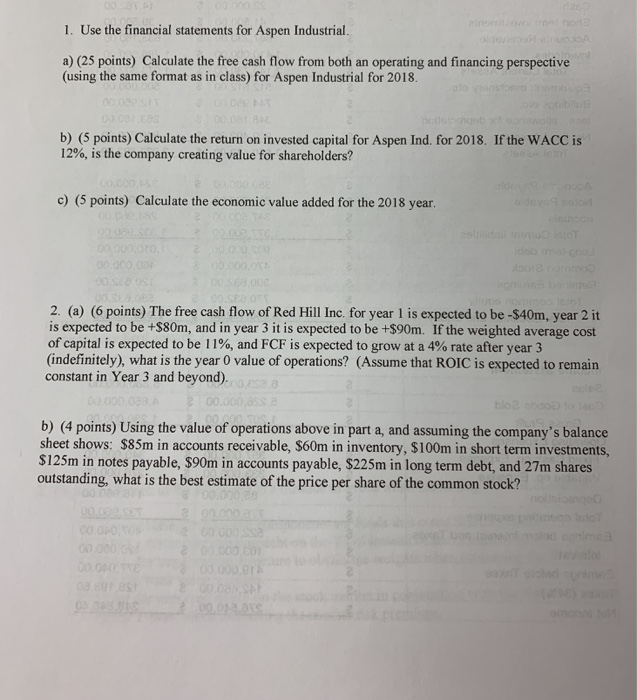

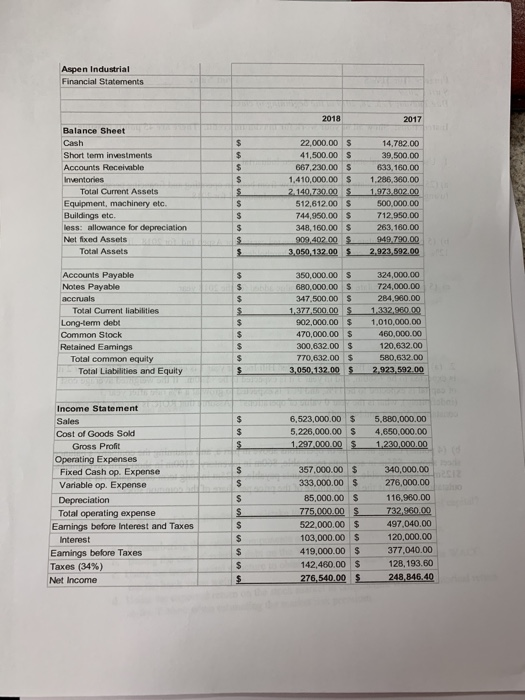

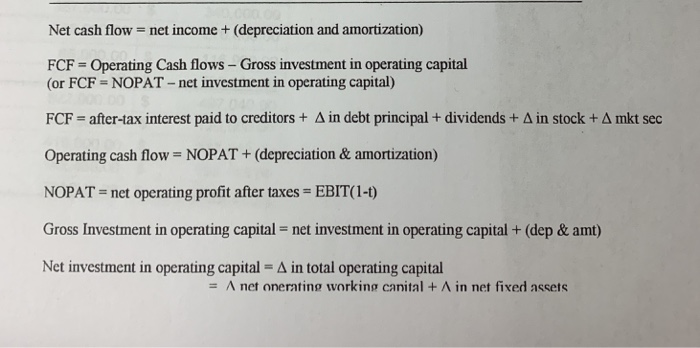

1 I. Use the financial statements for Aspen Industrial a) (25 points) Calculate the free cash flow from both an operating and financing perspective (using the same format as in class) for Aspen Industrial for 2018. b) (5 points) Calculate the return on invested capital for Aspen Ind. for 2018. If the WACC is 12%, is the company creating value for shareholders? c) (5 points) Calculate the economic value added for the 2018 year 2. (a) (6 points) The free cash flow of Red Hill Inc. for year 1 is expected to be-$40m, year 2 it is expected to be +$80m, and in year 3 it is expected to be +$90m. If the weighted average cost of capital is expected to be l 1%, and FCF is expected to grow at a 4% rate after year 3 (indefinitely), what is the year 0 value of operations? (Assume that ROIC is expected to remain constant in Year 3 and beyond) b) (4 points) Using the value of operations above in part a, and assuming the company's balance sheet shows: $85m in accounts receivable, $60m in inventory, $100m in short term investments, $125m in notes payable, $90m in accounts payable, $225m in long term debt, and 27m shares outstanding, what is the best estimate of the price per share of the common stock? 1 Aspen Industrial Financial Statements Balance Sheet Cash Short term investments Accounts Receivable 22,000.00 $ 1,500.00 S 667,230.00 14,782.00 39,500.00 633,160.00 1,410,000.00$1,286,360.00 Total Current Assets Equipment, machinery etc Buildings etc. less: allowance for depreciation Net fixed Assets 512,612.00$ 744.950.00$ 348,160.00$ 900402 00$949 790 00 500,000.00 712,950.00 263,160.00 Total Assets 350,000.00 S 680,000.00 S 347,500.00$ 324,000,00 724,000.00 284,960.00 Notes Payable Total Current liabilities 1377,500.001332,960 debt 902,000.001,010,000.00 470,000.00 S 300,632.00 S 770,632.00 $ 460,000.00 120,632.00 Common Stock Retained Eamings Total common equity Total Liabilities and Equity 3,050.132.00 Income Statement Cost of Goods Sold Gross Profit Operating Expenses 6,523,000.00 $ 5,880,000.00 5,226,000.00 S 4.650,000.00 1297,000.00 $ 1230,000 357,000.00$ 333,000.00$ 85,000.00 $ 775,000.00 S 522,000.00 S 103,000.00 S 419,000.00 $ 142,460.00 $ 276,540.00 Fixed Cash op. Expense 340,000.00 Variable op. Expense 116,980.00 Total operating expense Eamings before Interest and Taxes 497,040.00 120,000.00 377,040.00 128,193.60 Eamings before Taxes Taxes (34%) Net Income Net cash flow net income + (depreciation and amortization) FCF Operating Cash flows - Gross investment in operating capital or FCF NOPAT-net investment in operating capital) FCF = after-tax interest paid to creditors + in debt principal + dividends + in stock + mkt sec Operating cash flow NOPAT+ (depreciation &amortization) NOPAT = net oper ting profit after taxes = EBIT( 1-t) Gross investment in operating capital = net investment in operating capital + (dep & amt) Net investment in operating capital- A in total operating capital = A net oner:ting working canital + A in net fixed assets 1 I. Use the financial statements for Aspen Industrial a) (25 points) Calculate the free cash flow from both an operating and financing perspective (using the same format as in class) for Aspen Industrial for 2018. b) (5 points) Calculate the return on invested capital for Aspen Ind. for 2018. If the WACC is 12%, is the company creating value for shareholders? c) (5 points) Calculate the economic value added for the 2018 year 2. (a) (6 points) The free cash flow of Red Hill Inc. for year 1 is expected to be-$40m, year 2 it is expected to be +$80m, and in year 3 it is expected to be +$90m. If the weighted average cost of capital is expected to be l 1%, and FCF is expected to grow at a 4% rate after year 3 (indefinitely), what is the year 0 value of operations? (Assume that ROIC is expected to remain constant in Year 3 and beyond) b) (4 points) Using the value of operations above in part a, and assuming the company's balance sheet shows: $85m in accounts receivable, $60m in inventory, $100m in short term investments, $125m in notes payable, $90m in accounts payable, $225m in long term debt, and 27m shares outstanding, what is the best estimate of the price per share of the common stock? 1 Aspen Industrial Financial Statements Balance Sheet Cash Short term investments Accounts Receivable 22,000.00 $ 1,500.00 S 667,230.00 14,782.00 39,500.00 633,160.00 1,410,000.00$1,286,360.00 Total Current Assets Equipment, machinery etc Buildings etc. less: allowance for depreciation Net fixed Assets 512,612.00$ 744.950.00$ 348,160.00$ 900402 00$949 790 00 500,000.00 712,950.00 263,160.00 Total Assets 350,000.00 S 680,000.00 S 347,500.00$ 324,000,00 724,000.00 284,960.00 Notes Payable Total Current liabilities 1377,500.001332,960 debt 902,000.001,010,000.00 470,000.00 S 300,632.00 S 770,632.00 $ 460,000.00 120,632.00 Common Stock Retained Eamings Total common equity Total Liabilities and Equity 3,050.132.00 Income Statement Cost of Goods Sold Gross Profit Operating Expenses 6,523,000.00 $ 5,880,000.00 5,226,000.00 S 4.650,000.00 1297,000.00 $ 1230,000 357,000.00$ 333,000.00$ 85,000.00 $ 775,000.00 S 522,000.00 S 103,000.00 S 419,000.00 $ 142,460.00 $ 276,540.00 Fixed Cash op. Expense 340,000.00 Variable op. Expense 116,980.00 Total operating expense Eamings before Interest and Taxes 497,040.00 120,000.00 377,040.00 128,193.60 Eamings before Taxes Taxes (34%) Net Income Net cash flow net income + (depreciation and amortization) FCF Operating Cash flows - Gross investment in operating capital or FCF NOPAT-net investment in operating capital) FCF = after-tax interest paid to creditors + in debt principal + dividends + in stock + mkt sec Operating cash flow NOPAT+ (depreciation &amortization) NOPAT = net oper ting profit after taxes = EBIT( 1-t) Gross investment in operating capital = net investment in operating capital + (dep & amt) Net investment in operating capital- A in total operating capital = A net oner:ting working canital + A in net fixed assets