Question

1. How much cash would be paid to acquire the debt on 1/1/2018 (round to the nearest dollar)? 2. How much interest revenue would be

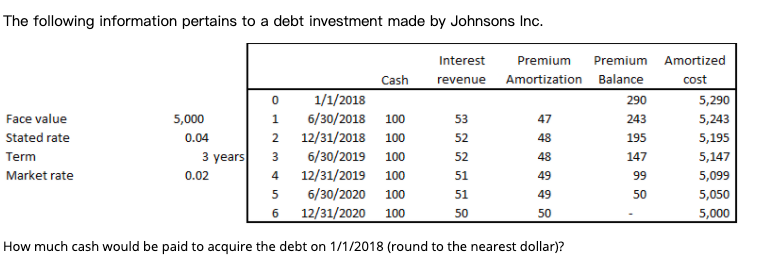

1. How much cash would be paid to acquire the debt on 1/1/2018 (round to the nearest dollar)?

2. How much interest revenue would be recorded on 6/30/2020 (round to the nearest dollar)?

3.Assuming the fair value of the debt is $5,200 on December 31, 2018 and the investment is classified as a trading security. What would be the debit to investment in bonds on that date (round to the nearest dollar)

4.Assuming the fair value of the debt is $5,200 on December 31, 2018 and $6,000 on December 31, 2018 and the investment is classified as a trading security. What would be the debit to investment in bonds on December 31, 2019 (round to the nearest dollar)?

5. Assuming the fair value of the debt is $5,200 on December 31, 2018 and was sold for $6,000 on December 31, 2018. The investment was classified as available-for sale. What gain would be recorded on December 31, 2019 (round to the nearest dollar)?

NEED PROCESS THANKS

The following information pertains to a debt investment made by Johnsons Inc. Interest revenue Premium Amortization Premium Balance Cash 0 243 1 2 Face value Stated rate Term Market rate 5,000 0.04 3 years 0.02 1 1 /1/2018 6/30/2018 12/31/2018 6 /30/2019 12/31/2019 6/30/2020 12/31/2020 3 4 Amortized cost 5,290 5,243 5,195 5,147 5,099 100 100 100 100 100 100 5,050 5 6 5,000 How much cash would be paid to acquire the debt on 1/1/2018 (round to the nearest dollar)? The following information pertains to a debt investment made by Johnsons Inc. Interest revenue Premium Amortization Premium Balance Cash 0 243 1 2 Face value Stated rate Term Market rate 5,000 0.04 3 years 0.02 1 1 /1/2018 6/30/2018 12/31/2018 6 /30/2019 12/31/2019 6/30/2020 12/31/2020 3 4 Amortized cost 5,290 5,243 5,195 5,147 5,099 100 100 100 100 100 100 5,050 5 6 5,000 How much cash would be paid to acquire the debt on 1/1/2018 (round to the nearest dollar)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started