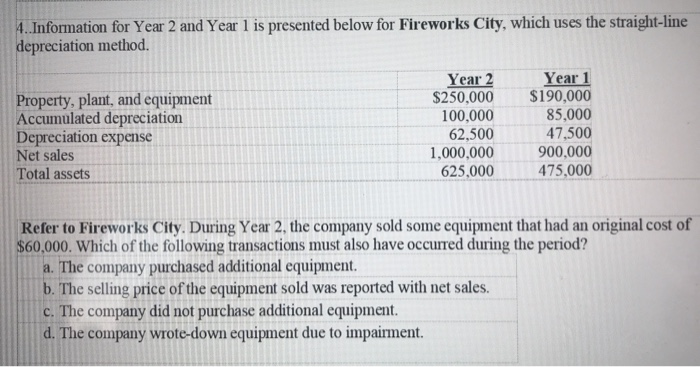

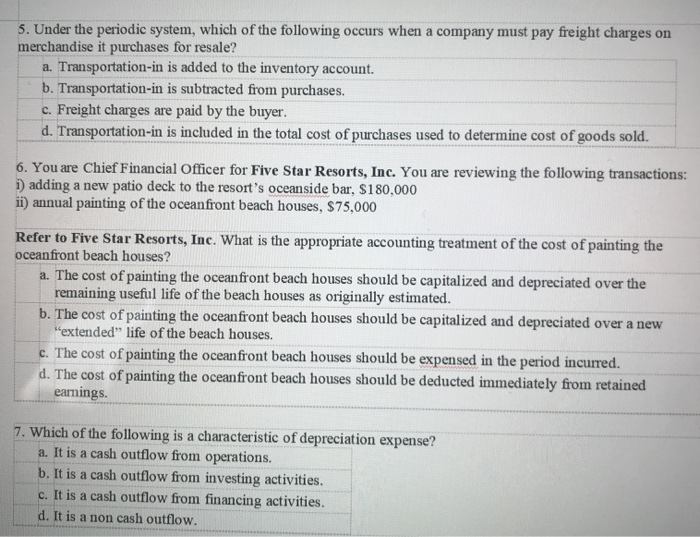

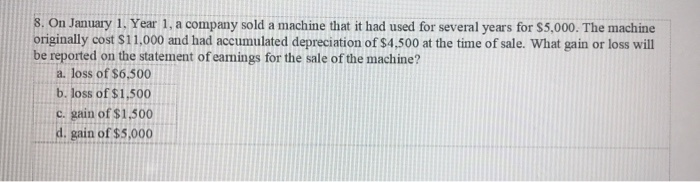

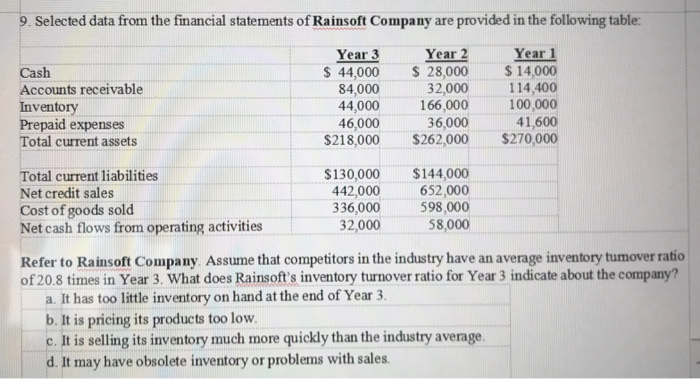

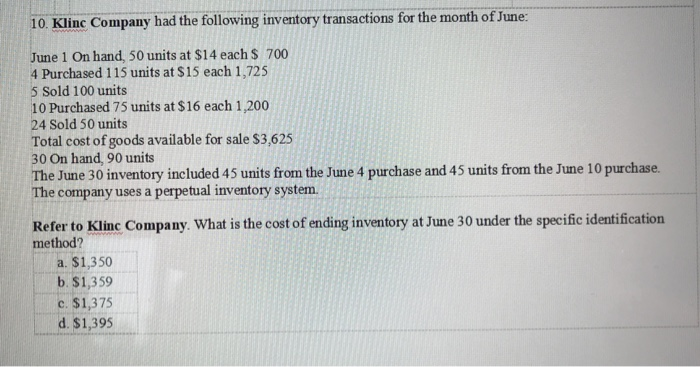

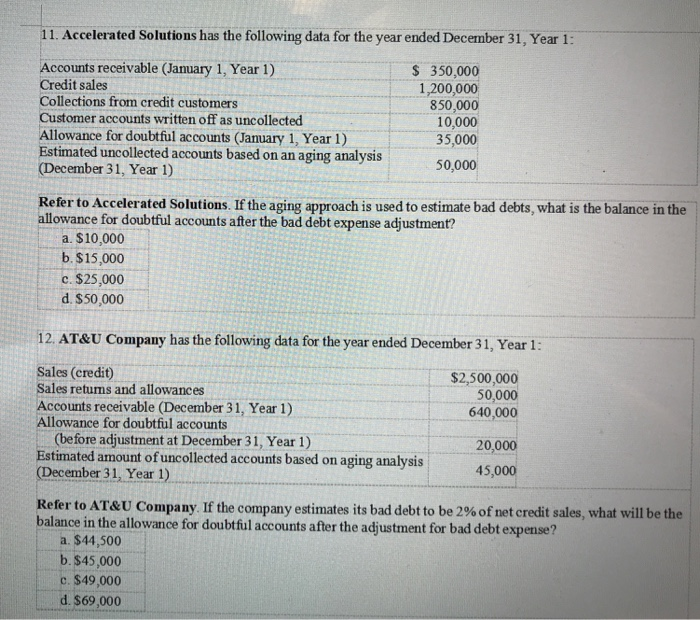

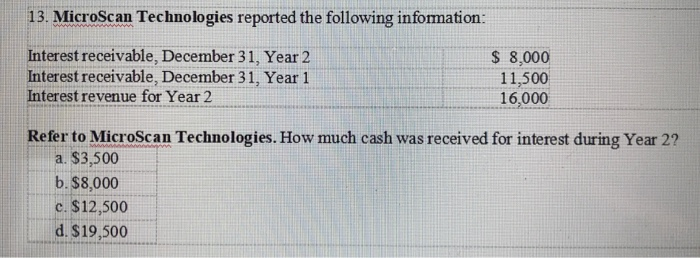

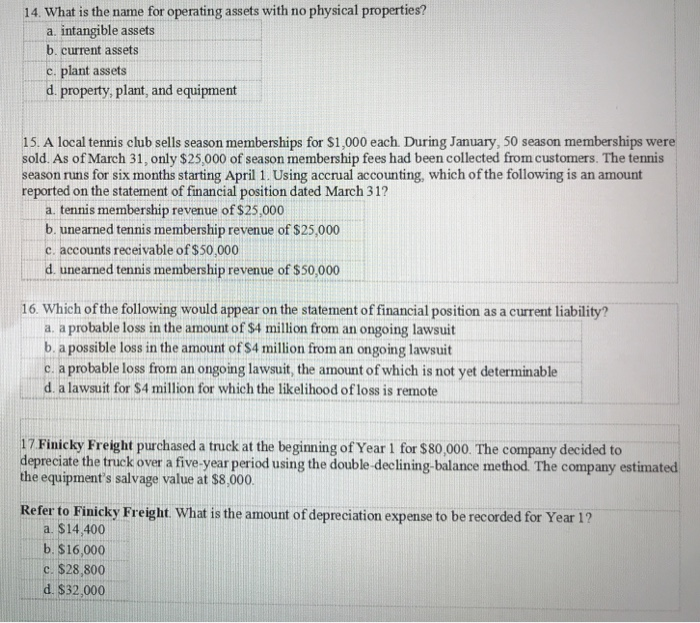

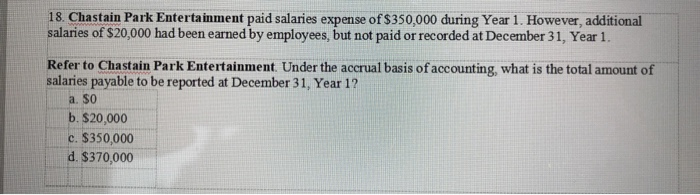

1. How are purchase returns and purchase discounts recorded by a company using the periodic inventory system? a. as a reduction to the sales b.in contra-accounts to the purchases account c.as operating expenses d.as miscellaneous expenses 2. . A customer retumed damaged goods for credit. Under a perpetual system, which of the seller's accounts decreases? a. purchase returns b. accounts receivable c. sales retums d. accounts payable 3. What is the effect of extending the collection period for accounts receivable? a. The collection cost will be reduced. b. The company should expand operations with its excess cash. c.Cash flows from operations may be higher than expected for the company's sales. d.Bad debt expense will generally be higher. 4.Information for Year 2 and Year 1 is presented below for Fireworks City, which uses the straight-line depreciation method. Property, plant, and equipment Accumulated depreciation Depreciation expense Net sales Total assets Year 2 $250,000 100,000 62,500 1,000,000 625,000 Year 1 $190,000 85,000 47,500 900,000 475,000 Refer to Fireworks City. During Year 2, the company sold some equipment that had an original cost of $60,000. Which of the following transactions must also have occurred during the period? a. The company purchased additional equipment. b. The selling price of the equipment sold was reported with net sales. c. The company did not purchase additional equipment. d. The company wrote-down equipment due to impairment. 5. Under the periodic system, which of the following occurs when a company must pay freight charges on merchandise it purchases for resale? a. Transportation-in is added to the inventory account. b. Transportation-in is subtracted from purchases. c. Freight charges are paid by the buyer. d. Transportation-in is included in the total cost of purchases used to determine cost of goods sold. 6. You are Chief Financial Officer for Five Star Resorts, Inc. You are reviewing the following transactions: 1) adding a new patio deck to the resort's oceanside bar, $180,000 ii) annual painting of the oceanfront beach houses, $75,000 Refer to Five Star Resorts, Inc. What is the appropriate accounting treatment of the cost of painting the oceanfront beach houses? a. The cost of painting the oceanfront beach houses should be capitalized and depreciated over the remaining useful life of the beach houses as originally estimated. b. The cost of painting the oceanfront beach houses should be capitalized and depreciated over a new "extended" life of the beach houses. c. The cost of painting the oceanfront beach houses should be expensed in the period incurred. d. The cost of painting the oceanfront beach houses should be deducted immediately from retained earnings. 7. Which of the following is a characteristic of depreciation expense? a. It is a cash outflow from operations. b. It is a cash outflow from investing activities. c. It is a cash outflow from financing activities. d. It is a non cash outflow. 8. On January 1. Year 1, a company sold a machine that it had used for several years for $5,000. The machine originally cost $11,000 and had accumulated depreciation of $4,500 at the time of sale. What gain or loss will be reported on the statement of eamings for the sale of the machine? a. loss of $6,500 b. loss of $1,500 c. gain of $1,500 d. gain of $5,000 9. Selected data from the financial statements of Rainsoft Company are provided in the following table: Cash Accounts receivable Inventory Prepaid expenses Total current assets Year 3 $ 44,000 84,000 44,000 46,000 $218,000 Year 2 $ 28,000 32,000 166,000 36,000 $262,000 Year 1 $ 14,000 114,400 100,000 41,600 $270,000 Total current liabilities Net credit sales Cost of goods sold Net cash flows from operating activities $130,000 442,000 336,000 32,000 $144,000 652,000 598,000 58,000 Refer to Rainsoft Company. Assume that competitors in the industry have an average inventory tumover ratio of 20.8 times in Year 3. What does Rainsoft's inventory turnover ratio for Year 3 indicate about the company? a. It has too little inventory on hand at the end of Year 3. b. It is pricing its products too low c. It is selling its inventory much more quickly than the industry average d. It may have obsolete inventory or problems with sales. 10. Klinc Company had the following inventory transactions for the month of June: June 1 On hand, 50 units at $14 each $ 700 4 Purchased 115 units at $15 each 1,725 5 Sold 100 units 10 Purchased 75 units at $16 each 1,200 24 Sold 50 units Total cost of goods available for sale $3,625 30 On hand, 90 units The June 30 inventory included 45 units from the June 4 purchase and 45 units from the June 10 purchase. The company uses a perpetual inventory system. Refer to Klinc Company. What is the cost of ending inventory at June 30 under the specific identification method? a. $1,350 b. $1,359 c. $1,375 d. $1,395 11. Accelerated Solutions has the following data for the year ended December 31, Year 1: Accounts receivable (January 1, Year 1) Credit sales Collections from credit customers Customer accounts written off as uncollected Allowance for doubtful accounts (January 1, Year 1) Estimated uncollected accounts based on an aging analysis (December 31, Year 1) $ 350,000 1,200,000 850,000 10,000 35,000 50.000 Refer to Accelerated Solutions. If the aging approach is used to estimate bad debts, what is the balance in the allowance for doubtful accounts after the bad debt expense adjustment? a. $10,000 b. $15,000 c. $25,000 d. $50,000 12. AT&U Company has the following data for the year ended December 31, Year 1: $2,500,000 50,000 640,000 Sales (credit) Sales retums and allowances Accounts receivable (December 31, Year 1) Allowance for doubtful accounts (before adjustment at December 31, Year 1) Estimated amount of uncollected accounts based on aging analysis (December 31, Year 1) 20,000 45,000 Refer to AT&U Company. If the company estimates its bad debt to be 2% of net credit sales, what will be the balance in the allowance for doubtful accounts after the adjustment for bad debt expense? a. $44,500 b. $45,000 c. $49,000 d. 369,000 13. MicroScan Technologies reported the following information: Interest receivable, December 31, Year 2 Interest receivable, December 31, Year 1 Interest revenue for Year 2 $ 8,000 11,500 16,000 Refer to MicroScan Technologies. How much cash was received for interest during Year 2? a. $3,500 b.$8,000 c. $12,500 d. $19,500 14. What is the name for operating assets with no physical properties? a. intangible assets b. current assets c. plant assets d. property, plant, and equipment 15. A local tennis club sells season memberships for $1,000 each. During January, 50 season memberships were sold. As of March 31, only $25,000 of season membership fees had been collected from customers. The tennis season runs for six months starting April 1. Using accrual accounting, which of the following is an amount reported on the statement of financial position dated March 31? a. tennis membership revenue of $25,000 b. unearned tennis membership revenue of $25,000 c. accounts receivable of $50,000 d unearned tennis membership revenue of $50,000 16. Which of the following would appear on the statement of financial position as a current liability? a, a probable loss in the amount of $4 million from an ongoing lawsuit b. a possible loss in the amount of S4 million from an ongoing lawsuit c. a probable loss from an ongoing lawsuit the amount of which is not yet determinable d. a lawsuit for $4 million for which the likelihood of loss is remote 17 Finicky Freight purchased a truck at the beginning of Year 1 for $80,000. The company decided to depreciate the truck over a five-year period using the double declining-balance method. The company estimated the equipment's salvage value at $8,000. Refer to Finicky Freight. What is the amount of depreciation expense to be recorded for Year 1? a. $14,400 b. $16,000 C. $28,800 d. $32,000 18. Chastain Park Entertainment paid salaries expense of $350,000 during Year 1. However, additional salaries of $20,000 had been earned by employees, but not paid or recorded at December 31, Year 1. Refer to Chastain Park Entertainment. Under the accrual basis of accounting, what is the total amount of salaries payable to be reported at December 31, Year 1? a. So b. $20,000 c. $350,000 d. $370,000