Answered step by step

Verified Expert Solution

Question

1 Approved Answer

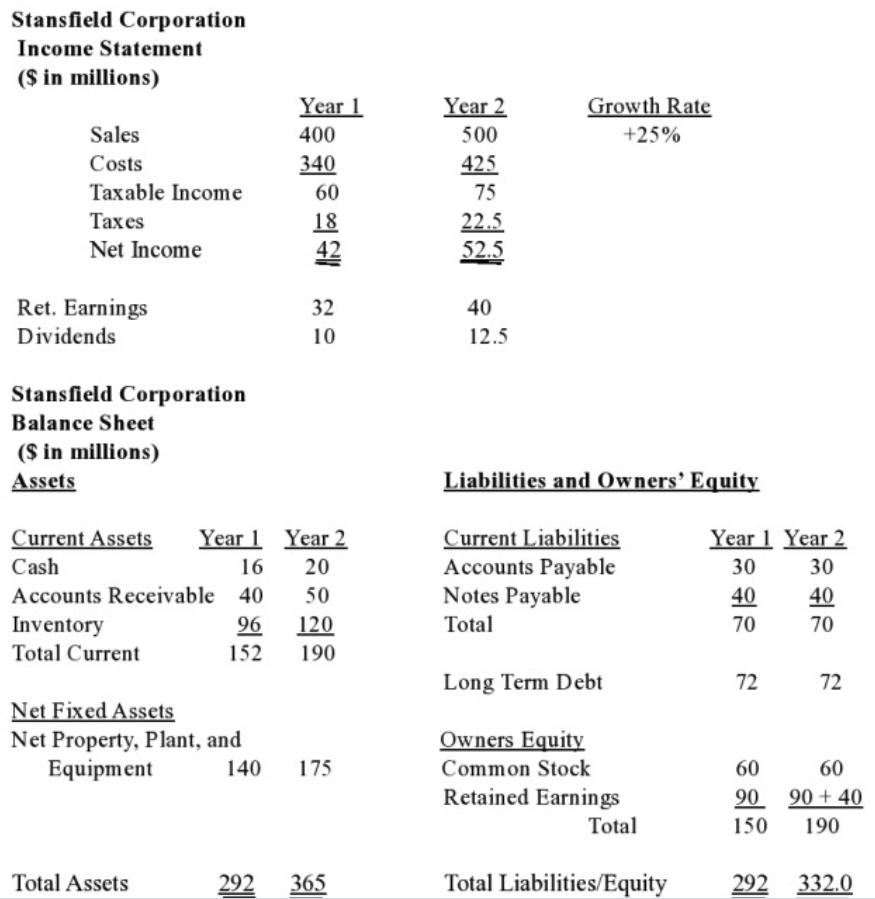

1. How much external financing is needed for a 25% increase in sales if Stansfield Corporation is currently operating at full capacity? Assume only costs

1. How much external financing is needed for a 25% increase in sales if Stansfield Corporation is currently operating at full capacity? Assume only costs and total assets increase with sales, with no new current liabilities, debt, or stock needed.

2. What is the internal growth rate for Stansfield Corporation?

3. What is Stansfield Corporation's sustainable growth rate?

Stansfield Corporation Income Statement ($ in millions) Sales Costs Taxable Income Taxes Net Income Ret. Earnings Dividends Stansfield Corporation Balance Sheet ($ in millions) Assets Net Fixed Assets Net Property, Plant, and Equipment Year 1 400 340 Total Assets 60 18 42 Current Assets Year 1 Year 2 Cash 16 20 Accounts Receivable 40 50 Inventory 96 120 Total Current 152 190 32 10 140 175 292 365 Year 2 500 425 75 22.5 52.5 40 12.5 Growth Rate +25% Liabilities and Owners' Equity Current Liabilities Accounts Payable Notes Payable Total Long Term Debt Owners Equity Common Stock Retained Earnings Total Total Liabilities/Equity Year 1 Year 2 30 40 70 72 60 90 150 30 40 70 72 60 90+40 190 292 332.0

Step by Step Solution

★★★★★

3.43 Rating (159 Votes )

There are 3 Steps involved in it

Step: 1

Lets address each question 1 External Financing Needed for a 25 Increase in Sales Since the company is operating at full capacity and only costs and t...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started