Question

1- If the central bank buys bonds from the public* The money supply will contract Bank reserve ratio will change Banks will be able to

1- If the central bank buys bonds from the public*

The money supply will contract

Bank reserve ratio will change

Banks will be able to make additional loans

Demand deposits will decrease

2- Which list contains only actions that decrease the money supply?*

Lower the discount rate, raise the required reserve ratio

Lower the discount rate, lower the required reserve ratio

Raise the discount rate, raise the required reserve ratio

Raise the discount rate, lower the required reserve ratio

3- In the bank's balance sheet, assets include*

Reserves, loans and checkable deposits

Reserves, loans and bank capital

Reserves, loans and securities

Reserves, loans and borrowings

4- If the money multiplier is 8, the required reserve ratio is*

8%

16%

12.5%

20%

5- Using the money demand and money supply model, an increase in the reserve ratio by the central bank would cause the interest rate to*

Increase, then decrease

Not change

Decrease

Increase

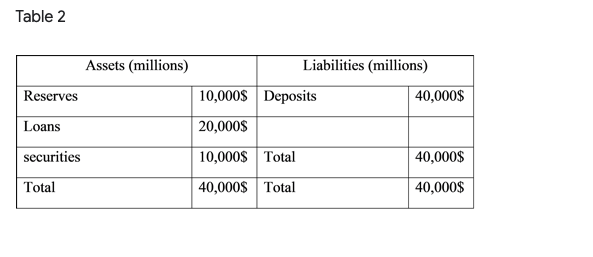

6- If the required reserve ratio is 10% , then the required reserves are*

$ 10, 000

$ 20, 000

$ 5,000

$ 4,000

7- If the required reserve ratio is 10% and the central bank buys $5,000 of government securities from Byblos bank, then securities will decrease by ______ and the money supply will _______*

$5,000; increase by $5,000

$5,000; decrease by $5,000

$5,000; decrease by $50,000

$5,000; increase by $50,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started