Answered step by step

Verified Expert Solution

Question

1 Approved Answer

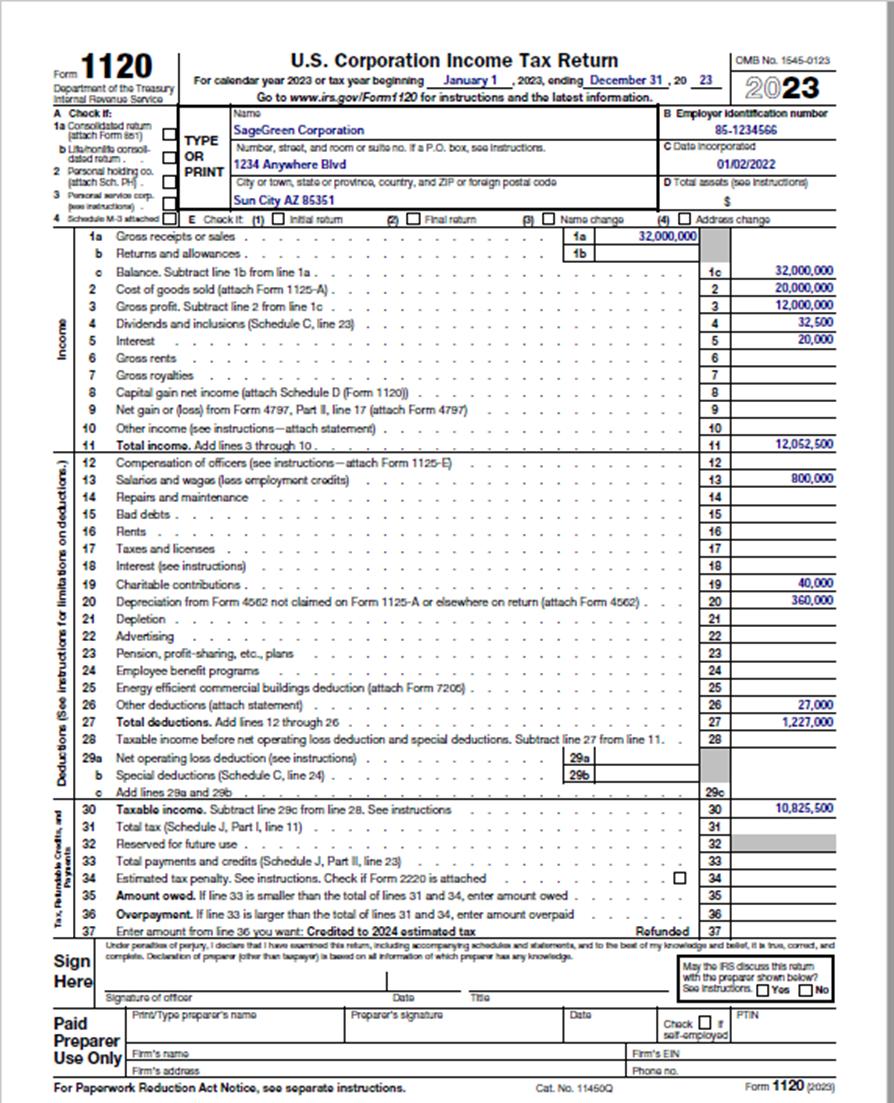

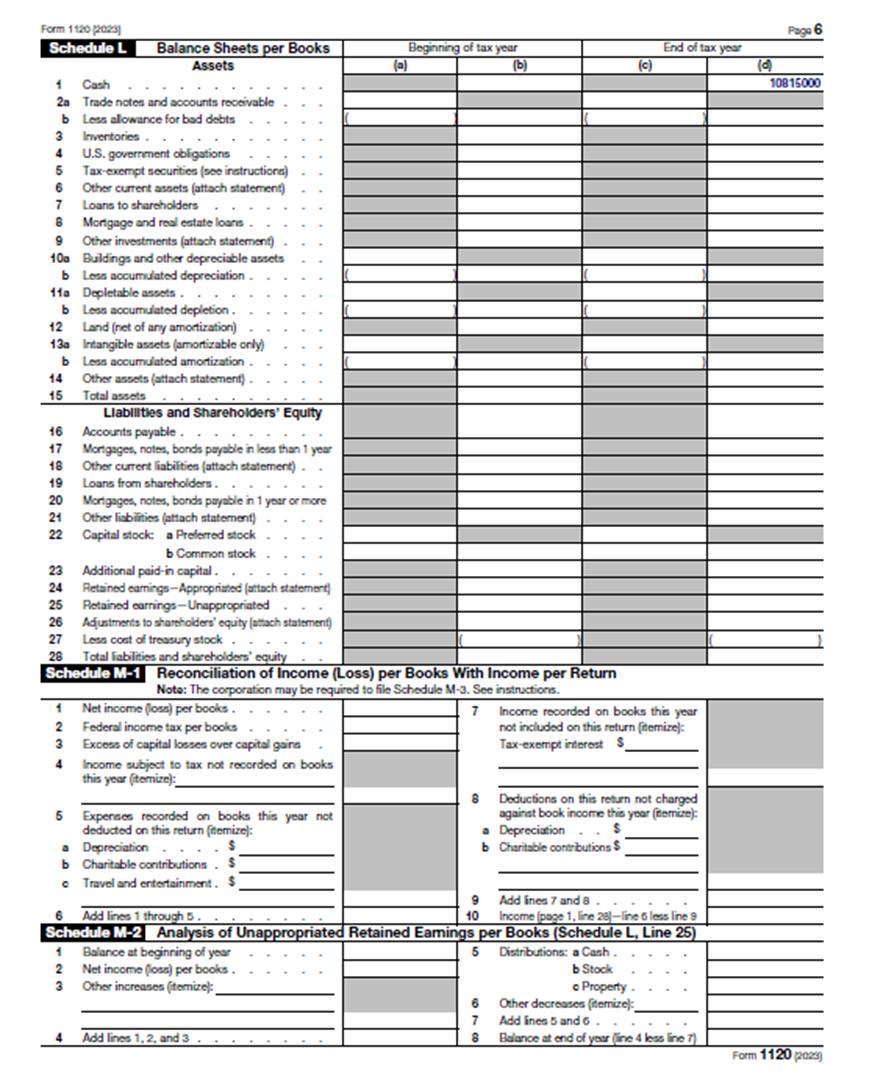

Please use this 1120 for the above memo and client letter .... Fo1120 Department of the Treasury Internal Rovanus Service A Check If: 1a Consolidated

Please use this 1120 for the above memo and client letter ....

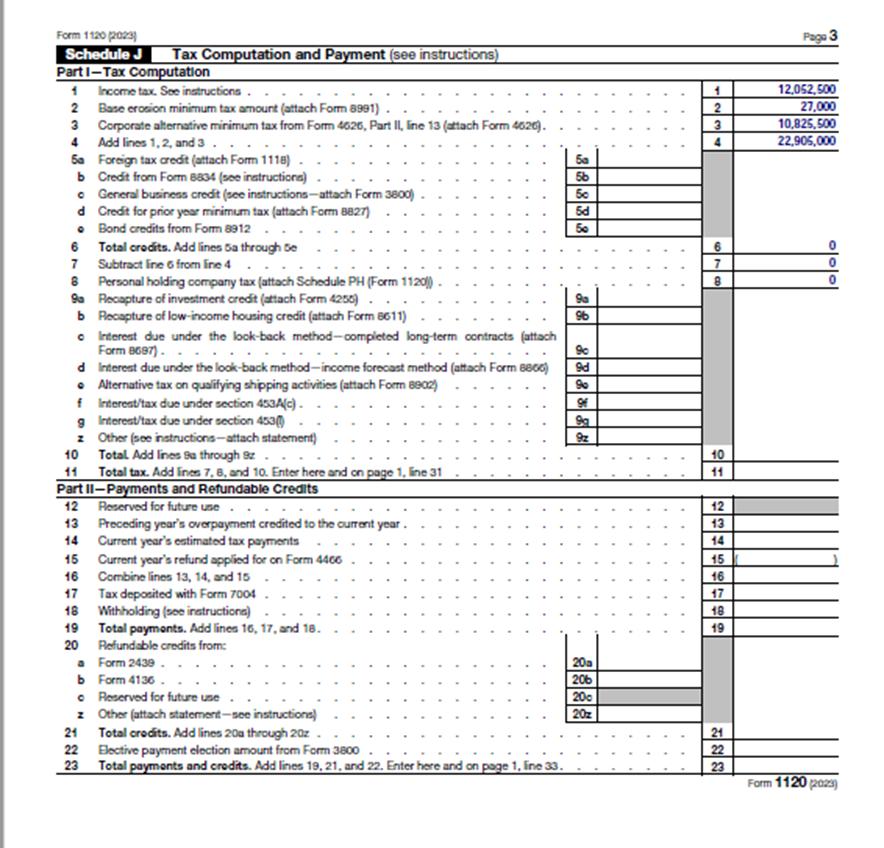

Fo1120 Department of the Treasury Internal Rovanus Service A Check If: 1a Consolidated ratum attach Form 881) b Lithonia consol- datadrum. 2 Parsonal holding co attach Sch. PH. 3 Pusoral service corp Schedule M-3 attached U.S. Corporation Income Tax Return For calendar year 2023 or tax year beginning January 1, 2023, ending December 31,20 23 Go to www.irs.gov/Form1120 for instructions and the latest information. TYPE OR PRINT Namo SageGreen Corporation Number, street, and room or suite no. If a P.O. box, see instructions. 1234 Anywhere Blvd City or town, state or province, country, and ZIP or foreign postal codo Sun City AZ 85351 E Chack It (1) Intal rotu fa Gross receipts or sales 2 3 b Returns and allowances. Balance. Subtract line 1b from line 1a. Cost of goods sold (attach Form 1125-A). Gross profit. Subtract line 2 from line 1c Dividends and inclusions (Schedule C, line 23) 4 5 Interest 6 Gross rents 7 Gross royalties CMB No. 1545-0123 2023 B Employer Identification number 85-1234566 C Data incorporated 01/02/2022 D Total assots (soo instructions Final return B Nama chango fa (4) 32,000,000 $ Address change 1b 22345 32,000,000 20,000,000 6 12,000,000 32,500 20,000 7 9 8 Capital gain net income (attach Schedule D (Form 1120)) Net gain or loss) from Form 4797, Part II, line 17 (attach Form 4797) 8 9 10 Other income (see instructions-attach statement). 10 11 Total income. Add lines 3 through 10. 11 12,052,500 Deductions (See instructions for limitations on deductions.) 12 Compensation of officers (see instructions-attach Form 1125-E) 12 13 Salarios and wagas (loss employment crodits) 13 800,000 14 Repairs and maintenance 14 15 Bad debts. 15 16 Rents 16 17 Taxes and licenses 17 18 Interest (see instructions) 18 19 Charitable contributions. 19 40,000 20 Depreciation from Form 4562 not claimed on Form 1125-A or elsewhere on return (attach Form 4562) 20 360,000 21 Depletion 21 22 Advertising 22 23 Pension, profit-sharing, etc., plans 23 24 Employee benefit programs 24 25 Energy efficient commercial buildings deduction (attach Form 7206). 25 26 Other deductions (attach statement). 26 27,000 27 Total deductions. Add lines 12 through 26 27 1,227,000 28 29a Taxable income before net operating loss deduction and special deductions. Subtract line 27 from line 11. Net operating loss deduction (see instructions) 28 299 b Special deductions (Schedule C, line 24). 296 O Add lines 29a and 29b Tax Flip Credits, and 85883885 30 Taxable income. Subtract line 29c from line 28. See instructions 31 Total tax (Schedule J, Part I, line 11) 32 Reserved for future use. 33 Total payments and credits (Schedule J, Part II, line 23) Estimated tax penalty. See instructions. Check if Form 2220 is attached 36 37 Amount owed. If line 33 is smaller than the total of lines 31 and 34, enter amount owed Overpayment. If line 33 is larger than the total of lines 31 and 34, enter amount overpaid Enter amount from line 36 you want: Credited to 2024 estimated tax Under peration of perjury, I declare that I have 28588388 29c 30 10,825,500 31 34 Refunded 36 37 Sign Here Signature of offoor Print/Typo preparar's namo Dato The Proparor's signature Paid Preparer this, including accompanying ached and tents, and to the best of my knowledge and bet, trus, corred, and complate Declaration of propar fother than byr) bad on a information of which proper has any knowledge May the IRS discuss this ratum with the preparer shown below? Soo Instructions Yos No Chack self-employed PTIN Dato Use Only Frm's na Firm's address For Paperwork Reduction Act Notice, soo separate instructions. Firm's EIN Phone no. Cat. No. 11450Q Form 1120 (2023)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started