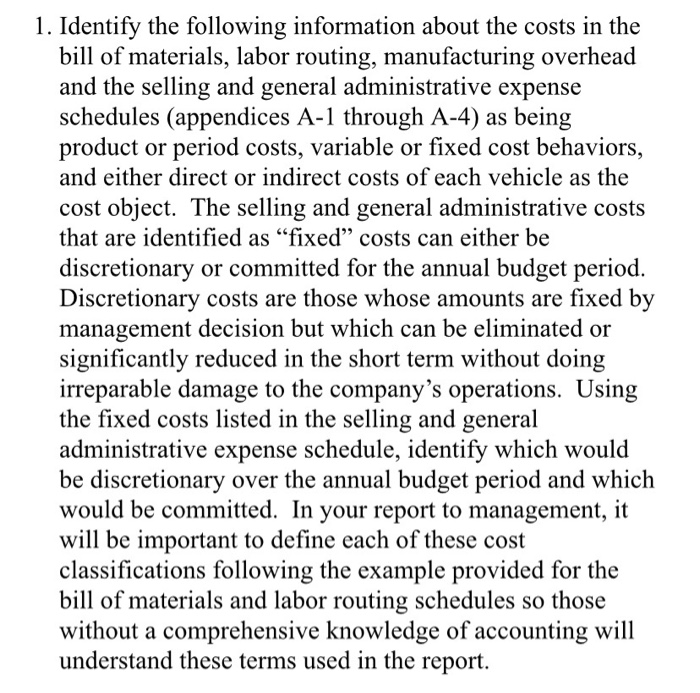

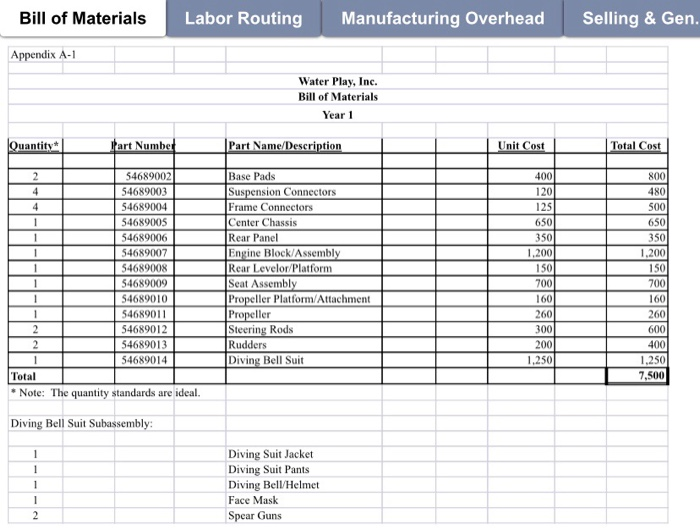

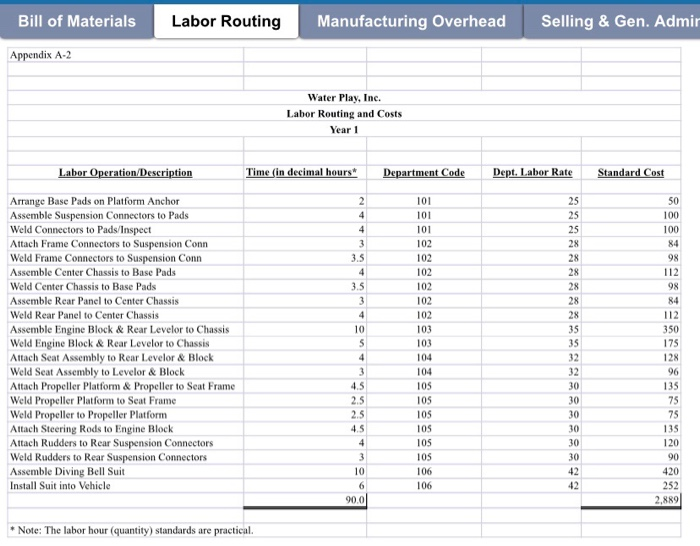

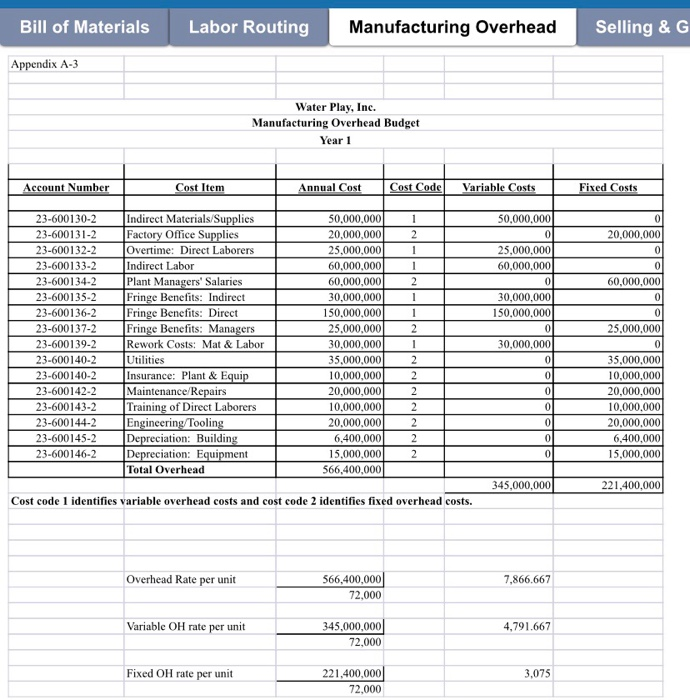

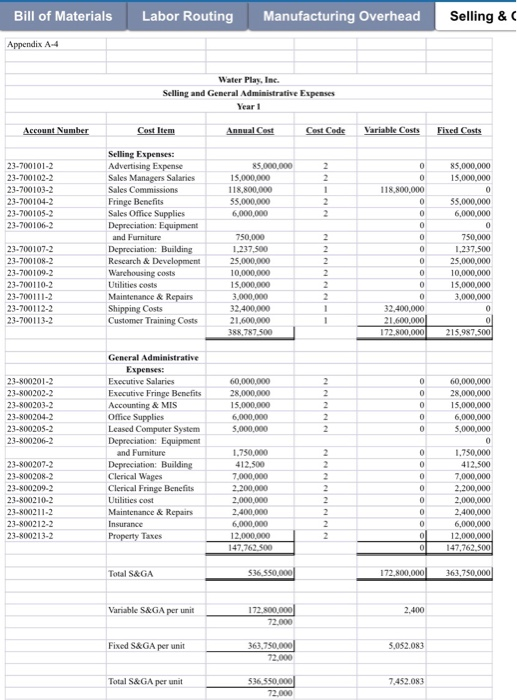

1. Identify the following information about the costs in the bill of materials, labor routing, manufacturing overhead and the selling and general administrative expense schedules (appendices A-1 through A-4) as being product or period costs, variable or fixed cost behaviors, and either direct or indirect costs of each vehicle as the cost object. The selling and general administrative costs that are identified as fixed costs can either be discretionary or committed for the annual budget period. Discretionary costs are those whose amounts are fixed by management decision but which can be eliminated or significantly reduced in the short term without doing irreparable damage to the company's operations. Using the fixed costs listed in the selling and general administrative expense schedule, identify which would be discretionary over the annual budget period and which would be committed. In your report to management, it will be important to define each of these cost classifications following the example provided for the bill of materials and labor routing schedules so those without a comprehensive knowledge of accounting will understand these terms used in the report. Bill of Materials Labor Routing Manufacturing Overhead Selling & Gen. Appendix A-1 Water Play, Inc. Bill of Materials Year 1 Quantity* Part Number Part Name/Description Unit Cost Total Cost 4001 800 480 120 125 500 650 1 546890021 54689003 54689004 54689005 54689006 54689007 54689008 54689009 54689010 54689011 54689012 54689013 54689014 Total * Note: The quantity standards are ideal. Base Pads Suspension Connectors Frame Connectors Center Chassis Rear Panel Engine Block/Assembly Rear Levelor/Platform Seat Assembly Propeller Platform/Attachment Propeller Steering Rods Rudders Diving Bell Suit 6501 350l 1,200 150 7001 1601 2601 350 1,200 150 700 160 300 200 1.2501 1.250 7,500 Diving Bell Suit Subassembly: Diving Suit Jacket Diving Suit Pants Diving Bell/Helmet Face Mask Spear Guns Bill of Materials Labor Routing Manufacturing Overhead Selling & Gen. Admir Appendix A-2 Water Play, Inc. Labor Routing and Costs Year 1 Labor Operation/Description Time (in decimal hours Department Code Dept. Labor Rate Standard Cost 101 101 101 102 102 100 100 84 102 28 112 102 102 102 112 103 Arrange Base Pads on Platform Anchor Assemble Suspension Connectors to Pads Weld Connectors to Pads/Inspect Attach Frame Connectors to Suspension Conn Weld Frame Connectors to Suspension Conn Assemble Center Chassis to Base Pads Weld Center Chassis to Base Pads Assemble Rear Panel to Center Chassis Weld Rear Panel to Center Chassis Assemble Engine Block & Rear Levelor to Chassis Weld Engine Block & Rear Levelor to Chassis Attach Seat Assembly to Rear Levelor & Block Weld Seat Assembly to Levelor & Block Attach Propeller Platform & Propeller to Seat Frame Weld Propeller Platform to Seat Frame Weld Propeller to Propeller Platform Attach Steering Rods to Engine Block Attach Rudders to Rear Suspension Connectors Weld Rudders to Rear Suspension Connectors Assemble Diving Bell Suit Install Suit into Vehicle 103 104 350 175 128 104 96 30 135 10S 105 105 105 105 30 135 4 120 10S 30 90 10 106 106 90.01 * Note: The labor hour (quantity) standards are practical. Bill of Materials Labor Routing Manufacturing Overhead Selling & G Appendix A-3 Water Play, Inc. Manufacturing Overhead Budget Year 1 Account Number Cost Item Annual Cost Cost Code Variable Costs Fixed Costs 50,000,000 2 20,000,000 25,000,000 60,000,000 2 60,000,000 30,000,000 150.000.000 25,000,0001 23-600130-2 23-600131-2 23-600132-2 23-600133-2 23-600134-2 23-600135-2 23-600136-2 23-600137-2 23-600139-2 23-600140-2 23-600140-2 23-600142-2 23-600143-2 23-600144-2 23-600145-2 23-600146-2 Indirect Materials/Supplies Factory Office Supplies Overtime: Direct Laborers Indirect Labor Plant Managers' Salaries Fringe Benefits: Indirect it Fringe Benefits: Direct Fringe Benefits: Managers Rework Costs: Mat & Labor Utilities Insurance: Plant & Equip Maintenance/Repairs Training of Direct Laborers Engineering Tooling Depreciation: Building Depreciation: Equipment Total Overhead 50.000.000 20,000,000 25,000,000 60,000,000 60,000,000 30,000,000 150,000,000 25.000.000 30,000,000 35,000,000 10,000,000 20,000,000 10.000.000 20.000.000 6,400,000 15,000,000 566,400,000 30,000,000 0 0 0 T 2 2 2 2 2 2 2 35,000,000 10,000,000 20,000,000 10.000.000 20.000.000 6,400,000 15,000,000 0 0 0 345,000,000 221,400,000 Cost code 1 identifies variable overhead costs and cost code 2 identifies fixed overhead costs. Overhead Rate per unit 7,866.667 566,400,000 72,000 Variable OH rate per unit 4,791.667 345,000,000 72,000 Fixed OH rate per unit 3,075 221,400,000 72,000 Bill of Materials Labor Routing Manufacturing Overhead Appendix A4 Water Play, Inc. Selling and General Administrative Expenses Year 1 Acre Number Castle Annual Cost Cost Code Variable Costs Eised Costs 85,000,000 15,000,000 23-700101-2 21.700102-2 23-7001012 23-700104-2 23-700105-2 23-700106-2 $5.000.000 15.000.000 118 800 000 55.000.000 6.000.000 118.800,000 35,000,000 6,000,000 Selling Expenses Advertising Expense Sales Managers Salaries Sales Commissions Fringe Benefits Sales Office Supplies Depreciation Equipment and Furniture Depreciation Building Research & Development Warehousing costs Utilities costs Maintenance & Repairs Shipping Costs Customer Training Costs 23-700107-2 23-700108-2 23-700109-2 23-700110-2 23.700111-2 23-700112-2 21.700113-2 750.000 1.237.500 25.000.000 10.000.000 15,000,000 3,000,000 32.400.000 21.600.000 38,787 500 750,000 1.237.500 25,000,000 10,000,000 15,000,000 3,000,000 32.400,000 21,600,000 172,800,000 215,987.500 23.800201-2 23-800202-2 23.800203-2 23.800204-2 23-00205-2 23-800206-2 60.000.000 28,000,000 15.000.000 6,000,000 5.000.000 60,000,000 28,000,000 15,000,000 6,000,000 5,000,000 General Administrative Expenses: Executive Salaries Executive Fringe Benefits Accounting & MIS Office Supplies Leased Computer System Depreciation Equipment and Furniture Depreciation Building Clerical Wages Clerical Fringe Benefits Utilities cost Maintenance & Repairs Insurance Property Taxes 23-800207-2 23-800208-2 23-800209-2 23.800210-2 23.800211-2 23-800212-2 23-00213-2 1.750,000 412.500 7.000.000 2.200.000 2.000.000 2.400.000 6.000.000 12.000 147,762500 1.750,000 412.500 7,000,000 2.200,000 2,000,000 2.400,000 6.000.000 12.000.000 147 763.500) Total SAGA 536 550.000 72.00. 361,750.000 Variable SRGA per unit 17200 2.400 Fixed S&GA per unit 363.750.000 72.000 5.052.083 Total S&GA per unit 7452083 536 550 l 72.000