Question

1. If HP shares are currently priced at $ 100. One period later it can go up by an increase of 25 percent or down

1. If HP shares are currently priced at $ 100. One period later it can go up by an increase of 25 percent or down by 20 percent. A call option with an exercise price of $100. The risk-free rate is 7 percent. Find the value of the option today using Binomial option model.

{Note: Please explain and show steps and calculations, formula is not compulsory, unable to type it is still okay. Can delete the lines if needed}

2. Compare and contrast in your own words Forward and future contracts.

3. In your own words discuss the difference between Call Option Taker and Put Option Taker.

4. In your own words explain Standardisation of options in ASX Option trading

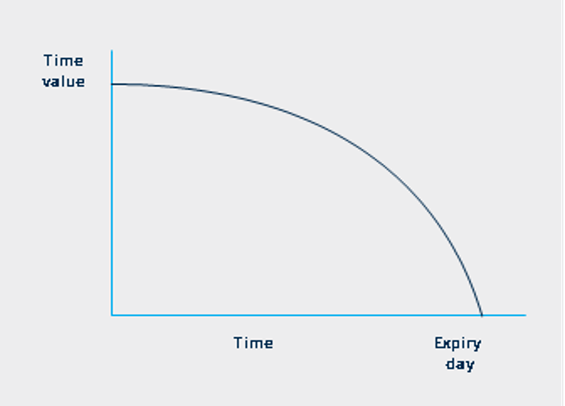

5.(A) Time value of option is affected by key factors name them. Explain the options time value interpretation of the diagram in your own words

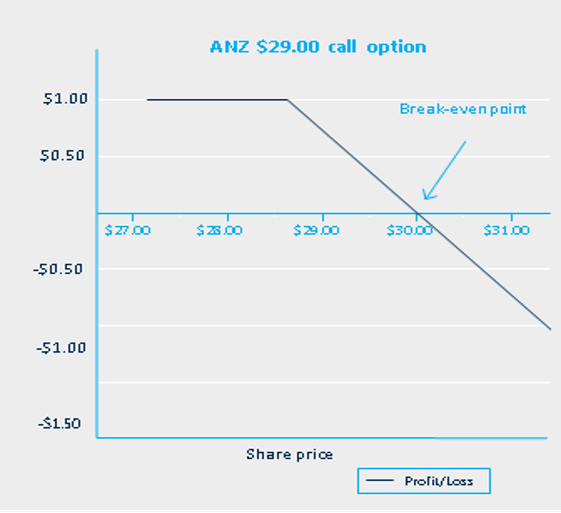

(B) The diagram is for which one (a call option writer/ a call option taker)? What is the break-even point? The loss here is limited/unlimited? Give reasons?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started