Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. How much is Adjusted Gross Income (AGI) in Form 1040? 2. How much is Adjustment to Income, line 22 from Schedule 1? 3. How

1. How much is Adjusted Gross Income (AGI) in Form 1040?

2. How much is Adjustment to Income, line 22 from Schedule 1?

3. How much is the taxable income on Form 1040?

4 .How much is Additional Child Tax Credit on Form 1040?

5. How much is the refund on Form 1040, if any

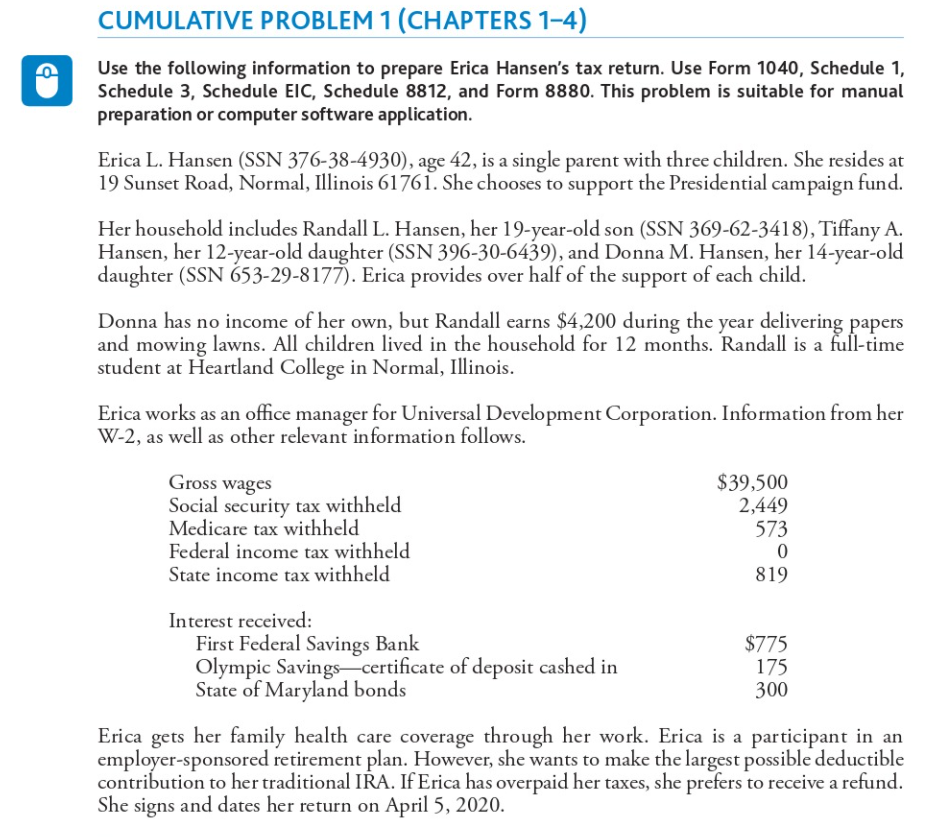

CUMULATIVE PROBLEM 1 (CHAPTERS 1-4) Use the following information to prepare Erica Hansen's tax return. Use Form 1040, Schedule 1, Schedule 3, Schedule EIC, Schedule 8812, and Form 8880. This problem is suitable for manual preparation or computer software application. Erica L. Hansen (SSN 376-38-4930), age 42, is a single parent with three children. She resides at 19 Sunset Road, Normal, Illinois 61761. She chooses to support the Presidential campaign fund. Her household includes Randall L. Hansen, her 19-year-old son (SSN 369-62-3418), Tiffany A. Hansen, her 12-year-old daughter (SSN 396-30-6439), and Donna M. Hansen, her 14-year-old daughter (SSN 653-29-8177). Erica provides over half of the support of each child. Donna has no income of her own, but Randall earns $4,200 during the year delivering papers and mowing lawns. All children lived in the household for 12 months. Randall is a full-time student at Heartland College in Normal, Illinois. Erica works as an office manager for Universal Development Corporation. Information from her W-2, as well as other relevant information follows. Gross wages Social security tax withheld Medicare tax withheld Federal income tax withheld State income tax withheld $39,500 2,449 573 0 819 Interest received: First Federal Savings Bank $775 Olympic Savings certificate of deposit cashed in 175 State of Maryland bonds 300 Erica gets her family health care coverage through her work. Erica is a participant in an employer-sponsored retirement plan. However, she wants to make the largest possible deductible contribution to her traditional IRA. If Erica has overpaid her taxes, she prefers to receive a refund. She signs and dates her return on April 5, 2020Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started