Question

1. Identify items in reported in Chipotle's Consolidated Statement... 1. Identify items in reported in Chipotle's Consolidated Statement of Income (Exhibit 6.17) and Consolidated Statement

1. Identify items in reported in Chipotle's Consolidated Statement...

1. Identify items in reported in Chipotle's Consolidated Statement of Income (Exhibit 6.17) and Consolidated Statement of Cash Flows (6.19) that are potentially nonrecurring. Using Notes 5 and 6, describe the nature of those items. 2. Why are the amounts different in the two statements, and why does that difference matter? 3. Are the amounts material? Recurring? 4. Examine Chipotle's Consolidated Statement of Comprehensive Income (Exhibit 6.18). What do the amounts that reconcile net income and comprehensive income represent? Are these events relevant for performance evaluation of Chipotle's executives? For risk assessment? For equity valuation?

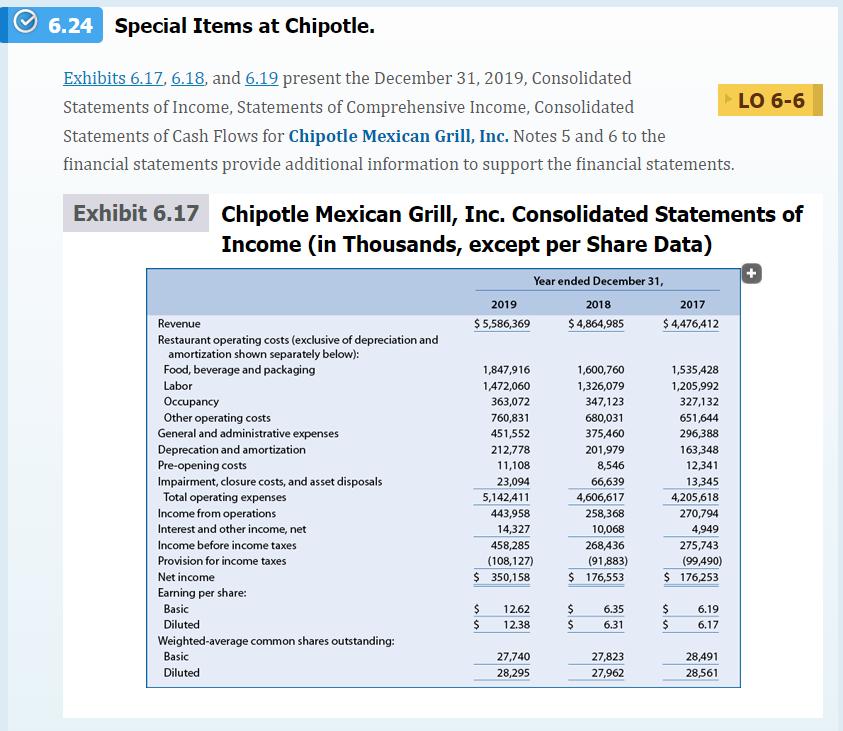

6.24 Special Items at Chipotle. Exhibits 6.17, 6.18, and 6.19 present the December 31, 2019, Consolidated Statements of Income, Statements of Comprehensive Income, Consolidated Statements of Cash Flows for Chipotle Mexican Grill, Inc. Notes 5 and 6 to the financial statements provide additional information to support the financial statements. LO 6-6 Exhibit 6.17 Chipotle Mexican Grill, Inc. Consolidated Statements of Income (in Thousands, except per Share Data) Year ended December 31, 2019 Revenue $5,586,369 2018 $4,864,985 2017 $4,476,412 Restaurant operating costs (exclusive of depreciation and amortization shown separately below): Food, beverage and packaging 1,847,916 1,600,760 1,535,428 Labor 1,472,060 1,326,079 1,205,992 Occupancy 363,072 347,123 327,132 Other operating costs 760,831 680,031 651,644 General and administrative expenses 451,552 375,460 296,388 Deprecation and amortization 212,778 201,979 163,348 Pre-opening costs 11,108 8,546 12,341 Impairment, closure costs, and asset disposals 23,094 66,639 13,345 Total operating expenses 5,142,411 4,606,617 4,205,618 Income from operations Interest and other income, net 443,958 14,327 258,368 270,794 10,068 Income before income taxes Provision for income taxes 458,285 (108,127) 268,436 (91,883) 4,949 275,743 (99,490) Net income $ 350,158 $ 176,553 $ 176,253 Earning per share: Basic $ 12.62 $ 6.35 $ 6.19 Diluted $ 12.38 $ 6.31 $ 6.17 Weighted-average common shares outstanding: Basic 27,740 27,823 28,491 Diluted 28,295 27,962 28,561

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started