Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1) How much is the gain or loss on sale of Asset S? 2) What is the adjusting entry to correct the error/failure to

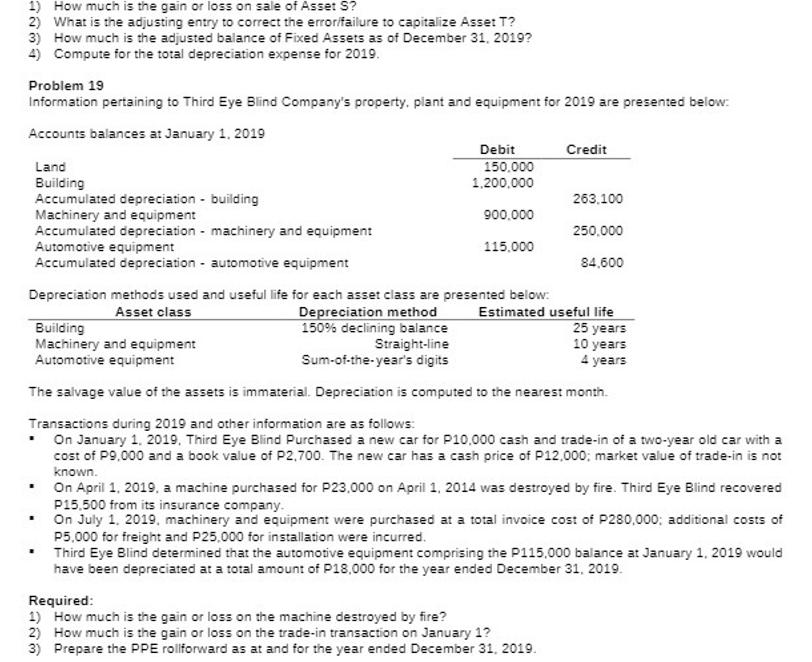

1) How much is the gain or loss on sale of Asset S? 2) What is the adjusting entry to correct the error/failure to capitalize Asset T? 3) How much is the adjusted balance of Fixed Assets as of December 31, 2019? 4) Compute for the total depreciation expense for 2019. Problem 19 Information pertaining to Third Eye Blind Company's property, plant and equipment for 2019 are presented below: Accounts balances at January 1, 2019 Land Building Accumulated depreciation - building Machinery and equipment Accumulated depreciation Automotive equipment Accumulated depreciation Building Machinery and equipment Automotive equipment . Debit 150,000 1,200,000 . 900,000 115,000 machinery and equipment automotive equipment Depreciation methods used and useful life for each asset class are presented below: Asset class Depreciation method 150% declining balance Straight-line Sum-of-the-year's digits The salvage value of the assets is immaterial. Depreciation is computed to the nearest month. Transactions during 2019 and other information are as follows: On January 1, 2019, Third Eye Blind Purchased a new car for P10,000 cash and trade-in of a two-year old car with a cost of P9,000 and a book value of P2,700. The new car has a cash price of P12,000; market value of trade-in is not known. Credit 263.100 250,000 84,600 Estimated useful life Required: 1) How much is the gain or loss on the machine destroyed by fire? 2) How much is the gain or loss on the trade-in transaction on January 1? 3) Prepare the PPE rollforward as at and for the year ended December 31, 2019. 25 years 10 years 4 years On April 1, 2019, a machine purchased for P23,000 on April 1, 2014 was destroyed by fire. Third Eye Blind recovered P15,500 from its insurance company. On July 1, 2019, machinery and equipment were purchased at a total invoice cost of P280,000; additional costs of P5,000 for freight and P25,000 for installation were incurred. Third Eye Blind determined that the automotive equipment comprising the P115,000 balance at January 1, 2019 would have been depreciated at a total amount of P18,000 for the year ended December 31, 2019.

Step by Step Solution

★★★★★

3.39 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

Here are the answers to the questions 1 Gain or loss on the machine destroyed by fire Book value of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started