1. How much of their income are Bob and Debbie giving away?

1. How much of their income are Bob and Debbie giving away?

Enter your 50-100 word response below each question. Review the case study information and assignment instructions closely, and then be sure to demonstrate your understanding of the concepts at hand, your ability to apply these concepts to the case study situation, and your professional-level writing skills. Save a copy of this file for yourself and then submit a copy to your instructor, using the Dropbox, by the end of the Workshop. Attach both this response template and your separate Excel spreadsheet as outlined in the assignment instructions.

2. How much of Bob and Debbies income are they spending on lifestyle?

Enter your 50-100 word response below each question.

3. What areas could be minimized or reduced to provide more margin/liquidity for savings?

Enter your 50-100 word response below each question.

4. What would Bob and Debbies spendable income be?

Enter your 50-100 word response below each question.

5. Write down 5 to 10 questions that you would ask Bob and Debbie to learn more about their expenses.

Enter your 50-100 word response below each question.

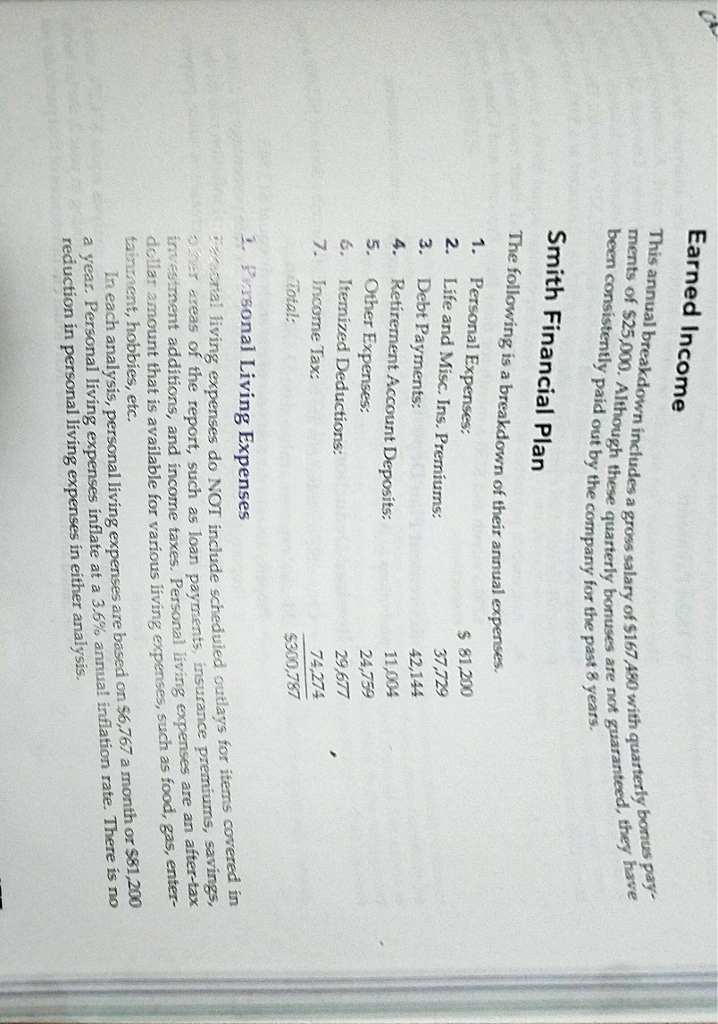

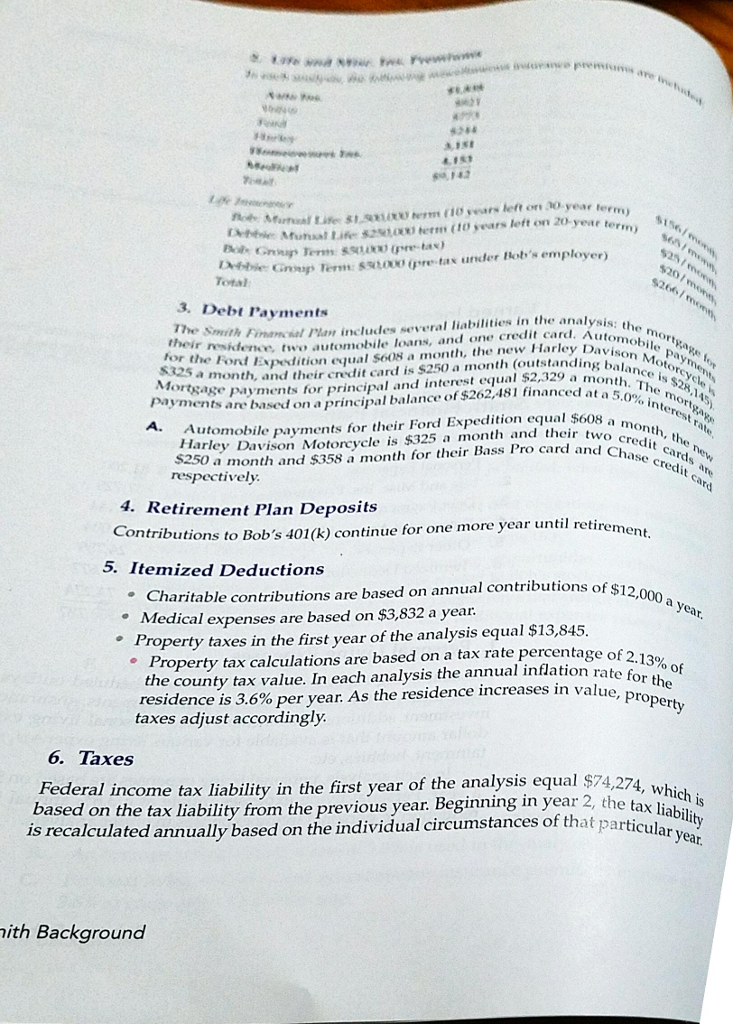

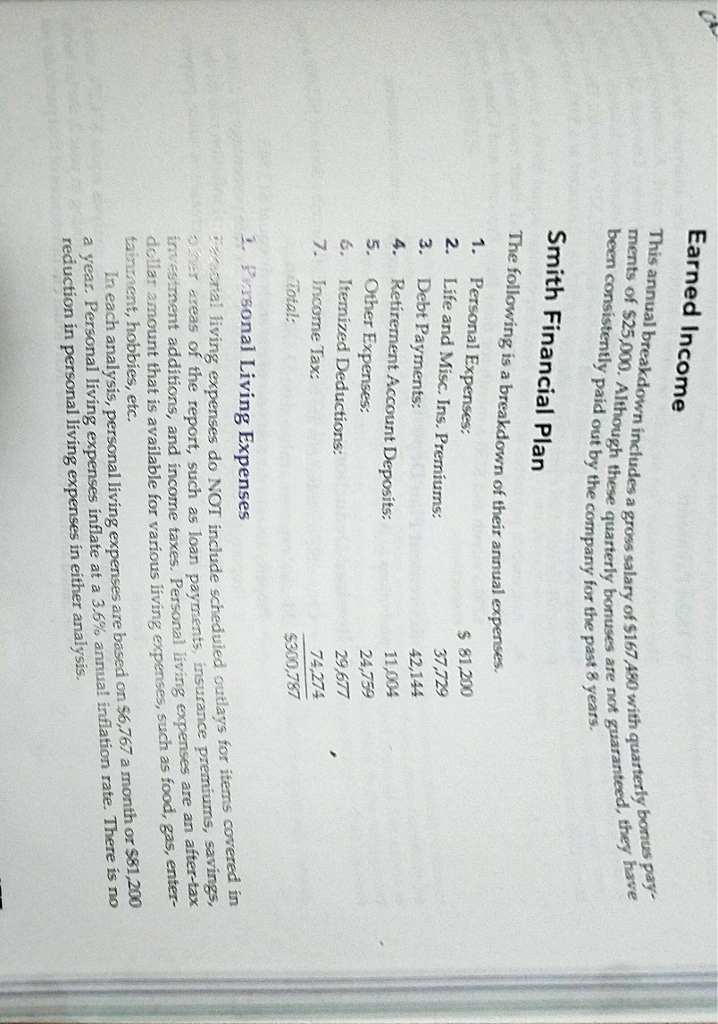

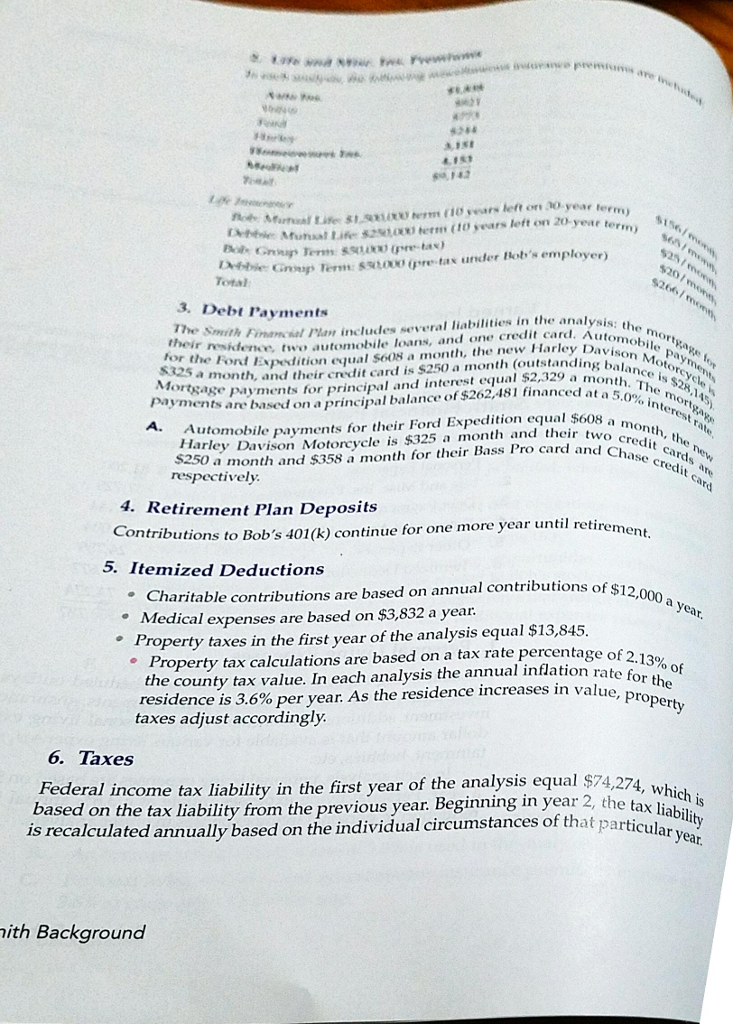

or year term) Total 3. Debt rayments the analysis The smirr run includes several liabilities in Auto their r idene two automobile loans, and one credit card. Ra for the Ford equal month, the new Davison a month, and their credit card is $250 (outstanding nnco. Mortgage payments for principal and interest equal $2,329 a n a 5 Th Payments are based on apr cipal balance of $262,481 financed at payments for Ford Expedition equal $608 a month. Harley Davison their and their two Credit the S250 month Motorcycle is $325 a month Pro card and Ch Se Cred and s358 a month for their Bass respectively. 4. Retirement Plan Deposits utions to Bob's 401(k) continue for one more year until retire 5. Itemized Deductions Charitable contributions are based on annual contributions of $12 n yea Medical expenses are based on $3,832 a year Property taxes in the first year of the analysis equal $13,845. Property tax calculations are based on a tax rate percentage o the coun tax value. In each analysis the annual inflation rate forth residence is 3.6% per year. As the residence increases in value property taxes adjust accordingly. 6. Taxes Federal income tax liability in the first year of the analysis equal $74.274 which is based on the tax liability from the previous year. Beginning in year 2, the t liabili is recalculated annually based on the individual circumstances of that particular year. ith Background or year term) Total 3. Debt rayments the analysis The smirr run includes several liabilities in Auto their r idene two automobile loans, and one credit card. Ra for the Ford equal month, the new Davison a month, and their credit card is $250 (outstanding nnco. Mortgage payments for principal and interest equal $2,329 a n a 5 Th Payments are based on apr cipal balance of $262,481 financed at payments for Ford Expedition equal $608 a month. Harley Davison their and their two Credit the S250 month Motorcycle is $325 a month Pro card and Ch Se Cred and s358 a month for their Bass respectively. 4. Retirement Plan Deposits utions to Bob's 401(k) continue for one more year until retire 5. Itemized Deductions Charitable contributions are based on annual contributions of $12 n yea Medical expenses are based on $3,832 a year Property taxes in the first year of the analysis equal $13,845. Property tax calculations are based on a tax rate percentage o the coun tax value. In each analysis the annual inflation rate forth residence is 3.6% per year. As the residence increases in value property taxes adjust accordingly. 6. Taxes Federal income tax liability in the first year of the analysis equal $74.274 which is based on the tax liability from the previous year. Beginning in year 2, the t liabili is recalculated annually based on the individual circumstances of that particular year. ith

1. How much of their income are Bob and Debbie giving away?

1. How much of their income are Bob and Debbie giving away?