Question

, 1. Identify and explain two advantages and two disadvantages of using the payback period method and the net present value method, respectively. 2. Which

, 1. Identify and explain two advantages and two disadvantages of using the payback period method and the net present value method, respectively.

, 1. Identify and explain two advantages and two disadvantages of using the payback period method and the net present value method, respectively.

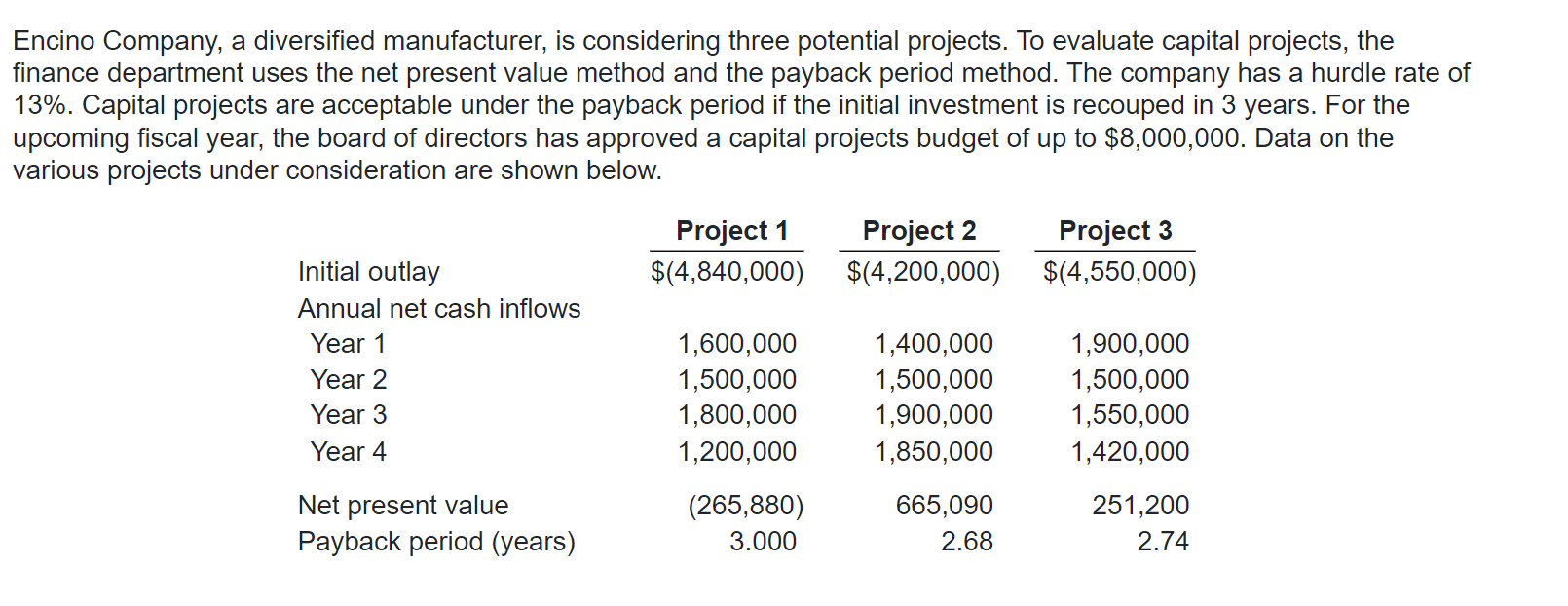

2. Which project(s) should Encino select based on the payback period method? Explain your answer.

3. Which project(s) should Encino select based on the net present value method? Explain your answer.

4. Assume the board of directors increases the capital budget to $10,000,000. Which project(s) should the company select based on the payback period method and the net present value method, respectively? Explain your answer.

5. Define sensitivity analysis and explain how management could use sensitivity analysis in its capital budgeting process.

6. Discuss two qualitative factors that Encino should consider when making capital budgeting decisions.

Encino Company, a diversified manufacturer, is considering three potential projects. To evaluate capital projects, the finance department uses the net present value method and the payback period method. The company has a hurdle rate of 13%. Capital projects are acceptable under the payback period if the initial investment is recouped in 3 years. For the upcoming fiscal year, the board of directors has approved a capital projects budget of up to $8,000,000. Data on the various projects under consideration are shown below

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started