Question

1. Hypothetical Limited employs job order costing. It uses an annual predetermined rate for applying manufacturing overheads to jobs. The company furnishes you with

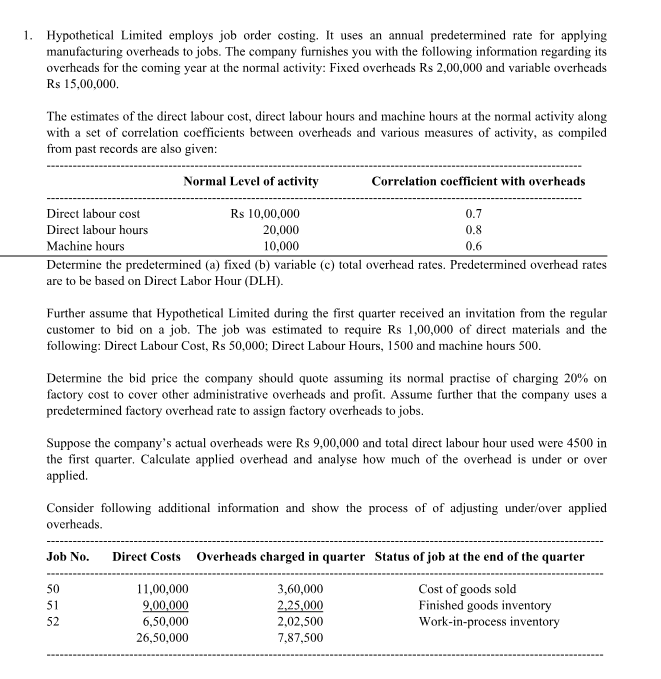

1. Hypothetical Limited employs job order costing. It uses an annual predetermined rate for applying manufacturing overheads to jobs. The company furnishes you with the following information regarding its overheads for the coming year at the normal activity: Fixed overheads Rs 2,00,000 and variable overheads Rs 15,00,000. The estimates of the direct labour cost, direct labour hours and machine hours at the normal activity along with a set of correlation coefficients between overheads and various measures of activity, as compiled from past records are also given: Normal Level of activity Direct labour cost Rs 10,00,000 Direct labour hours Machine hours 20,000 10,000 Correlation coefficient with overheads 0.7 0.8 0.6 Determine the predetermined (a) fixed (b) variable (c) total overhead rates. Predetermined overhead rates are to be based on Direct Labor Hour (DLH). Further assume that Hypothetical Limited during the first quarter received an invitation from the regular customer to bid on a job. The job was estimated to require Rs 1,00,000 of direct materials and the following: Direct Labour Cost, Rs 50,000; Direct Labour Hours, 1500 and machine hours 500. Determine the bid price the company should quote assuming its normal practise of charging 20% on factory cost to cover other administrative overheads and profit. Assume further that the company uses a predetermined factory overhead rate to assign factory overheads to jobs. Suppose the company's actual overheads were Rs 9,00,000 and total direct labour hour used were 4500 in the first quarter. Calculate applied overhead and analyse how much of the overhead is under or over applied. Consider following additional information and show the process of of adjusting under/over applied overheads. Job No. Direct Costs Overheads charged in quarter Status of job at the end of the quarter 50 51 11,00,000 9,00,000 3,60,000 2,25,000 52 6,50,000 2,02,500 26,50,000 7,87,500 Cost of goods sold Finished goods inventory Work-in-process inventory

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started