Answered step by step

Verified Expert Solution

Question

1 Approved Answer

3. (i) Address the following points related to risk-free assets using clear expla- nation and precise mathematical notation. (a) Explain the three methods of

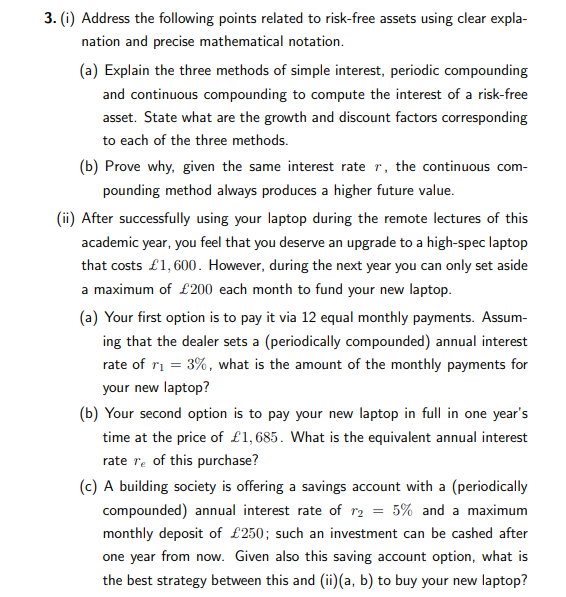

3. (i) Address the following points related to risk-free assets using clear expla- nation and precise mathematical notation. (a) Explain the three methods of simple interest, periodic compounding and continuous compounding to compute the interest of a risk-free asset. State what are the growth and discount factors corresponding to each of the three methods. (b) Prove why, given the same interest rater, the continuous com- pounding method always produces a higher future value. (ii) After successfully using your laptop during the remote lectures of this academic year, you feel that you deserve an upgrade to a high-spec laptop that costs 1,600. However, during the next year you can only set aside a maximum of 200 each month to fund your new laptop. (a) Your first option is to pay it via 12 equal monthly payments. Assum- ing that the dealer sets a (periodically compounded) annual interest rate of r = 3%, what is the amount of the monthly payments for your new laptop? (b) Your second option is to pay your new laptop in full in one year's time at the price of 1,685. What is the equivalent annual interest rate re of this purchase? (c) A building society is offering a savings account with a (periodically compounded) annual interest rate of r2 = 5% and a maximum monthly deposit of 250; such an investment can be cashed after one year from now. Given also this saving account option, what is the best strategy between this and (ii)(a, b) to buy your new laptop?

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started