Question

1. If r s increases to 10%, what would be the value of the constant growth stock? (Note: D 0 is $1.15 and the expected

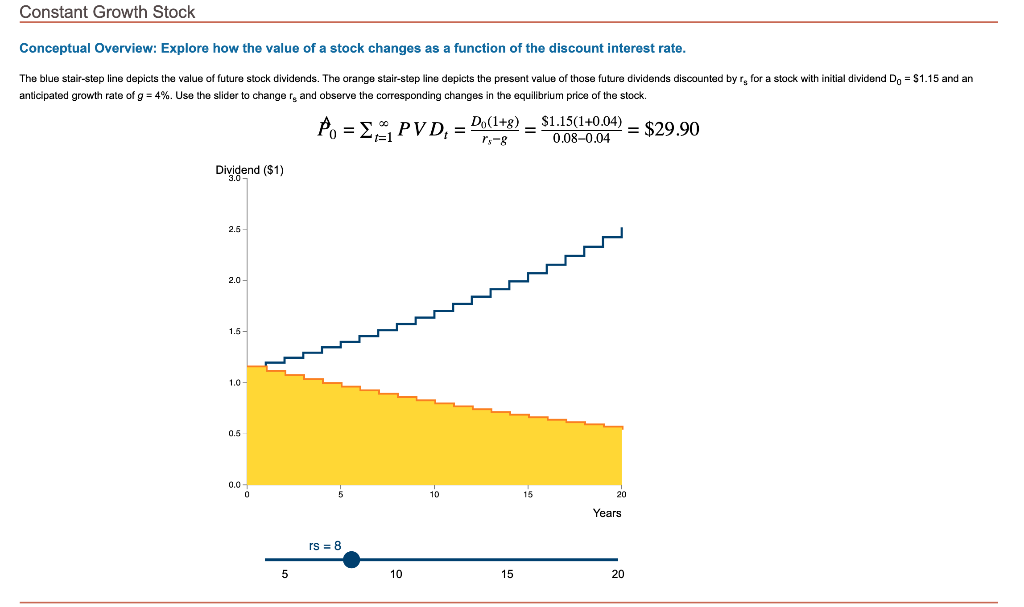

1. If rs increases to 10%, what would be the value of the constant growth stock? (Note: D0 is $1.15 and the expected constant growth rate g = 4%.)

- $29.90

- $19.93

- $10.87

- Undetermined

2. When rs increases from, say, 8% to 10%, the value of the constant growth stock:

- Increases because the interest rate is higher.

- Decreases because its dividends are being discounted at a higher rate.

- Remains the same because it is a "constant growth" stock.

- Might either increase or decrease.

3. Move the slider so that rs is 12%. If the stock were selling on the market for $15.50, would you buy it? (Note: D0 is $1.15 and the expected growth consstant rate g = 4%.)

- Yes, it is a bargain.

- No, the stock is overvalued, as the expected stock price is only $14.95.

- Not enough information to determine whether it would be a good buy.

4. The slider for rs is limited to a minimum of 4.1% so that rs is always greater than g. Move the slider to the minimum and observe how the present value of the stock changes. Must rs be greater than g?

-

No reason rs needs to be greater than g because the formula adjusts the value of the stock appropriately.

No reason rs needs to be greater than g because the formula adjusts the value of the stock appropriately. - Yes, because if rs were not greater than g, then the graph would be too large to display easily.

- Yes, because if rs = g, then the formula divides by zero, producing an infinite value.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started