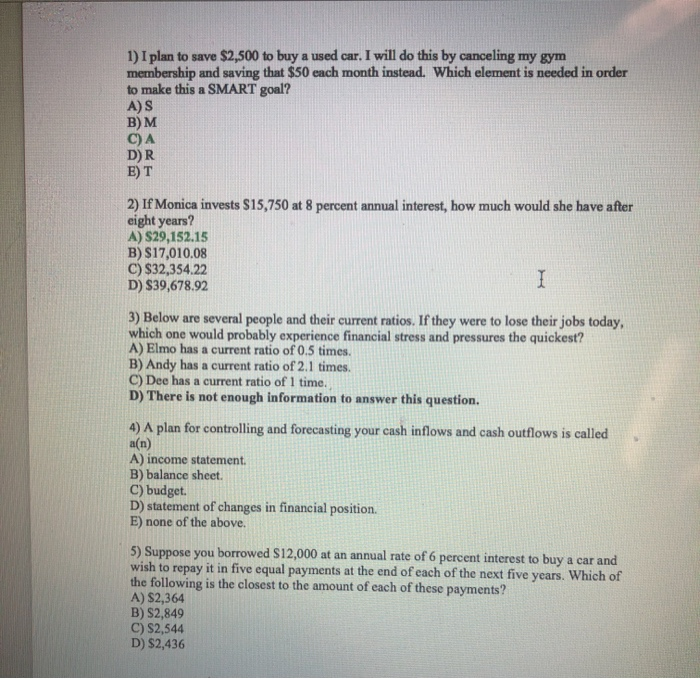

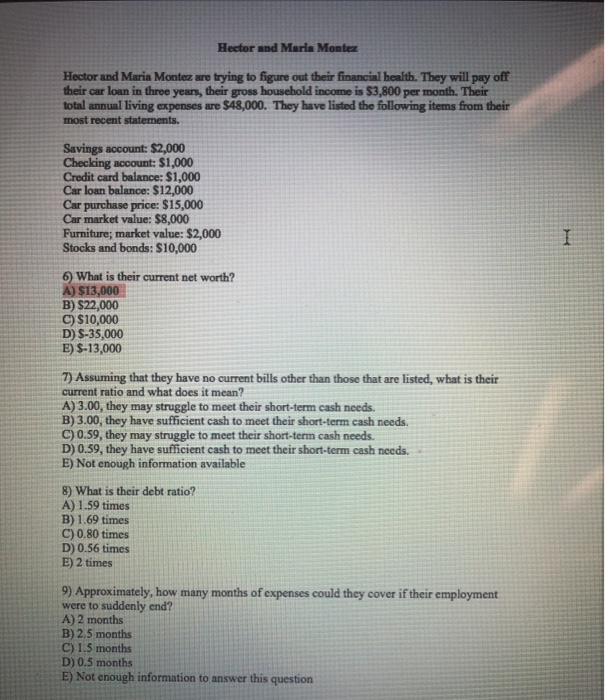

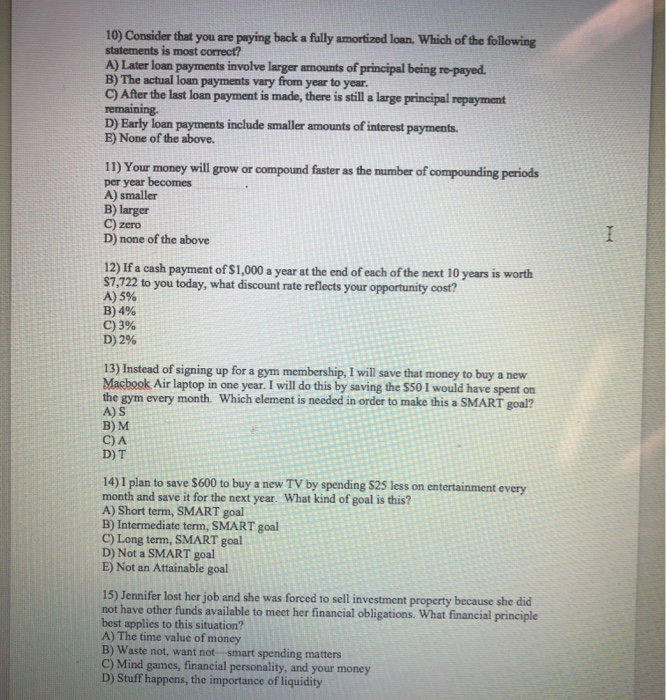

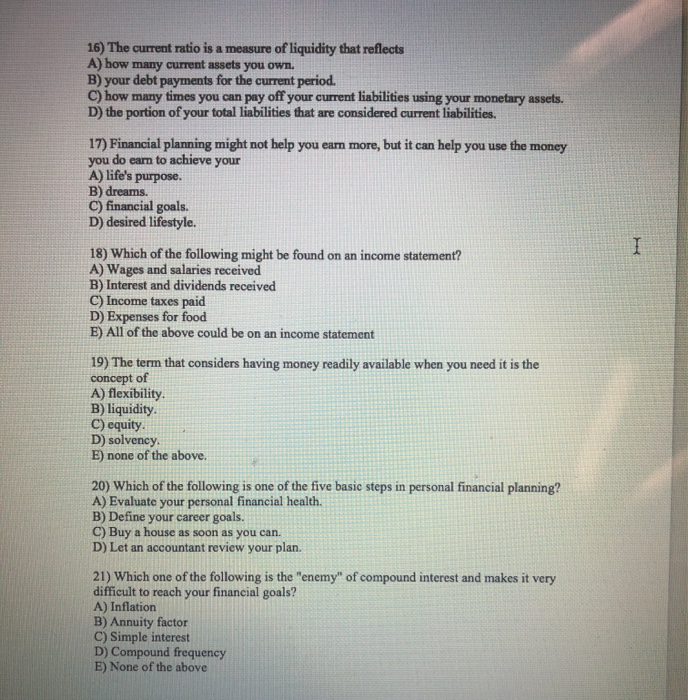

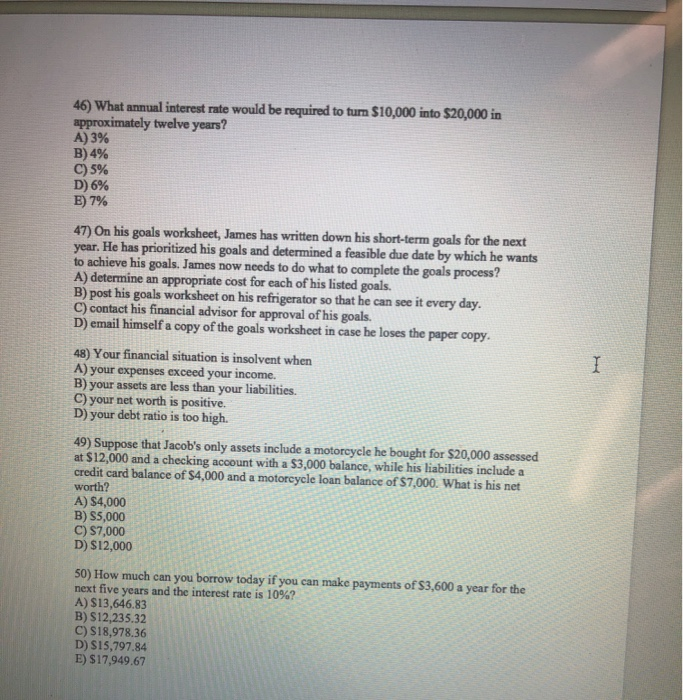

1) I plan to save $2,500 to buy a used car. I will do this by canceling my gym membership and saving that $50 each month instead. Which element is needed in order to make this a SMART goal? A) S B) M C) A D) R E) T 2) If Monica invests $15,750 at 8 percent annual interest, how much would she have after eight years? A) S29,152.15 B)$17,010.08 C) $32,354.22 D) S39,678.92 3) Below are several people and their current ratios. If they were to lose their jobs today, which one would probably experience financial stress and pressures the quickest? A) Elmo has a current ratio of 0.5 times. B) Andy has a current ratio of 2.1 times. C) Dee has a current ratio of 1 time. D) There is not enough information to answer this question. 4) A plan for controlling and forecasting your cash inflows and cash outflows is called a(n) A) income statement. B) balance sheet. D) statement of changes in financial position. E) none of the above. Suppose you borrowed S12,000 at an annual rate of 6 percent interest to buy a car and 5) wish to repay it in five equal payments at the end of each of the next five years. Which of the following is the closest to the amount of each of these payments? A) S2,364 B) S2,849 C) S2,544 D) $2,436 Hector and Maria Montez Hector and Maria Montez are trying to figure out their financial health. They will pay off heir car loan in three years, their gross household income is $3,800 per month. Their total annual living expenses are $48,000. They have listed the following items from their most recent statenents Savings account: $2,000 Checking account: $1,000 Credit card balance: $1,000 Car loan balance: $12,000 Car purchase price: $15,000 Car market value: $8,000 Furniture; market value: $2,000 Stocks and bonds: $10,000 6) What is their current net worth? A) $13,000 B) $22,000 C) $10,000 D) S-35,000 E) S-13,000 7) Assuming that they have no current bills other than those that are listed, what is their current ratio and what does it mean? A)3.00, they may struggle to meet their short-term cash needs. B) 3.00, they have sufficient cash to meet their short-term cash needs. C) 0.59, they may struggle to meet their short-term cash needs. D) 0.59, they have sufficient cash to meet their short-term cash needs E) Not enough information available 8) What is their debt ratio? A) 1.59 times B) 1.69 times C) 0.80 times D) 0.56 times E) 2 times 9) Approximately, how many months of expenses could they cover if their employment were to suddenly end? A) 2 months B) 2.5 months C) 1.5 months D) 0.5 months E) Not enough information to answer this question 10) Consider that you are paying back a fully amortized loan. Which of the following statements is most correct? A) Later loan payments involve larger amounts of principal being ro-payed B) The actual loan payments vary from year to year. C) After the last loan payment is made, there is still a large principal repayment remaining D) Early loan payments include smaller amounts of interest payments. E) None of the above. 11) Your money will grow or compound faster as the number of compounding periods per year becomes A) smaller B) larger zcro D) none of the above 12) If a cash payment of $1,000 a year at the end of each of the next 10 years is worth S7,722 to you today, what discount rate reflects your opportunity cost? A) 5% B) 4% C) 3% D) 2% 13) Instead of signing up for a gym membership, I will save that money to buy a new Macbook Air laptop in one year. I will do this by saving the $50 1 would have spent on the gym every month. Which element is needed in order to make this a SMART goal? A) S B) M C) A D) T 14) I plan to save $600 to buy a new TV by spending $25 less on entertainment every month and save it for the next year. What kind of goal is this? A) Short term, SMART goal B) Intermediate term, SMART goal C) Long term, SMART goal D) Not a SMART goal E) Not an Attainable goal 15) Jennifer lost her job and she was forced to sell investment property because not have other funds available to meet her financial obligations. What financial principle best applies to this situation? A) The time value of money B) Waste not, want not -smart spending matters C) Mind games, financial personality, and your money D) Stuff happens, the importance of liquidity she did 16) The current ratio is a measure of liquidity that reflects A) how many current assets you own. B) your debt payments for the current period C) how many times you can pay off your current liabilities using your monetary assets. D) the portion of your total liabilities that are considered current liabilities. 17) Financial planning might not help you earn more, but it can help you use the money you do earn to achieve your A) life's purpose. B) dreams. C) financial goals. D) desired lifestyle 18) Which of the following might be found on an income statement? A) Wages and salaries received B) Interest and dividends received C) Income taxes paid D) Expenses for food E) All of the above could be on an income statement 19) The term that considers having money readily available when you need it is the concept of A) flexibility B) liquidity C) equity. D) solvency E) none of the above. 20) Which of the following is one of the five basic steps in personal financial planning? A) Evaluate your personal financial health B) Define your career goals. C) Buy a house as soon as you can. D) Let an accountant review your plan. 21) Which one of the following is the "enemy" of compound interest and makes it very difficult to reach your financial goals? A) Inflation B) Annuity factor C) Simple interest D) Compound frequency E) None of the above 22) A series of equal dollar payments at the end of each period for a defined number of time periods is A) an annuity. B) a perpetuity C) a present value plan. D) a roth IRA B) a traditional IRA 23) Suppose that you placed $500 in a bank account at the end of each year for the next 10 years. How much would be in that account at the end of the tenth year if the deposits earned an annual rate of return of 8% each year? A) $8,07946 B) $5,400.00 C) $7,243.28 D) S6,355.04 B) $7,774.51 24) What would happen to your net worth if you sold an asset you owned for $1,000 and used the money to pay off your credit card balance for $1,000? A) Since your liabilities decreased, your net worth would increase by S1,000. B) Since your assets decreased, your net worth would decrease by $1,000. C) Your net worth would increase by $500. D) Your net worth would remain the same. 25) Which of the following would be included on a personal income statement? A) Your 401(k) balance B) A payment to your phone company C) Making a payment to your credit card company. D) All of the above 26) Being financially secure involves balancing what you earn with A) your investments. B) what you spend. C) your retirement plans. D) your current level of debt. 27) In order for your financial plan to be realistic and attainable it needs to be based upon your A) budget. B) number of tax deductions, exemption, exclusions, and credits. C) balance sheet. D) none of the above. 34) What is the present value of an IOU for $1,000 due to be paid in two years, if the discount rate is 8%? A) $857.34 B) $766.40 C) $885.00 D) $683.26 E) $810.77 35) Suppose that you want to create a "college fund" for your newborn child and place S300 in a bank account at the end of each of the next 20 years. If that account earns an annual rate of return of 7%, how much will be in that account at the end of the twentieth year? A) S13,420.00 B) S12,977.53 C) S13,178.20 D) $11,828.32 B) $12,298.65 36) The major reason to make a financial plan is to A) account for your spending. B) see where you are overspending or underspending. C) help you achieve your financial goals. D) allow for a surplus. E) serve as a tax planning guide. 37) Suppose that you are a 21-year-old college student. What stage of the financial life cycle are you currently in? A) Stage l: wealth accumulation B) Stage 2: the golden years C) Stage 3: the retirement years D) Stage 4: the formative years E) Stage 5: the educational years 38) When including an asset such as a car on your balance sheet A) list its current value as indicated in a blue book or site like www.edmunds.com. B) list the original purchase price of the vehicle. C) list the amount it would cost to purchase a new model of this vehicle. D) none of the above. 39) A personal income statement is prepared A) on an accrual basis, like a corporation would B) on a cash basis. C) based on forecasted cash flows D) according to generally accepted accounting principles. 40) What is the approximate annual interest rate earned on a deposit that grew from $250 to $505 over the last 5 years? A) 15% B) 1396 C)11% D)9% 41) Suppose that you invested S100 in a bank account that eamed an annual rate of return of10%. How much would you have in that bank account at the end of 10 years? A) $259.37 B) S238.55 C) $293.74 D) $214.46 E) $279.23 42) Based on the Life Cycle of Financial Planning, when would be a good time to review and possibly adjust an effective financial plan? A) A really effective financial plan doesn't need to be adjusted. B) When you get married C) When you have children D) When the stock market goes up E) Both B and C are correct answers. 43) What is the present value of a S500 payment received at the end of each of the next five years, worth to you today at the appropriate discount rate of 6 percent? A)$1,105 B) $1,850 C) $2,106 D) S2,778 44) An amortized loan is an example of an annuity, where the payments A) change from month to month. B) do not include interest. C) are the same every month. D) never stop. 45) Carolyn wants to go to Aruba. She has decided that she is willing to spend S100 less on eating meals out every month and save it for the next 1 year. What kind of goal is this? A) Short term, SMART goal B) Intermediate term, SMART goal C) Long term, SMART goal D) Not a SMART goal 46) What anmual interest rate would be required to tun $10,000 into $20,000 im approximately twelve years? A) 3% B) 4% C) 5% D) 6% E)796 47) On his goals worksheet, James has written down his short-term goals for the next year. He has prioritized his goals and determined a feasible due date by which he wants to achieve his goals. James now needs to do what to complete the goals process? A) determine an appropriate cost for each of his listed goals. B) post his goals worksheet on his refrigerator so that he can see it every day. C) contact his financial advisor for approval of his goals D) email himself a copy of the goals worksheet in case he loses the paper copy 48) Your financial situation is insolvent when A) your expenses exceed your income B) your assets are less than your liabilities. C) your net worth is positive. D) your debt ratio is too high. 49) Suppose that Jacob's only assets include a motorcycle he bought for $20,000 assessed at $12,000 and a checking account with a $3,000 balance, while his liabilities include a credit card balance of $4,000 and a motorcycle loan balance of $7,000. What is his net worth? A) $4,000 B) S5,000 C) S7,000 D) $12,000 50) How much can you borrow today if you can make payments of S3,600 a year for the next five years and the interest rate is 10%? A) $13,646.83 B) S12,235.32 C) $18,978.36 D) S15,797.84 E) $17,949.67