Answered step by step

Verified Expert Solution

Question

1 Approved Answer

1. i am confused between recovery of impairment loss and unrealized gain on revaluation after recognizing the impairment loss 500,000 and acc. depreciation 1,250,000 the

1. i am confused between recovery of impairment loss and unrealized gain on revaluation

after recognizing the impairment loss 500,000 and acc. depreciation 1,250,000 the remaing book value is3,750,000 from here when the recoverable amount is estimated 5,250,000 2. I don't know whether i should use recovery of impairment loss or unrealized gain in revaluation.

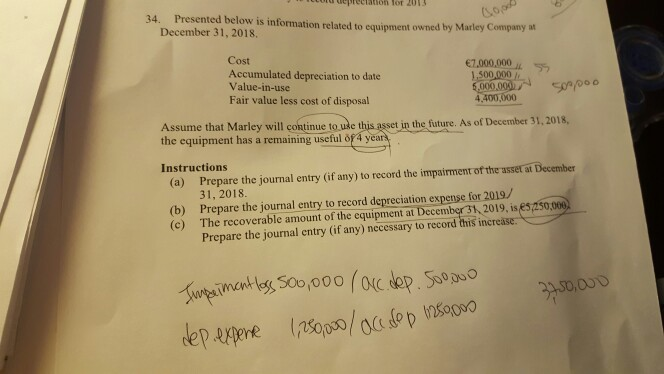

for 2013 Presented below is information related to equipment owned by Marley Company at December 31, 2018, 34. Cost 7,000,000 1,500,000 5,000,000 4.400,000 Accumulated depreciation to date Value-in-use Fair value less cost of disposal S09/000 Assume that Marley will continue to use this asset in the future. As of December 31, 2018, the equipment has a remaining useful f 4 years Instructions Prepare the journal entry (if any) to record the impairment of the asset at December 31, 2018. Prepare the journal entry to record depreciation expense for 2019/ (a) (b) The recoverable amount of the equipment at December 31, 2019, is e5,250,000 (c) Prepare the journal entry (if any) necessary to record this increase Suagpainent lss Soo,000 (oc dep Soopuo ps0ps0 dep oo0 dep-expene

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started