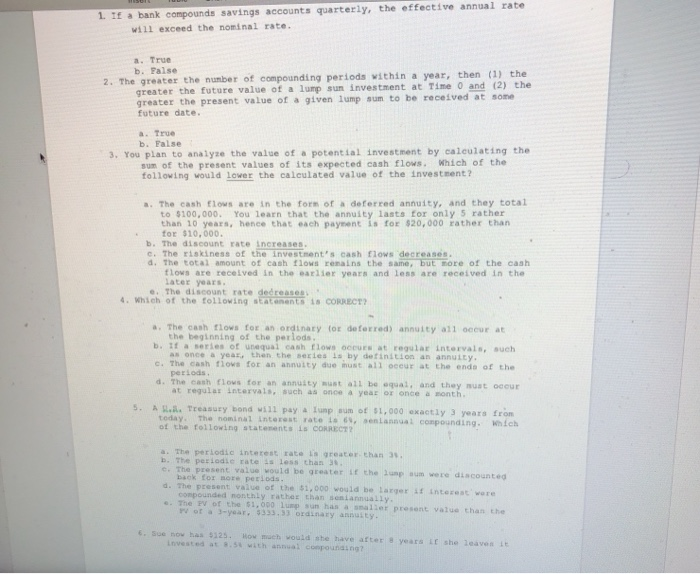

1. If a bank compounds savings accounts quarterly, the effective annual rate will exceed the nominal rate. a. True b. False 2. The greater the number of compounding periods within a year, then (1) the greater the future value of a lump sun investment at Time and (2) the greater the present value of a given lump sum to be received at some future date a. True b. False 3. You plan to analyze the value of a potential investment by calculating the sum of the present values of its expected cash flows. Which of the following would lower the calculated value of the investment? a. The cash flows are in the form of a deferred annuity, and they total to $100,000. You learn that the annuity lasts for only 5 rather than 10 years, hence that each payment is for $20,000 rather than for $10,000. b. The discount rate increases. c. The skiness of the investment's cash flows decreases d. The total amount of cash flow remains the same, but more of the cash flows are received in the earlier years and less are received in the Later years. e. The discount rate dedreses 4. Which of the following statements is CORRECT? a. The cash flows for an ordinary for de ferred) annuity all OCCUF at the beginning of the periods. b. If Series of qual cash flow OCCUE at regular intervals, such as once a year, then the series is by definition an annutty. C. The cash flows for an annuity due mustall Decur at the end of the periods.. d. The cash flows for an annuity must all be equal, and they must OGCUE at regular intervals, such as once a year or once a month. 5. A Treasury bond will pay lump sum of 51, 000 exactly 3 years from today. The nominal Interest rate is su senlannual compounding, which of the following statements is CORRECT 2 The periodic interest rate a greater than 31. b. The periodie rate is less than c. The present value would be greater in the lump sum were discounted back for more periods. d. The present value of the s1,000 would be larger is interest wore Compounded monthly rather thansen a ally. .. The py of the si,ooo Lump sun has a smaller present value than the wota 3-year, 3333.33 ordinary annuity. 6. Sue now has $125. How much would she have after Invested at .st with annual compounasnaze years if she louvor it