Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. How does Lexys age affect her decision to get an MBA? A Aceto, Frank BUS 622 Week 3 Case Study Template F19- Excel AutoSave

1. How does Lexys age affect her decision to get an MBA?

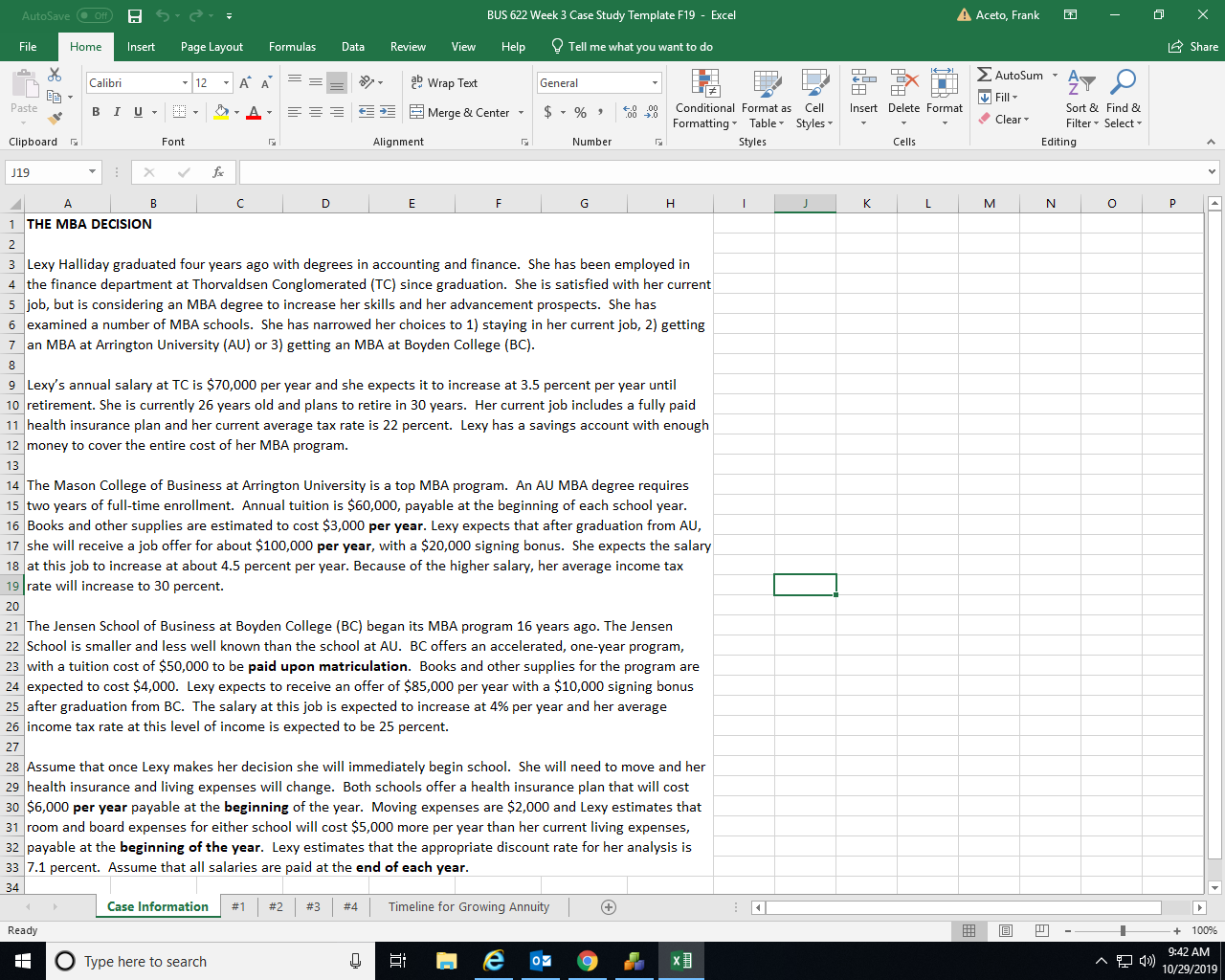

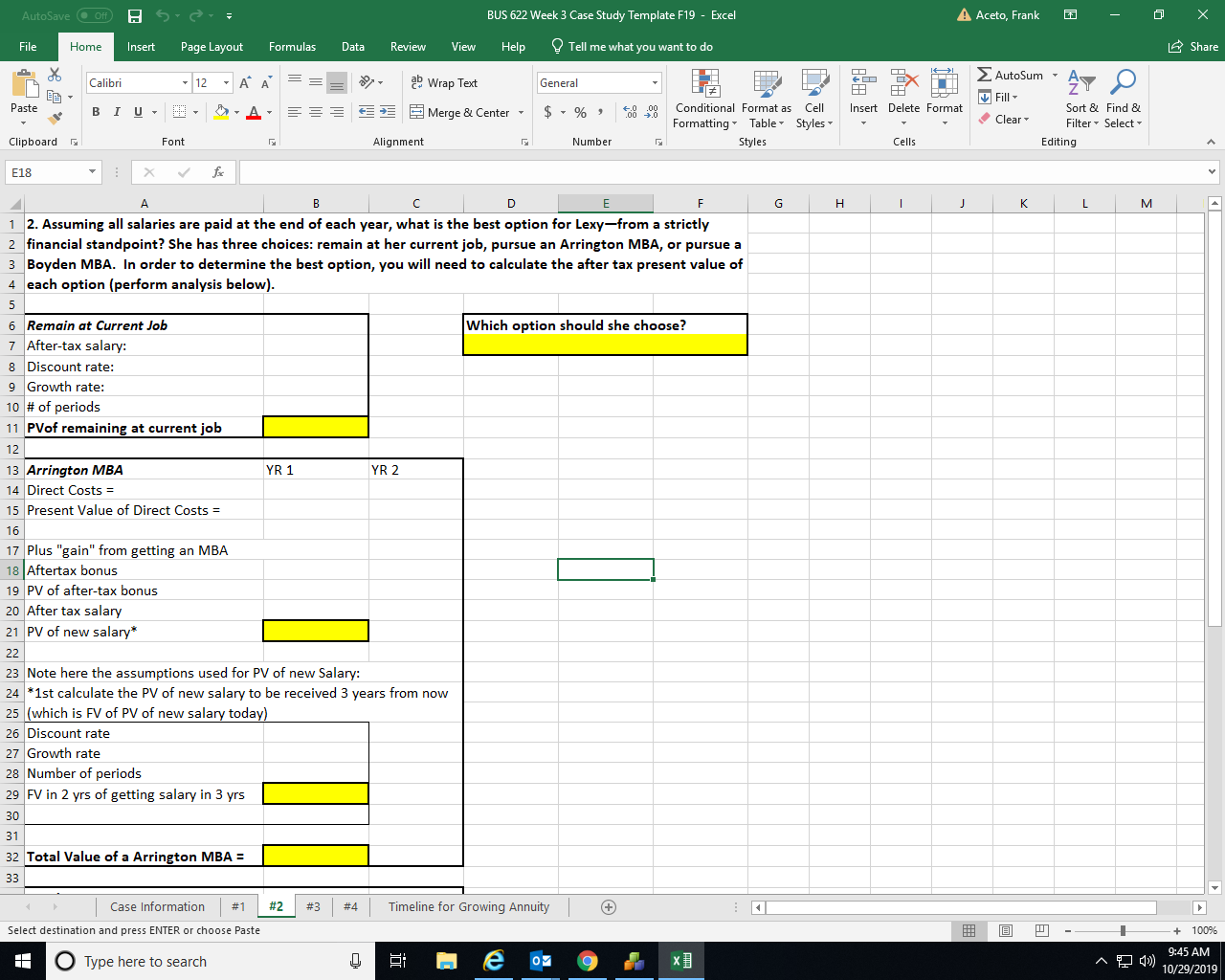

A Aceto, Frank BUS 622 Week 3 Case Study Template F19- Excel AutoSave Off Share Review File Home Insert Page Layout Formulas Data View Help Tell me what you want to do AutoSum As 12A A Wrap Text Calibri General Fill Paste I U Conditional Format as Insert Delete Format Sort & Find & - A 0 00 00 0 | Merge & Center Clear Formatting Table Styles Filter Select Number Editing Clipboard Font Alignment Styles Cells fox J19 C. E G K L M N O P 1 THE MBA DECISION 2 3 Lexy Halliday graduated four years ago with degrees in accounting and finance. She has been employed in 4 the finance department at Thorvaldsen Conglomerated (TC) since graduation. She is satisfied with her current 5 job, but is considering an MBA degree to increase her skills and her advancement prospects. She has 6 examined a number of MBA schools. She has narrowed her choices to 1) staying in her current job, 2) getting 7 an MBA at Arrington University (AU) or 3) getting an MBA at Boyden College (BC). 9 Lexy's annual salary at TC is $70,000 per year and she expects it to increase at 3.5 percent per year until 10 retirement. She is currently 26 years old and plans to retire in 30 years. Her current job includes a fully paid 11 health insurance plan and her current average tax rate is 22 percent. Lexy has a savings account with enough 12 money to cover the entire cost of her MBA program. 13 14 The Mason College of Business at Arrington University is a top MBA program. An AU MBA degree requires 15 two years of full-time enrollment. Annual tuition is $60,000, payable at the beginning of each school year. 16 Books and other supplies are estimated to cost $3,000 per year. Lexy expects that after graduation from AU, 17 she will receive a job offer for about $100,000 per year, with a $20,000 signing bonus. She expects the salary 18 at this job to increase at about 4.5 percent per year. Because of the higher salary, her average income tax 19 rate will increase to 30 percent 20 21 The Jensen School of Business at Boyden College (BC) began its MBA program 16 years ago. The Jensen 22 School is smaller and less well known than the school at AU. BC offers an accelerated, one-year program 23 with a tuition cost of $50,000 to be paid upon matriculation. Books and other supplies for the program are 24 expected to cost $4,000. Lexy expects to receive an offer of $85,000 per year with a $10,000 signing bonus 25 after graduation from BC. The salary at this job is expected to increase at 4% per year and her average 26 income tax rate at this level of income is expected to be 25 percent. 27 28 Assume that once Lexy makes her decision she will immediately begin school. She will need to move and her 29 health insurance and living expenses will change. Both schools offer a health insurance plan that will cost 30 $6,000 per year payable at the beginning of the year. Moving expenses are $2,000 and Lexy estimates that 31 room and board expenses for either school will cost $5,000 more per year than her current living expenses, 32 payable at the beginning of the year. Lexy estimates that the appropriate discount rate for her analysis is 33 7.1 percent. Assume that all salaries are paid at the end of each year. 34 Timeline for Growing Annuity Case Information #1 # 2 #3 #4 Ready 100% 9:42 AM O Type here to search 10/29/2019 A Aceto, Frank BUS 622 Week 3 Case Study Template F19- Excel AutoSave Off Share File Home Insert Page Layout Formulas Data Review View Help Tell me what you want to do AutoSum As 12A A Wrap Text General Calibri Fill Paste IU- Conditional Format as Cell Insert Delete Format Sort & Find & A 0 00 00 0 | Merge & Center Clear Formatting Table Styles Filter Select Number Editing Clipboard Font Alignment Styles Cells X 18 A C. D G K L M 1 2. Assuming all salaries are paid at the end of each year, what is the best option for Lexy-from a strictly 2 financial standpoint? She has three choices: remain at her current job, pursue an Arrington MBA, or pursue a 3 Boyden MBA. In order to determine the best option, you will need to calculate the after tax present value of 4 each option (perform analysis below) 6 Remain at Current Job 7 After-tax salary 8 Discount rate: Which option should she choose? 9 Growth rate: 10of periods 11 PVof remaining at current job 12 13 Arrington MBA 14 Direct Costs 15 Present Value of Direct Costs YR 1 YR 2 16 17 Plus "gain" from getting an MBA 18 Aftertax bonus 19 PV of after-tax bonus 20 After tax salary 21 PV of new salary* 22 23 Note here the assumptions used for PV of new Salary: 24 1st calculate the PV of new salary to be received 3 years from now 25 which is FV of PV of new salary today) 26 Discount rate 27 Growth rate 28 Number of periods 29 FV in 2 yrs of getting salary in 3 yrs 30 31 32 Total Value of a Arrington MBA = 33 Timeline for Growing Annuity Case Information #2 # 1 #3 #4 Select destination and press ENTER or choose Paste 100% 9:45 AM O Type here to search A 10/29/2019 EMStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started