Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. How does the reduced liquidity of the corporate bonds affect their interest rates relative to the interest rate on Treasury bonds? Illustrate and explain

1. How does the reduced liquidity of the corporate bonds affect their interest rates relative to the interest rate on Treasury bonds? Illustrate and explain thoroughly

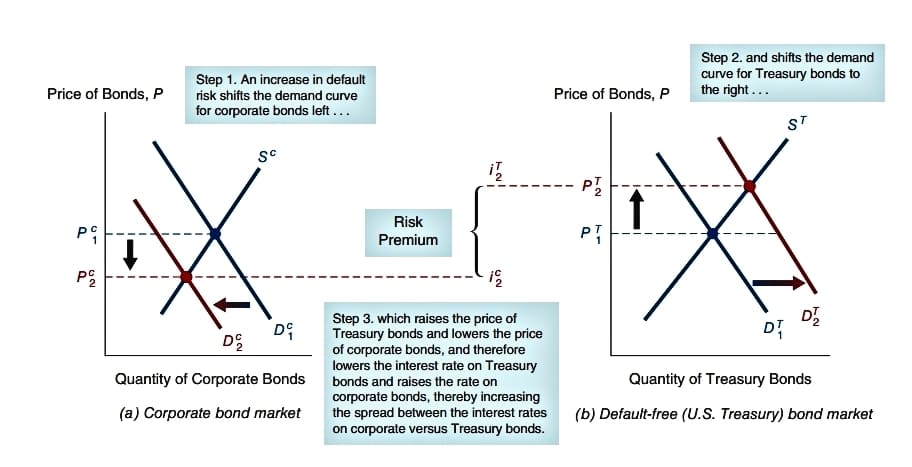

2. Could you help explain what the labels in the graphic below mean ( for example Pc1, Pc2 and so on )? Kindly explain the illustration below as well. Provide an example and explain

Price of Bonds, P PG P Step 1. An increase in default risk shifts the demand curve for corporate bonds left... Sc D D Quantity of Corporate Bonds (a) Corporate bond market Risk Premium 1/2 192 Step 3. which raises the price of Treasury bonds and lowers the price of corporate bonds, and therefore lowers the interest rate on Treasury bonds and raises the rate on corporate bonds, thereby increasing the spread between the interest rates on corporate versus Treasury bonds. Price of Bonds, P T2 P22 PT Step 2. and shifts the demand curve for Treasury bonds to the right... ST * DI 72 D/2 Quantity of Treasury Bonds (b) Default-free (U.S. Treasury) bond market

Step by Step Solution

There are 3 Steps involved in it

Step: 1

How reduced liquidity affects corporate bond interest rates Corporate bonds are generally less liquid than Treasury bonds meaning that they are harder ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started