Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. How much is the taxable income for the period Dec 31, 2022? 2. How much is the balance of deferred tax liability as of

1. How much is the taxable income for the period Dec 31, 2022?

2. How much is the balance of deferred tax liability as of December 31, 2022?

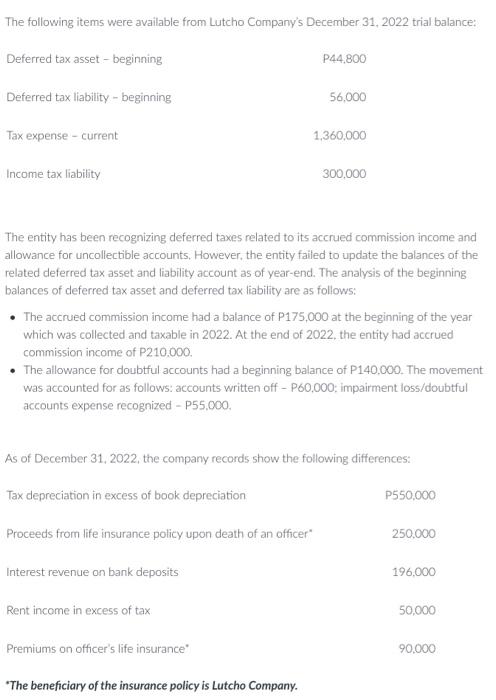

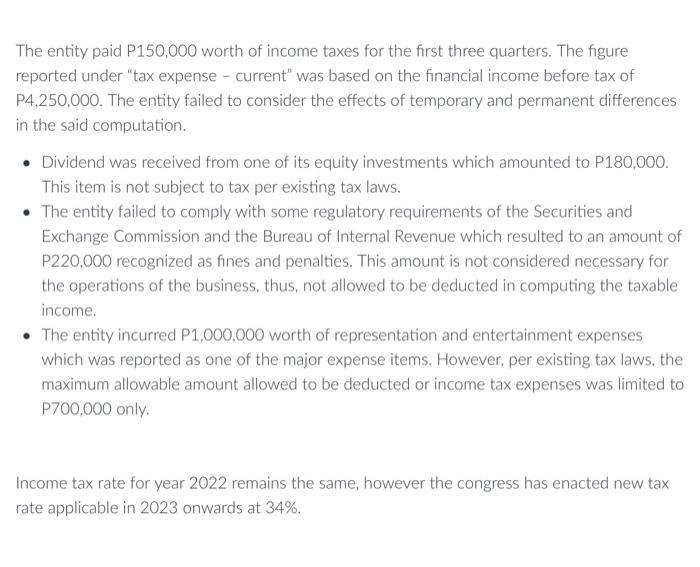

The following items were available from Lutcho Company's December 31, 2022 trial balance: Deferred tax asset - beginning P44.800 Deferred tax liability - beginning 56,000 Tax expense - current 1,360,000 Income tax liability 300,000 The entity has been recognizing deferred taxes related to its accrued commission income and allowance for uncollectible accounts. However, the entity failed to update the balances of the related deferred tax asset and liability account as of year-end. The analysis of the beginning balances of deferred tax asset and deferred tax liability are as follows: The accrued commission income had a balance of P175,000 at the beginning of the year which was collected and taxable in 2022. At the end of 2022, the entity had accrued commission income of P210.000. The allowance for doubtful accounts had a beginning balance of P140.000. The movement was accounted for as follows: accounts written off-P60,000: impairment loss/doubtful accounts expense recognized - P55.000 As of December 31, 2022, the company records show the following differences: Tax depreciation in excess of book depreciation P550,000 Proceeds from life insurance policy upon death of an officer 250.000 Interest revenue on bank deposits 196,000 Rent income in excess of tax 50,000 Premiums on officer's life insurance 90.000 The beneficiary of the insurance policy is Lutcho Company. The entity paid P150,000 worth of income taxes for the first three quarters. The figure reported under "tax expense - current" was based on the financial income before tax of P4,250,000. The entity failed to consider the effects of temporary and permanent differences in the said computation. Dividend was received from one of its equity investments which amounted to P180,000. This item is not subject to tax per existing tax laws. The entity failed to comply with some regulatory requirements of the Securities and Exchange Commission and the Bureau of Internal Revenue which resulted to an amount of P220,000 recognized as fines and penalties. This amount is not considered necessary for the operations of the business, thus, not allowed to be deducted in computing the taxable income. The entity incurred P1,000,000 worth of representation and entertainment expenses which was reported as one of the major expense items. However, per existing tax laws, the maximum allowable amount allowed to be deducted or income tax expenses was limited to P700,000 only. Income tax rate for year 2022 remains the same, however the congress has enacted new tax rate applicable in 2023 onwards at 34% Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started