Question: 1. How long will it take to save $15,000 by making deposits of $90 at the end of every month into an account earning interest

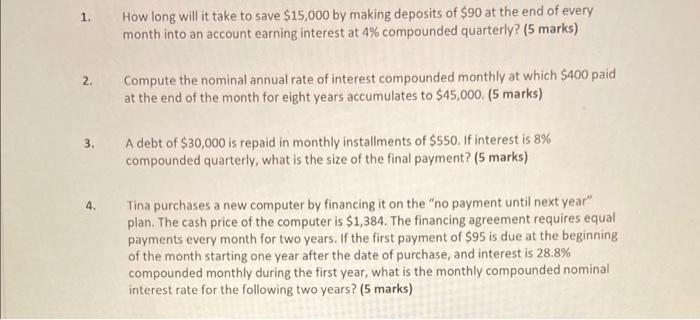

1. How long will it take to save $15,000 by making deposits of $90 at the end of every month into an account earning interest at 4% compounded quarterly? (5 marks) 2. Compute the nominal annual rate of interest compounded monthly at which $400 paid at the end of the month for eight years accumulates to $45,000. (5 marks) 3. A debt of $30,000 is repaid in monthly installments of $550. If interest is 8% compounded quarterly, what is the size of the final payment? (5 marks) 4. Tina purchases a new computer by financing it on the "no payment until next year" plan. The cash price of the computer is $1,384. The financing agreement requires equal payments every month for two years. If the first payment of $95 is due at the beginning of the month starting one year after the date of purchase, and interest is 28.8% compounded monthly during the first year, what is the monthly compounded nominal interest rate for the following two years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts