Answered step by step

Verified Expert Solution

Question

1 Approved Answer

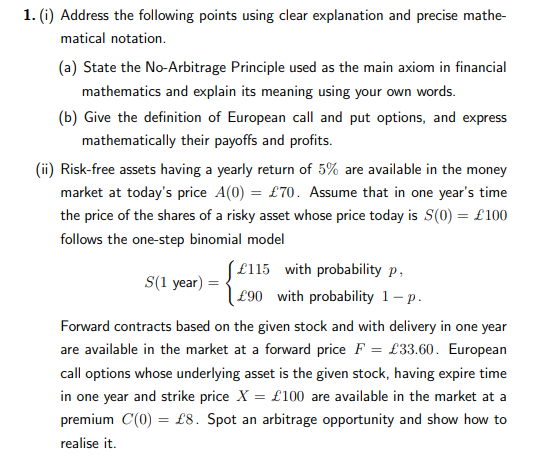

1. (i) Address the following points using clear explanation and precise mathe- matical notation. (a) State the No-Arbitrage Principle used as the main axiom

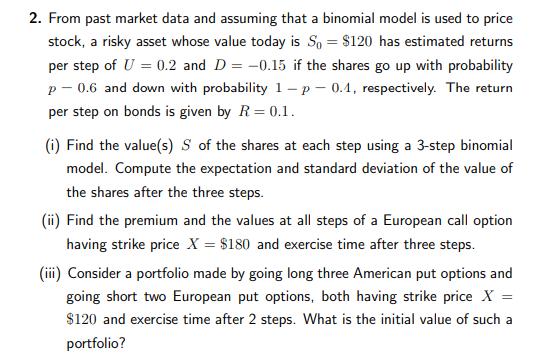

1. (i) Address the following points using clear explanation and precise mathe- matical notation. (a) State the No-Arbitrage Principle used as the main axiom in financial mathematics and explain its meaning using your own words. (b) Give the definition of European call and put options, and express mathematically their payoffs and profits. (ii) Risk-free assets having a yearly return of 5% are available in the money market at today's price A(0) = 70. Assume that in one year's time the price of the shares of a risky asset whose price today is S(0) = 100 follows the one-step binomial model S(1 year) 115 with probability p, 90 with probability 1 - p. Forward contracts based on the given stock and with delivery in one year are available in the market at a forward price F = 33.60. European call options whose underlying asset is the given stock, having expire time in one year and strike price X = 100 are available in the market at a premium C(0) = 8. Spot an arbitrage opportunity and show how to realise it. 2. From past market data and assuming that a binomial model is used to price stock, a risky asset whose value today is So= $120 has estimated returns per step of U = 0.2 and D= -0.15 if the shares go up with probability p - 0.6 and down with probability 1-p-0.1, respectively. The return per step on bonds is given by R = 0.1. (i) Find the value(s) S of the shares at each step using a 3-step binomial model. Compute the expectation and standard deviation of the value of the shares after the three steps. (ii) Find the premium and the values at all steps of a European call option having strike price X = $180 and exercise time after three steps. (iii) Consider a portfolio made by going long three American put options and going short two European put options, both having strike price X = $120 and exercise time after 2 steps. What is the initial value of such a portfolio?

Step by Step Solution

★★★★★

3.30 Rating (144 Votes )

There are 3 Steps involved in it

Step: 1

i a The NoArbitrage Principle is a fundamental axiom in financial mathematics that states that it is not possible to make riskfree profits from financ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started