Answered step by step

Verified Expert Solution

Question

1 Approved Answer

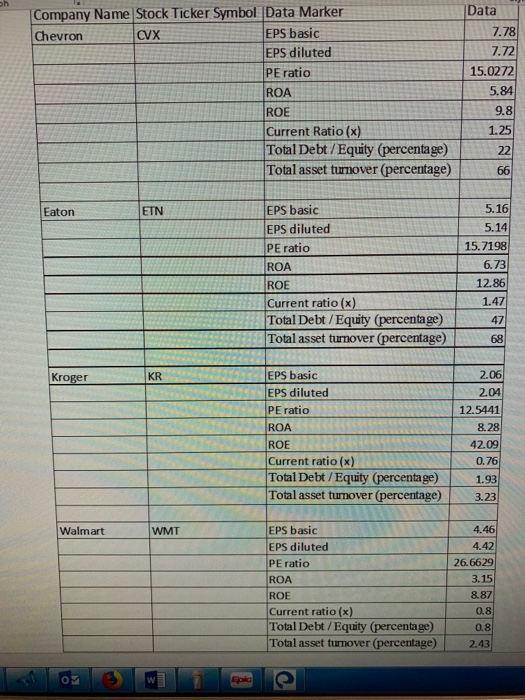

1. How would you rank the four firms in terms of financial performance? 2. Why might their finnacial performances differ? 3. What economic or market

1. How would you rank the four firms in terms of financial performance?

Data 7.78 7.72 15.0272 Company Name Stock Ticker Symbol Data Marker Chevron |cvx EPS basic EPS diluted PE ratio ROA ROE Current Ratio (x) Total Debt/Equity (percentage) Total asset turnover (percentage) 5.84 Eaton ETN EPS basic EPS diluted PE ratio ROA ROE Current ratio (x) Total Debt/Equity (percentage) Total asset turnover (percentage) 5.16 5.14 15.7198 6.73 12.86 1.47 Kroger KR E 2.06 2.04 12.5441 8.28 PS basic EPS diluted PE ratio ROA ROES Current ratio (x) Total Debt/Equity (percentage) Total asset turnover (percentage) 42.09 Walmart WMT E PS basic EPS diluted PE ratio ROA ROE Current ratio (x) Total Debt/Equity (percentage) Total asset turnover (percentage) 887 0.8 2.43 e 2. Why might their finnacial performances differ?

3. What economic or market factors might account for big differneces in the P/E ratios?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started