Question

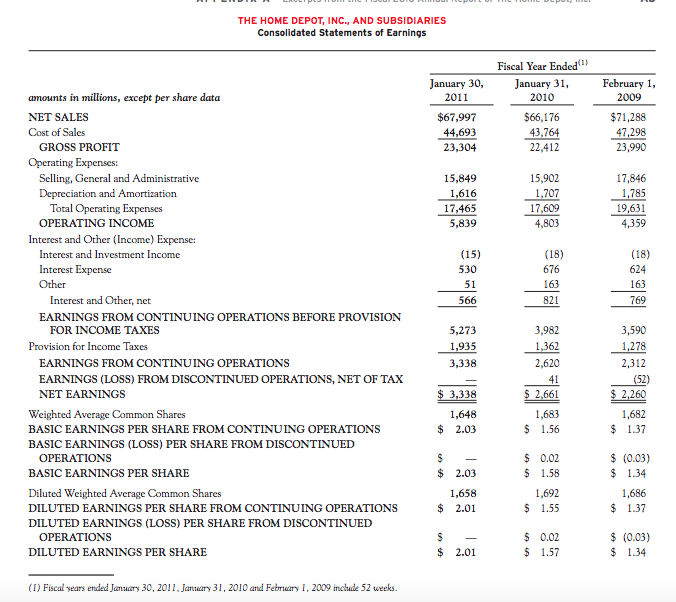

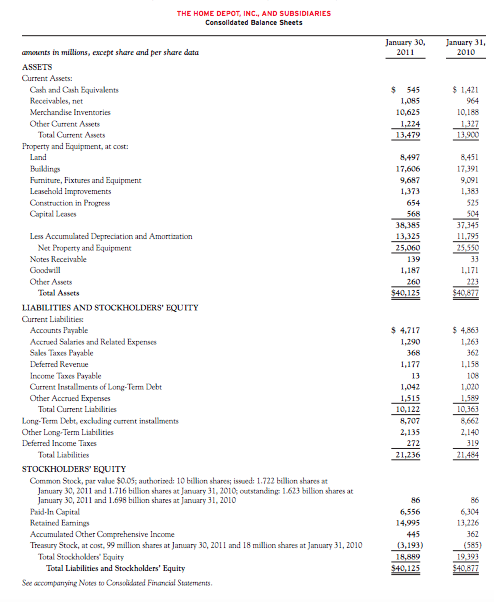

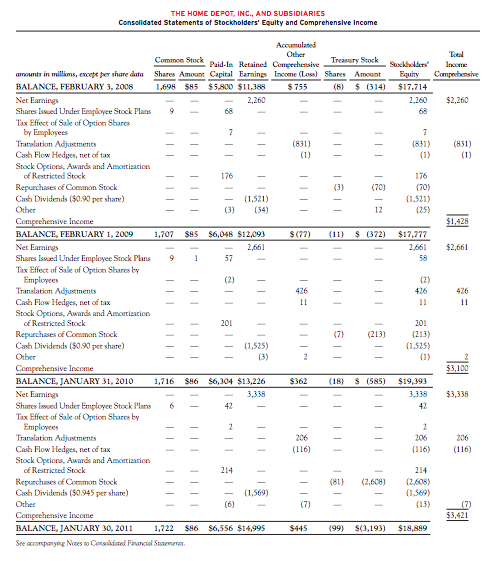

1. How much did The Home Depot owe for salaries and related expenses at January 30, 2011? Was this an increase or decrease from the

| 1. | How much did The Home Depot owe for salaries and related expenses at January 30, 2011? Was this an increase or decrease from the previous year? | ||||||||

|

|

| ||||||||

|

|

|

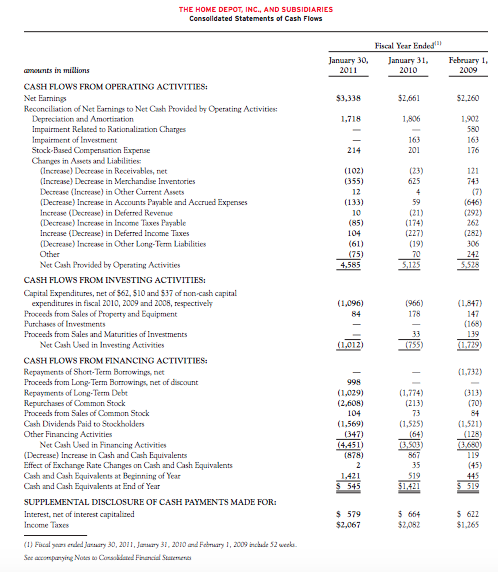

| 2. | Refer to the Revenues note in the Summary of Significant Accounting Policies that follows The Home Depots statements of cash flows. How does the company account for customer payments received in advance of providing services? | ||||||||||

|

|

| ||||||||||

|

|

| ||||||||||

| 3. | Assume that The Home Depot experienced no shrinkage in the most current year. Using the balance sheet and income statement, estimate the amount of purchases in the year ended January 30, 2011. | ||||||||||

|

|

| ||||||||||

|

|

| ||||||||||

| 4. | How much inventory does the company hold on January 30, 2011? Does this represent an increase or decrease in comparison to the prior year? | ||||||||||

|

|

| ||||||||||

|

|

|

| 5. | What method(s) does the company use to determine the cost of its inventory? Describe where you found this information. | ||||||||

|

|

| ||||||||

|

|

|

| 6. | Compute to one decimal place the companys inventory turnover ratio and days to sell for the most recent year. | ||||||||

|

|

| ||||||||

|

|

|

| 7. | Does the company believe FIFO, or weighted average cost, is a better method? |

| |||||||||

|

|

|

| |||||||||

|

|

|

| |||||||||

| 8. | Where does the company disclose the amount of its Allowance for Doubtful Accounts? (Hint: The company refers to its Allowance for Doubtful Accounts as a Valuation Reserve related to Accounts Receivable.) | ||||||||||

|

|

| ||||||||||

|

|

| ||||||||||

| 9. | Compute the companys receivables turnover ratio and days to collect for the year ended January 31, 2011. | ||||||||||

|

|

| ||||||||||

|

|

|

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started