Question

1.. I need the solution. the full, correct solution! I will give a thumbs up! A real estate investment has the following expected cash flows:

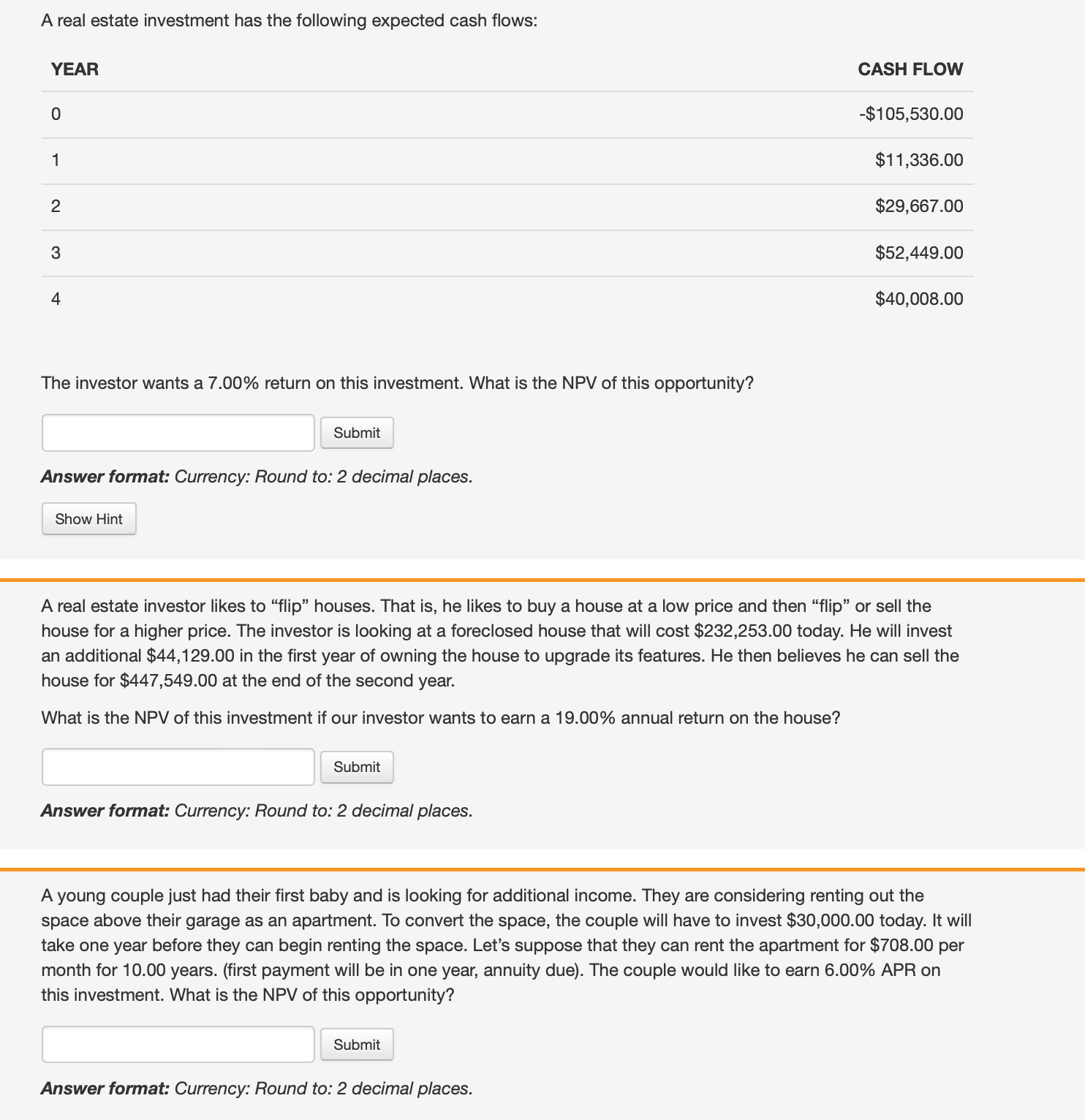

1.. I need the solution. the full, correct solution! I will give a thumbs up!  A real estate investment has the following expected cash flows: YEAR 0 1 CASH FLOW $105,530.00 $11,336.00 $29,667.00 $52,449.00 $40,008.00 The investor wants a 7.00% return on this investment. What is the NPV of this opportunity? Answer format: Currency: Round to: 2 decimal places. A real estate investor likes to "flip" houses. That is, he likes to buy a house at a low price and then "flip" or sell the house for a higher price. The investor is looking at a foreclosed house that will cost $232,253.00 today. He will invest an additional $44,129.00 in the first year of owning the house to upgrade its features. He then believes he can sell the house for $447,549.00 at the end of the second year. What is the NPV of this investment if our investor wants to earn a 19.00% annual return on the house? Answer format: Currency: Round to: 2 decimal places. A young couple just had their first baby and is looking for additional income. They are considering renting out the space above their garage as an apartment. To convert the space, the couple will have to invest $30,000.00 today. It will take one year before they can begin renting the space. Let's suppose that they can rent the apartment for $708.00 per month for 10.00 years. (first payment will be in one year, annuity due). The couple would like to earn 6.00% APR on this investment. What is the NPV of this opportunity? Answer format: Currency: Round to: 2 decimal places

A real estate investment has the following expected cash flows: YEAR 0 1 CASH FLOW $105,530.00 $11,336.00 $29,667.00 $52,449.00 $40,008.00 The investor wants a 7.00% return on this investment. What is the NPV of this opportunity? Answer format: Currency: Round to: 2 decimal places. A real estate investor likes to "flip" houses. That is, he likes to buy a house at a low price and then "flip" or sell the house for a higher price. The investor is looking at a foreclosed house that will cost $232,253.00 today. He will invest an additional $44,129.00 in the first year of owning the house to upgrade its features. He then believes he can sell the house for $447,549.00 at the end of the second year. What is the NPV of this investment if our investor wants to earn a 19.00% annual return on the house? Answer format: Currency: Round to: 2 decimal places. A young couple just had their first baby and is looking for additional income. They are considering renting out the space above their garage as an apartment. To convert the space, the couple will have to invest $30,000.00 today. It will take one year before they can begin renting the space. Let's suppose that they can rent the apartment for $708.00 per month for 10.00 years. (first payment will be in one year, annuity due). The couple would like to earn 6.00% APR on this investment. What is the NPV of this opportunity? Answer format: Currency: Round to: 2 decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started