Question

1. How should Investco finance the purchase of the shares of Target? Note: Combined Operating profits are $130 million including synergies from the purchase. Investcos

1. How should Investco finance the purchase of the shares of Target? Note: Combined Operating profits are $130 million including synergies from the purchase. Investcos interest cost on prior borrowings is $22 million and its tax rate is 15.5%. Prepare proforma amounts below assuming the transaction takes place at the beginning of 2021. Option (1) Investco borrows at 5% and then buys Target shares. Calculate the amount of borrowing and the impact on Investcos net income and earnings per share. Option (2) Investco issues more of its own shares to the private equity firm for cash ($10 per share) and then buys Target shares. Calculate the amount of shares issued and the impact on Investcos net income and earnings per share. Option (3) Investco finances 50% with long-term debt and 50% with its shares. Calculate the amount of debt and shares issued and the impact on Investcos net income and earnings per share. 2. Which Option would you recommend for Investco?

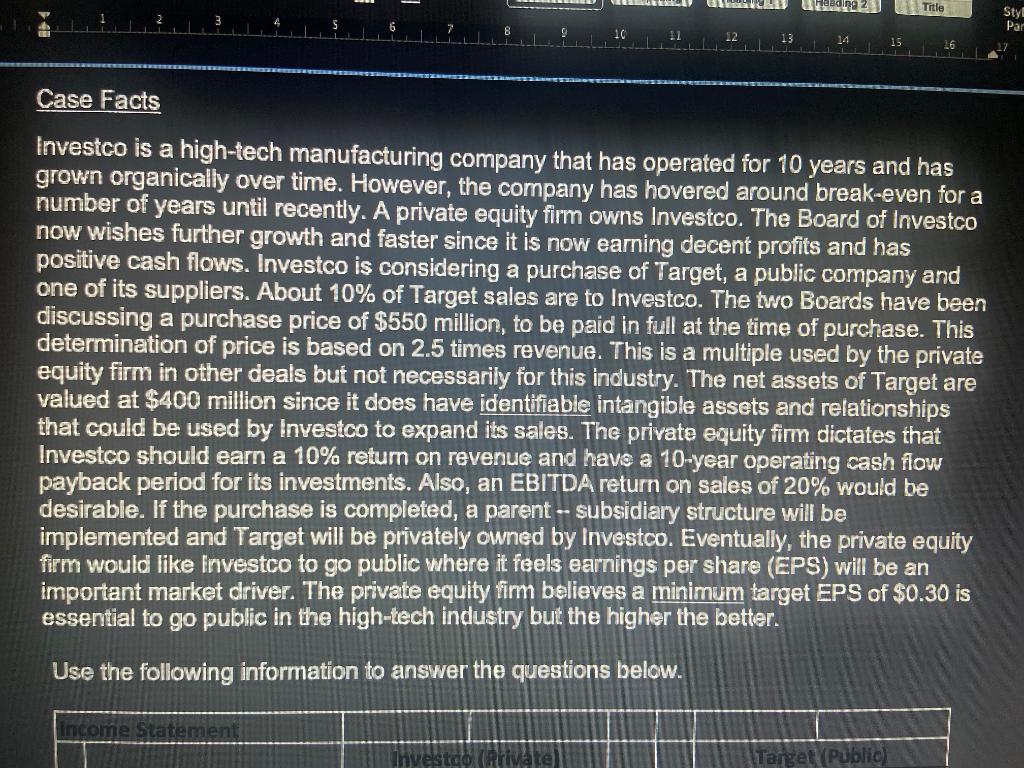

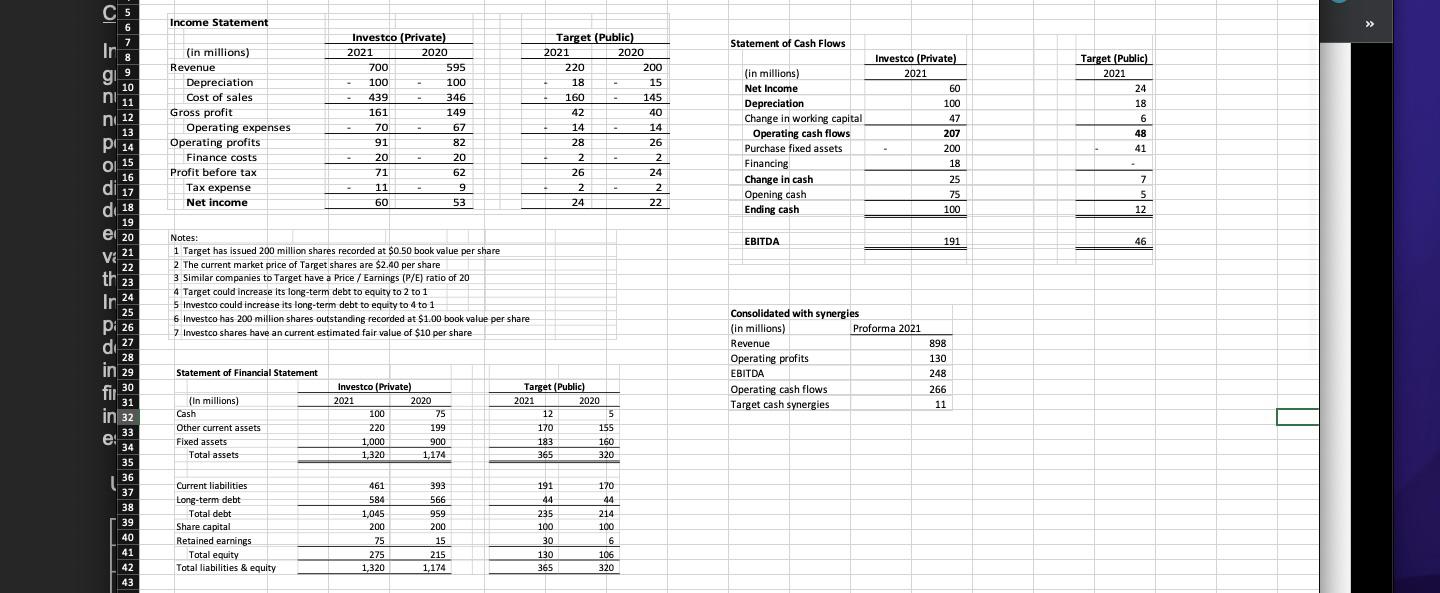

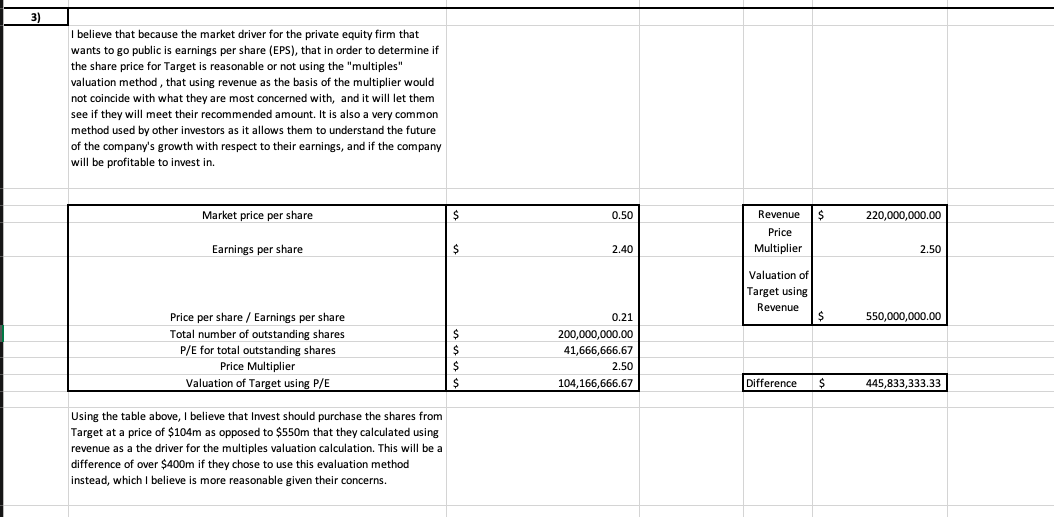

dne 23 Title Styt Par 26 Case Facts Investco is a high-tech manufacturing company that has operated for 10 years and has grown organically over time. However, the company has hovered around break-even for a number of years until recently. A private equity firm owns Investco. The Board of Investco now wishes further growth and faster since it is now earning decent profits and has positive cash flows. Investco is considering a purchase of Target, a public company and one of its suppliers. About 10% of Target sales are to Investco. The two Boards have been discussing a purchase price of $550 million, to be paid in full at the time of purchase. This determination of price is based on 2.5 times revenue. This is a multiple used by the private equity firm in other deals but not necessarily for this industry. The net assets of Target are valued at $400 million since it does have identifiable intangible assets and relationships that could be used by Investco to expand its sales. The private equity firm dictates that Investco should earn a 10% return on revenue and have a 10-year operating cash flow payback period for its investments. Also, an EBITDA return on sales of 20% would be desirable. If the purchase is completed, a parent -- Subsidiary structure will be implemented and Target will be privately owned by Investco. Eventually, the private equity firm would like investco to go public where it feels earnings per share (EPS) will be an important market driver. The private equity firm believes a minimum target EPS of $0.30 is essential to go public in the high-tech industry but the higher the better. Use the following information to answer the questions below. Income Statem Target (Public) C5 6 Income Statement Statement of Cash Flows 7 Ir 8 9 gi 10 n 11 ni 12 (in millions) Revenue Depreciation Cost of sales Gross profit Operating expenses Operating profits Finance costs Profit before tax Tax expense Net income Investco (Private) 2021 2020 700 595 100 100 439 346 161 149 70 67 91 82 20 20 71 62 11 9 9 60 53 DI Target (Public) 2021 2020 220 200 18 15 160 145 42 40 14 14 28 26 2 2 26 24 2 2 24 22 Target (Public) 2021 24 18 6 48 13 Pi 14 Ol 15 16 di 17 d 18 ei 20 V: 21 22 Investco (Private) 2021 60 100 47 207 200 18 25 75 100 (in millions) Net Income Depreciation Change in working capital Operating cash flows Purchase fixed assets Financing Change in cash Opening cash Ending cash 41 7 5 5 12 19 EBITDA 191 46 th 23 Notes: 1 Target has issued 200 million shares recorded at $0.50 book value per share 2 The current market price of Target shares are $2.40 per share 3 Similar companies to Target have a Price / Earnings (P/E) ratio of 20 4 Target could increase its long-term debt to equity to 2 to 1 5 Investco could increase its long-term debt to equity to 4 to 1 6 Investco has 200 million shares outstanding recorded at $1.00 book value per share 7 Investco shares have an current estimated fair value of $10 per share $ Consolidated with synergies (in millions) Proforma 2021 Revenue Operating profits EBITDA Operating cash flows Target cash synergies Statement of Financial Statement 898 130 248 266 11 2021 In 24 25 P: 26 di 27 28 in 29 fir 30 31 in 32 33 : e: 34 35 36 37 38 39 40 41 42 43 In millions) Cash Other current assets Fixed assets Total assets Investco (Private) 2021 2020 100 75 220 199 1,000 900 1,320 1,174 Target (Public) 2020 12 5 170 155 183 160 365 320 Current liabilities Long-term debt Total debt Share capital Retained earnings Total equity Total liabilities & equity 461 584 1,045 200 75 275 1,320 393 566 959 200 15 215 1,174 191 44 235 100 30 130 365 170 44 214 100 6 6 106 320 3) I believe that because the market driver for the private equity firm that wants to go public is earnings per share (EPS), that in order to determine if the share price for Target is reasonable or not using the "multiples" valuation method, that using revenue as the basis of the multiplier would not coincide with what they are most concerned with, and it will let them see if they will meet their recommended amount. It is also a very common method used by other investors as it allows them to understand the future of the company's growth with respect to their earnings, and if the company will be profitable to invest in. Market price per share $ 0.50 Revenue $ 220,000,000.00 Price Multiplier Earnings per share $ 2.40 2.50 Valuation of Target using Revenue $ 550,000,000.00 $ Price per share / Earnings per share Total number of outstanding shares P/E for total outstanding shares Price Multiplier Valuation of Target using P/E $ $ 0.21 200,000,000.00 41,666,666.67 2.50 104,166,666.67 $ Difference $ 445,833,333.33 Using the table above, I believe that Invest should purchase the shares from Target at a price of $104m as opposed to $550m that they calculated using revenue as a the driver for the multiples valuation calculation. This will be a difference of over $400m if they chose to use this evaluation method instead, which I believe is more reasonable given their concerns. dne 23 Title Styt Par 26 Case Facts Investco is a high-tech manufacturing company that has operated for 10 years and has grown organically over time. However, the company has hovered around break-even for a number of years until recently. A private equity firm owns Investco. The Board of Investco now wishes further growth and faster since it is now earning decent profits and has positive cash flows. Investco is considering a purchase of Target, a public company and one of its suppliers. About 10% of Target sales are to Investco. The two Boards have been discussing a purchase price of $550 million, to be paid in full at the time of purchase. This determination of price is based on 2.5 times revenue. This is a multiple used by the private equity firm in other deals but not necessarily for this industry. The net assets of Target are valued at $400 million since it does have identifiable intangible assets and relationships that could be used by Investco to expand its sales. The private equity firm dictates that Investco should earn a 10% return on revenue and have a 10-year operating cash flow payback period for its investments. Also, an EBITDA return on sales of 20% would be desirable. If the purchase is completed, a parent -- Subsidiary structure will be implemented and Target will be privately owned by Investco. Eventually, the private equity firm would like investco to go public where it feels earnings per share (EPS) will be an important market driver. The private equity firm believes a minimum target EPS of $0.30 is essential to go public in the high-tech industry but the higher the better. Use the following information to answer the questions below. Income Statem Target (Public) C5 6 Income Statement Statement of Cash Flows 7 Ir 8 9 gi 10 n 11 ni 12 (in millions) Revenue Depreciation Cost of sales Gross profit Operating expenses Operating profits Finance costs Profit before tax Tax expense Net income Investco (Private) 2021 2020 700 595 100 100 439 346 161 149 70 67 91 82 20 20 71 62 11 9 9 60 53 DI Target (Public) 2021 2020 220 200 18 15 160 145 42 40 14 14 28 26 2 2 26 24 2 2 24 22 Target (Public) 2021 24 18 6 48 13 Pi 14 Ol 15 16 di 17 d 18 ei 20 V: 21 22 Investco (Private) 2021 60 100 47 207 200 18 25 75 100 (in millions) Net Income Depreciation Change in working capital Operating cash flows Purchase fixed assets Financing Change in cash Opening cash Ending cash 41 7 5 5 12 19 EBITDA 191 46 th 23 Notes: 1 Target has issued 200 million shares recorded at $0.50 book value per share 2 The current market price of Target shares are $2.40 per share 3 Similar companies to Target have a Price / Earnings (P/E) ratio of 20 4 Target could increase its long-term debt to equity to 2 to 1 5 Investco could increase its long-term debt to equity to 4 to 1 6 Investco has 200 million shares outstanding recorded at $1.00 book value per share 7 Investco shares have an current estimated fair value of $10 per share $ Consolidated with synergies (in millions) Proforma 2021 Revenue Operating profits EBITDA Operating cash flows Target cash synergies Statement of Financial Statement 898 130 248 266 11 2021 In 24 25 P: 26 di 27 28 in 29 fir 30 31 in 32 33 : e: 34 35 36 37 38 39 40 41 42 43 In millions) Cash Other current assets Fixed assets Total assets Investco (Private) 2021 2020 100 75 220 199 1,000 900 1,320 1,174 Target (Public) 2020 12 5 170 155 183 160 365 320 Current liabilities Long-term debt Total debt Share capital Retained earnings Total equity Total liabilities & equity 461 584 1,045 200 75 275 1,320 393 566 959 200 15 215 1,174 191 44 235 100 30 130 365 170 44 214 100 6 6 106 320 3) I believe that because the market driver for the private equity firm that wants to go public is earnings per share (EPS), that in order to determine if the share price for Target is reasonable or not using the "multiples" valuation method, that using revenue as the basis of the multiplier would not coincide with what they are most concerned with, and it will let them see if they will meet their recommended amount. It is also a very common method used by other investors as it allows them to understand the future of the company's growth with respect to their earnings, and if the company will be profitable to invest in. Market price per share $ 0.50 Revenue $ 220,000,000.00 Price Multiplier Earnings per share $ 2.40 2.50 Valuation of Target using Revenue $ 550,000,000.00 $ Price per share / Earnings per share Total number of outstanding shares P/E for total outstanding shares Price Multiplier Valuation of Target using P/E $ $ 0.21 200,000,000.00 41,666,666.67 2.50 104,166,666.67 $ Difference $ 445,833,333.33 Using the table above, I believe that Invest should purchase the shares from Target at a price of $104m as opposed to $550m that they calculated using revenue as a the driver for the multiples valuation calculation. This will be a difference of over $400m if they chose to use this evaluation method instead, which I believe is more reasonable given their concernsStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started